Pandemic was likely to quash remittance. But inflows struck an all-time high

Recently, remittance has turned into a pillar of strength for the Bangladesh economy. Hence when the global coronavirus pandemic hit, all eyes had been on the remittance and whether its incredible momentum would sustain.

It had been widely expected that the inflows from the 1.20 crore-odd migrant workers would fall off massively. But, in reality, the inflows seem to get swimming against the tide.

Remittance hit a great all-time most of $18.20 billion in the just-concluded fiscal year, giving much-needed breathing space to the federal government to control the macroeconomic state of affairs hit hard by the ongoing financial whiplash.

The inflows were 10.87 % higher than in fiscal 2018-19, according to data from the central bank.Expatriate Bangladeshis sent residence $1.83 billion in June, the highest in a single month, eclipsing the $1.74 billion that flowed in-may last year.

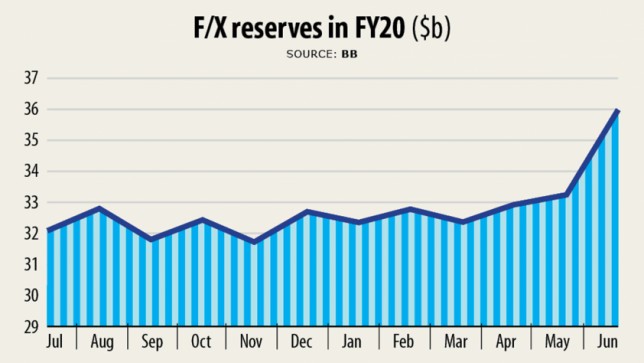

The healthy stream of remittance pushed foreign exchange reserves to surpass the $36-billion tag for the very first time on June 30.

And what brought on such remarkable efficiency seems to have gone economists and analysts scratching their heads.

"There was no justification for the sudden upsurge in remittance found in June as the economies of the center East, house to a major part of Bangladeshi expatriates, remain experiencing the meltdown," explained Ahsan H Mansur, executive director of the Policy Research Institute of Bangladesh.

Saudi Arabia has adopted austerity procedures to manage the finances deficit amid much fall in petroleum prices, he said.

Many state-backed projects in the Gulf nation attended to a halt because of the fund shortage. And the united states has lower salaries of the employees employed in the public sector.

The cost of petroleum products in the global market increased last month from April, however the hike is not sufficient to result in a quick rebound in the Gulf economies, he said.

Mansur apprehended that Bangladeshi employees were now sending their last savings before leaving their web host countries for good.

"The Gulf nations have launched a get to send back against the law foreign workers. Plus they are right now sending their deposits to family members beforehand," said Mansur, also a former high official of the International Monetary Fund.

About 8-10 lakh Bangladeshi expatriates are waiting to come back to the united states, he said.

However, Bangladeshi expatriates may even now survive the onslaught of the pandemic-induced slowdown.

They could face fewer job cuts weighed against their peers from other countries. And as they are lowly paid out, they may be in a position to survive, Mansur said.

Zahid Hussain, a ex - lead economist of the Community Bank's Dhaka business office, echoed Mansur, saying expatriates might be sending money right before leaving their host nations.

The economies of both Middle East and Europe include recently opened which may have pushed the remittance up.

The Gulf economies are rebounding, which includes played a role in boosting the remittance stream, he added.

The 2 2 per cent incentive for the remitters since the initial period of last fiscal season has had a good effect on remittance move, said Syed Mahbubur Rahman, managing director of Mutual Trust Lender.

The repatriation of staff has already established a positive influence on remittance for the time being.

"We need 2-3 months more to state if the inflow will continue in the a few months to come," stated Rahman, also a ex - chairman of the Association of Bankers, Bangladesh, a forum of the CEO of non-public banks.

The upward trend of remittance boosted the country's forex reserve to an excellent extent last month.

In May, the reserves ballooned to $34 billion before swelling up to $36 billion, also aided by lower-than-expected imports.

"We have never seen such a growing pattern of the reserve on a month. This is fairly good given the current recession," explained a Bangladesh Lender official.

Decrease imports and soft loans provided by the multilateral lenders have helped widen the reserve.

The Asian Development Bank approved yet another $500 million bank loan to fortify the Bangladesh government's efforts to control the impact of the coronavirus pandemic on the country's economy and public health.

The International Monetary Fund (IMF) sanctioned $732 million and the World Lender $1.05 billion.

The central bank is also buying us dollars from banks amid a decline in imports, helping the BB to augment the reserves.

The BB purchased $50 million on June 30 to inject the neighborhood currency.

This can help banks enjoy enough liquidity through the meltdown, Mansur said.

The rising remittance trend may not last in the coming days and nights if a recent projection of the IMF comes true.

Continued remittance weakness in the approaching months will result in a 7 per cent fall in fiscal 2020-21, it said.