Bangladesh on the right track to becoming a $6b pharma industry by 2025

The pharmaceutical industry of Bangladesh is likely to surpass $6 billion by 2025 with a complete growth of 114 per cent from its 2019 levels, according to a written report from a Dublin-based industry insight and analysis firm, Research and Markets.

"The pharmaceutical industry has been witnessing exceptional growth recently, and it is likely to possess a compound gross annual growth rate greater than 12 per cent during the 2019-2025 period," said the report titled "Bangladesh Pharmaceutical Market Near future Opportunity Outlook 2025".

According to the article, biotech pioneers of Bangladesh's pharmaceutical sector are considered as a valuable tool for the entire improvement and efficacy of the marketplace.

A majority of the growth will be contributed by local companies with market share of more than 90 per cent as similar to previous trends attained over the last 2 decades, the report said.

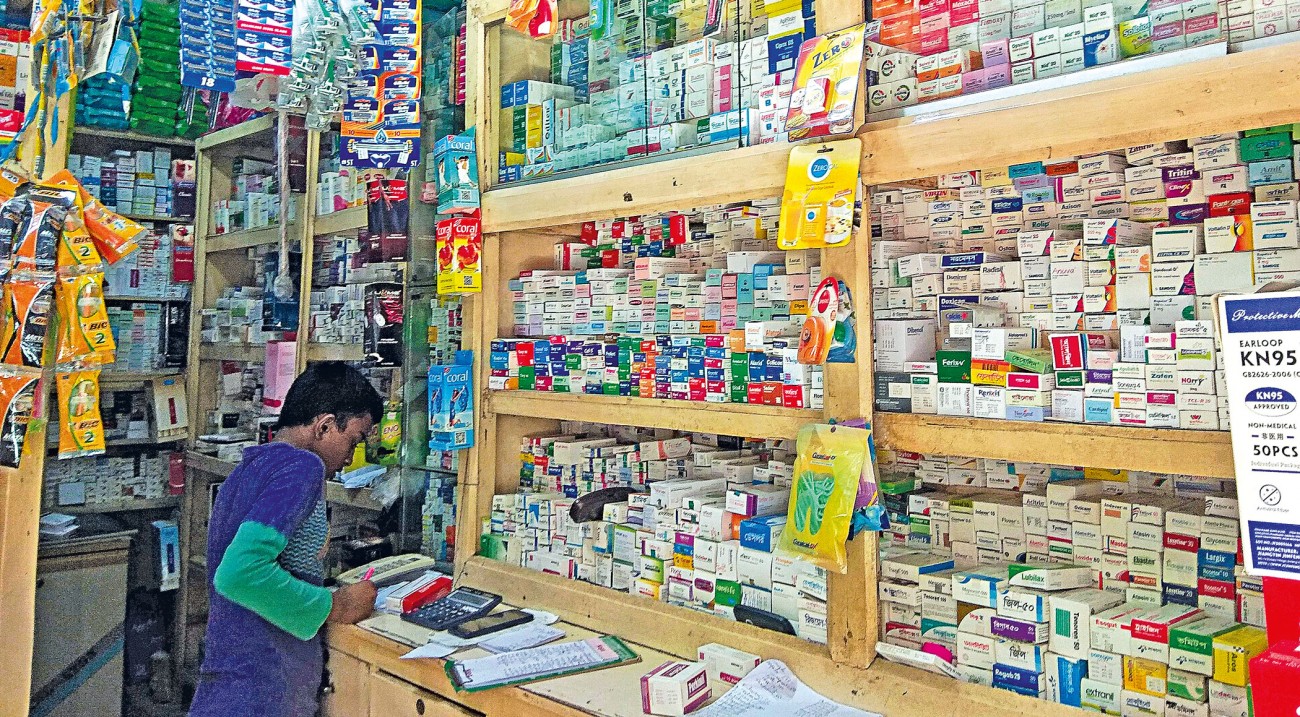

In recent times, local pharmaceutical companies have emerged as a game-changer by contributing a lot more than 90 per cent of the entire available medicines on the market.

Industry players estimate that the neighborhood industry size of the sector was about Tk 25,000 crore ($3 billion) in 2019. In 2012, it stood at about Tk 9,390 and in 2017 it hit Tk 18,755.6 crore, according to the IMS HEALTHCARE Report.

The pharmaceutical industry, successful of the global industry through dynamism and technology, experienced tremendous growth within the last decade and currently contributes 1.83 % to the country's gross domestic product (GDP), according to industry people.

