Pandemic downs garment shipments to a decade-low

The unprecedented coronavirus pandemic has put a scar in apparel shipments as earnings from the country's main export item in the recent past fiscal year fell substantially compared to anytime previously decade.

The wages declined 18.45 per cent year-on-year to $27.83 billion in the outgoing fiscal year.

That is $6.3 billion significantly less than that of fiscal 2018-19 and falls $10.37 billion short of the mark set for fiscal 2019-20.

The target for the immediate past fiscal year was $38.20 billion. Bangladesh exported $34.13 billion-worthwhile apparel in fiscal 2018-19.

But, things are looking up.

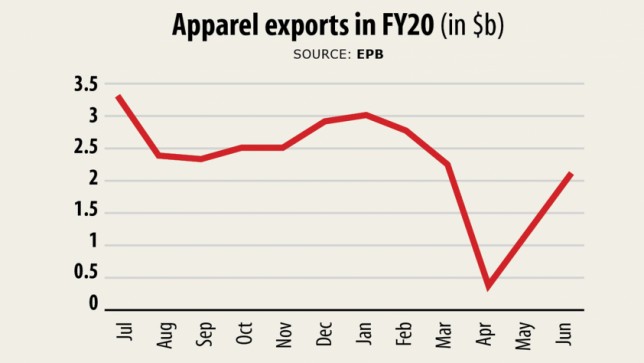

In June, the ultimate month of the recent past fiscal year, the wages were $2.12 billion, according to data from the Export Advertising Bureau, customs and Bangladesh Garment Producers and Exporters Association (BGMEA).

June's earnings were 11.43 % less than a year earlier but up 72.4 % from the previous month.

The sector experienced a historic lower in shipments in April this season. Revenue from the garments sector reached simply $0.37 billion, the lowest receipt because the sector started taking condition four decades ago.

Bangladesh's garment export of $34.13 billion in fiscal 2018-19 was 11.49 per cent higher than the preceding year.

The compound annual development rate of apparel exports in the past five years was 6.86 %. The rate is possibly higher for days gone by 10 years at 10.70 %.

The receipts from apparel, which typically makes up 84 % of national exports, was lower mainly as a result of two reasons fuelled by the pandemic coronavirus.

Primarily, thousands of shops were shut under western culture and secondly, factories were shut in Bangladesh due to coronavirus.

However, the vendors in Europe and the united states started reopening their retailers from May.

Due to this fact, garment shipments and creation in the local factories are rebounding gradually.

A quarter-sensible analysis of export performance reveals that the market had been distressed with many difficulties including a rise in the cost of production and stronger currency exchange charge, according to BGMEA President Rubana Huq.

The decline in export through the fiscal year in actual amount is $6.6 billion, which is just about one-fifth of what Bangladesh exported this past year.

A closer look reveals that of the $6.6 billion, $1 billion worth of export was misplaced in the first one half of the entire year and the remaining $5.6 billion in the latter half.

"We lost $4.8 billion worth of export just in 90 days, i.e. April-June 2020. This shows the severe nature of the COVID's impact on the sector," Huq said.

Regarding to global projections and forecasts simply by industry insiders, at the moment, the factories possess orders equivalent to 55 % of their capacities about the average, which is likely to pick up a little by simply the year's end, that is by 70 % of the capacity by December 2020.

A long-term prediction might not exactly be pragmatic in this volatile situation. However, it can be hoped that up to 80 per cent of regular exports may be regained towards the middle of 2021.

However, concerns remain above the actual fact that factories remain struggling with cashflow and credit rating, with the quantity of resulting unsettled liability/payables assumed to be about $1.9 billion.

Since March, 179 factories were forced to turn off and more might follow the trail, Huq told The Daily Superstar.

Garment exports started rebounding due to the reopening of the economies found in Europe and the US, said Ahsan H Mansur, executive director of Plan Research Institute (PRI).

However, most reforms are desired in the garment sector and the BGMEA offers been trying to bring those about, he said.

For instance, Bangladesh is a lot too reliant on cotton fibre-based garment items and needs to get garment items from manmade fibres.

Simply five basic items comprise nearly 80 per cent of the exports and at least 50 such items should be developed, he said.

Mansur, who's also a ex - economist of the International Monetary Fund, also suggested grabbing more export destinations found in Asia, Central Asia and Latin America along with European countries and the US.