Pandemic casts a gloom on greenfield investment

The value of greenfield investment project announcements - an indicator of future foreign direct investment trend - fell by 78 percent in Bangladesh in the first eight months of 2020 as a result of the coronavirus pandemic, said the Unctad yesterday.

The Global Investment Trends Monitor of the US Conference on Trade and Development (Unctad) made the disclosure. It did not provide any figure.

Greenfield investment typically identifies projects that create new physical facilities which are believed productive, partly because they usually generate jobs.

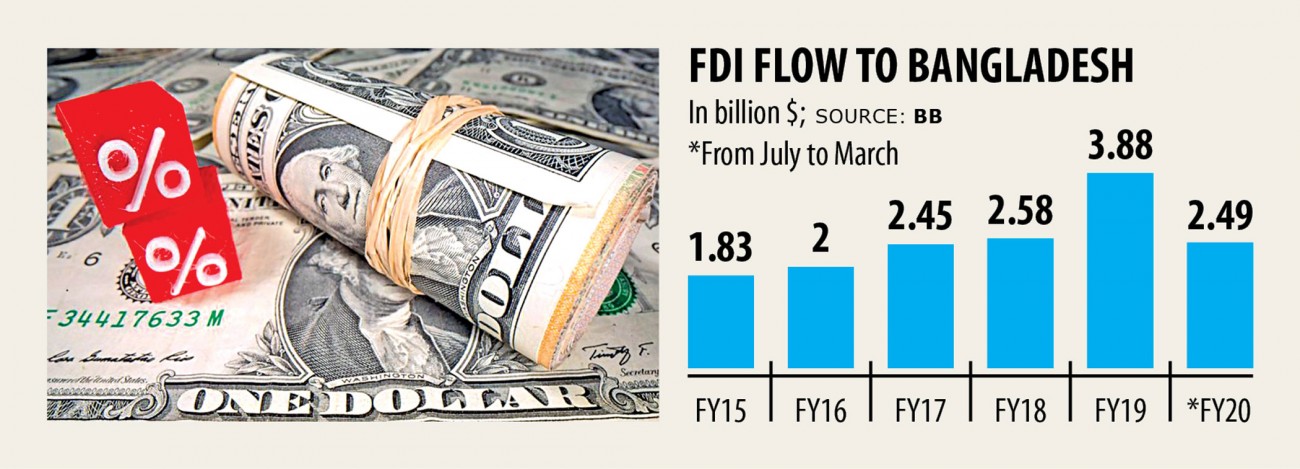

Bangladesh received $2.49 billion in gross FDI in the July-March amount of the last fiscal year, down from $3.97 billion in the same period this past year, Bangladesh Bank data showed.

FDI in South Asia fell from 31 % to $20 billion in the first half of the entire year. India, the largest FDI recipient in your community, saw FDI contracting by 33 % to $17 billion as the country struggles with Covid-19 containment, the UN agency said.

In other South Parts of Asia where investments are largely linked with export-oriented apparel manufacturing, greenfield investments have taken a severe hit due to activity stoppages and contracting global demand.

Announced greenfield projects in Bangladesh fell by 78 % and in Sri Lanka by 97 %.

Global FDI flows plunged 49 percent in the first half of 2020 compared to 2019, because of the economical fallout from the Covid-19.

In the wake of the pandemic, lockdowns all over the world slowed existing investment projects and the prospects of a deep recession led multinational enterprises to reassess new projects.

"The FDI decline is more drastic than we expected, particularly in developed economies. Developing economies weathered the storm relatively better for the first half of the year," said James Zhan, Unctad's investment and enterprise director, in a press release.

"The outlook remains highly uncertain."

In line with the report, developed economies saw the largest fall, with FDI reaching around $98 billion in the six-month period - a decline of 75 % compared to 2019.

The trend was exacerbated by sharply negative inflows in European economies, mainly in Holland and Switzerland. FDI flows to THE UNITED STATES plummeted by 56 % to $68 billion.

Meanwhile, the 16 percent reduction in FDI flows to developing economies was significantly less than expected, due mainly to resilient investment in China. Flows decreased by simply 12 % in Asia but were 28 % less than in 2019 in Africa and 25 % reduced in Latin America and the Caribbean.

In the half a year to June, developing countries in Asia accounted for over fifty percent of global FDI. Flows to economies in transition were down 81 % due to a solid decline in the Russian Federation.

The worthiness of greenfield investment project announcements was $358 billion in the first eight months of 2020. Developing economies saw a much bigger fall (-49 %) than developed economies (-17 %), reflecting their more limited capacity to roll out financial support packages.

The number of announced cross-border project finance deals declined by 25 %, suggesting that the slide continues to be accelerating.

The flows will hinge on the duration of the health crisis and the effectiveness of policy interventions to mitigate the economical ramifications of the pandemic. Geopolitical risks continue to enhance the uncertainty, the Unctad said.

Regardless of the 2020 drop, FDI remains the main way to obtain external finance for developing countries. Global FDI stock stood at $37 trillion at the end of 2019.