Localized pharmaceutical makers still have immense potential on the healthcare sector, as Bangladeshis spend around $2.04 billion abroad annually for medical treatment, which is 1.94 per cent of the country's GDP, according to market examination by the Bangladesh Investment Development Authority (Bida).

The require for healthcare services keeps growing at about 21 per cent annually because of the increasing purchasing power of the developing middle and upper-middle classes, the Bida said.

The notable change that attracted the world towards Bangladesh is a rsulting consequence innovation in the science and research and creation sector, the study and Markets said in its report.

Rise in life expectancy, growing per capita cash flow, changing disease profile, population progress, changes in lifestyle and increasing patient population are actually some of the major drivers that are actually boosting consumption in the local market, it said.

In the upcoming years, the federal government of Bangladesh will enjoy a significant role in the rapid growth of the pharmaceutical market by giving favourable policies for easy drug approval, development and marketing of new products, the Irish strong expects.

The government is concentrating on reducing the country's dependence on the import of recycleables. The establishment of an API Park will act as a turning point for this purpose.

The top 50 companies are setting up their facilities at the Active Pharmaceuticals Ingredient Industrial Park in Munshiganj that can help in the production of patented and already opened active pharmaceuticals ingredients.

It really is expected that the creation of the API Park will be complete by another two years, that may reduce the expenditure related to the import of recycleables.

The report said the share of generic drugs is likely to surpass 85 % by 2025, that will further fortify the dominance of local pharmaceutical companies in the market.

"The capacities of regional companies are improving, and they are expanding their facilities and investing in research and advancement, which can only help the sector grow," said SM Shafiuzzaman, secretary-general of the Bangladesh Association of Pharmaceutical Sectors (BAPI), a platform of about 250 local drug-markers.

He likewise said the option of workforce is likewise an essential element for the sector to flourish.

There is absolutely no difference in quality between original products and the generic products produced in Bangladesh, he said. "Bangladeshi pharmaceutical items have always maintained global standards."

"The product quality and global image of Bangladesh's medicines are better than the generics produced in India and Egypt," said Monjurul Alam, Beacon's director for global business.

"Since our labour expense and utilities happen to be cheaper than in many countries, our products are more affordable compared to other medicine manufacturing nations."

The general people of Bangladesh is now able to afford medicines as their purchasing power has increased four times within the last 20 years, he said.

"Moreover, persons are well alert to diseases nowadays. Chronic diseases are increasing, which desire a regular intake of medicines. Each one of these possess triggered the domestic market to boom."

Moreover, local firms are investing and growing dedicated facilities for specialised drugs for treating diseases such as for example cancer, he said.

"At least 10 to 15 facilities are creating items of international standards. We are actually working on creating APIs. If we are able to start the API development, we can offer more complex drugs at a more affordable price."

The pharmaceutical industry has were able to grow its exports in today's fiscal on the trunk of steady demand for medicine amid the coronavirus-induced monetary and health crises, that have decimated other important export sectors.

"Pharmaceutical products are crucial for all countries. This is why the industry's exports didn't decline amid the Covid-19 outbreak. Alternatively, it rose."

Pharmaceutical shipments soared 4.49 per cent year-on-year to $136 million in fiscal 2019-20 following improvements in merchandise quality and coverage support.

The industry is probably the couple of sectors that ended the fiscal year in the black when nationwide exports fell 16.93 %.

The sector fetched $130 million in export earnings in fiscal 2018-19 and $103.46 million in fiscal 2017-18.

"As a good least developed region, Bangladesh doesn't need to check out the patent, so that it is easy to formulate any generic drug locally," said Ananta Saha, international business manager of Renata.

He said the populace of Bangladesh is large, which is among the main known reasons for the neighborhood pharmaceutical industry's rapid expansion.

Relating to the export forecast, he said it could be achievable since it is simple to export pharma goods from an LDC to another.

The efficiency of the neighborhood companies is improving, and they are expanding their manufacturing facilities, said Muhammad Halimuzzaman, deputy controlling director and ceo of Healthcare Pharmaceuticals.

Rabbur Reza, chief operating officer of the company, believes Bangladesh can reach the export concentrate on for 2025 if the local sector is growing at the current rate.

Nevertheless, he said Bangladesh has to wait until June next year to find out the pharmaceutical industry's accurate progress rate, which will indicate whether the industry should be able to reach the $6 billion target by 2025.

The monetary growth of the country is helping the sector grow faster, he said.

The rising purchasing power of the people and awareness about the treatment is working as a traveling force for the sector, he added.