Pharmas rake in higher profits

Listed drug makers booked an 18 per cent expansion in profit in the first 9 months of the existing fiscal year because of a decrease in advertising costs amidst the coronavirus pandemic.

The figures and associated info were compiled by Prime Financing Asset Management Provider, analysing 13 pharmaceuticals companies. ACI and Orion Pharmaceuticals had been excluded because they are yet to reveal their earnings.

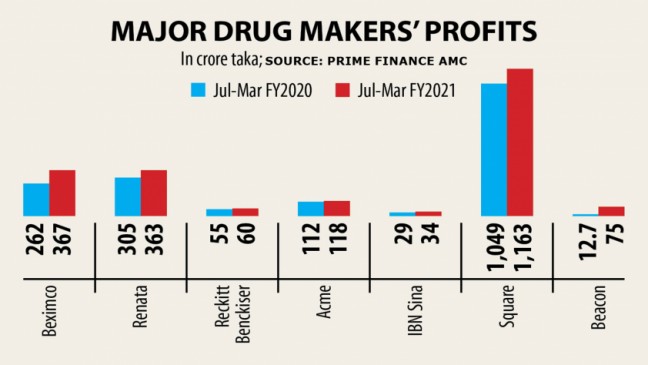

The full total profit of the outlined medicine-manufacturers rose to Tk 2,168 crore. Among them, the gains of eight rose. One of them was Beacon Pharmaceuticals, whose income surged five occasions to Tk 75 crore.

"Operational excellence found in productivity is the key reason for the bigger growth in gains of drug manufacturers," said Muhammad Zahangir Alam, chief monetary officer of Square Pharmaceuticals. The business's profits rose around 11 % to Tk 1,163 crore.

Elaborating, he explained administrative costs fell during the period. "Because of the pandemic, our communication cost declined along with promotional expenditure," he added.

Md Jubayer Alam, provider secretary of Renata, echoed the same, saying bigger profits mainly came from lower marketing costs.

Renata's gains rose to Tk 363 crore this season, whereas it was Tk 305 crore this past year.

This year company representatives went on fewer visits to meet up doctors, so the marketing costs were also lower, he said.

However, sales development of the medication maker was relatively lower compared to previous years, Jubayer Alam explained, adding that almost all of companies' sales expansion was 5 to 6 % this year that was higher a year earlier.

"This is because various doctors refrained from personal practices due to the contagion, and persons were reluctant to visit clinics and hospitals for treatment."

The export slowed a bit this year, nonetheless it will surge in the coming a few months as the next wave of the pandemic is easing away, he hoped.

Responding to a concern, Alam said Renata didn't raise the selling price of the medicines through the pandemic.

"From a stock market viewpoint, pharmaceuticals had been a good preferable sector for institutional investors," said Mir Ariful Islam, head of study and portfolio control of Prime Financing Asset Management Company.

"Medicines are a necessary product, so it was expected that they might fare better in virtually any situation."

Though sales were low for some for many reasons, the sector generated the best hopes. Institutional investors think that the sector would be able to sustain its performance even if the market required a plunge, he added.

Among the listed drug manufacturers and chemical companies, Renata closed 0.01 % larger on the Dhaka Stock Exchange yesterday.

Square Pharmaceuticals declined 0.23 per cent, Beximco Pharmaceuticals dropped 2.63 %, Ibn Sina Pharmaceutical was straight down 1.27 %, Acme Laboratories shed 0.98 %, Beacon slipped 0.71 per cent, and Reckitt Benckiser transpired 0.15 per cent.