FDI picking up, but slowly

Foreign direct investment in Bangladesh rose only 5.11 percent in fiscal 2017-18 from a year earlier -- the progress being slow because of inadequate infrastructure and poor ranking in the World Bank's Ease of Doing Business index.

Bangladesh ranked 176 out of 190 countries in the World Bank's Ease of Doing Business index this year, the lowest ranking for a South Asian nation.

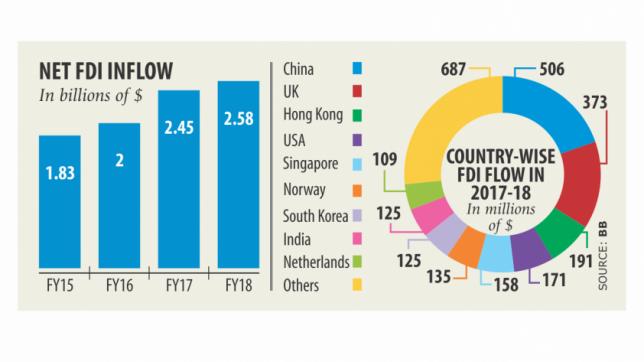

Last fiscal year, net FDI stood at $2.58 billion in contrast to $2.45 billion a year earlier, according to the central bank.

FDI flow has been maintaining a rising trend in recent years but it was not up to the mark given the GDP size, said AB Mirza Azizul Islam, a former finance adviser to a caretaker government.

The country's FDI to GDP ratio has been hovering below 1 percent for long but its peers like Vietnam, China, India and Cambodia have more than 2 percent, he said.

“Foreign businesses place great importance on the Ease of Doing Business ranking before taking an investment decision.”

Bangladesh is yet to become an investment destination for foreigners due to its poor governance, unavailability of energy supply, infrastructure deficits, corruption, political uncertainty and concerns over security, Islam said. The power sector saw the highest inflows in fiscal 2017-18 of $589 million, followed by textile at $459 million and banking at $321 million.

Last fiscal year, $506 million flew in from China, $373 million from the UK, $191 million from Hong Kong, $171 million from the US, $158 million from Singapore, $135 from Norway and $125 million from South Korea.

The central bank calculates the FDI in three categories: equity, reinvestment of earnings and intra-company loan.

Last fiscal year, equity capital or new investment came down 39 percent to $615 million.

The declining flow of equity capital is a matter of concern for the country's FDI as it is a pivotal element among the three categories, said a Bangladesh Bank official.

Reinvestment of earnings by existing foreign companies remained almost unchanged at $1,253.44 million.

The development indicated that the foreign companies had repatriated their profit abroad instead of investing them in the country, said a central bank official.

The FDI, however, posted a significant jump in intra-company loans last fiscal year: it rose 3.65 times year-on-year to $712 million.