Nearly half the state-run entities running at a loss

Nearly half of the listed state-run companies have been incurring losses for several years due to too little competitiveness, subsequently affecting stock investors.

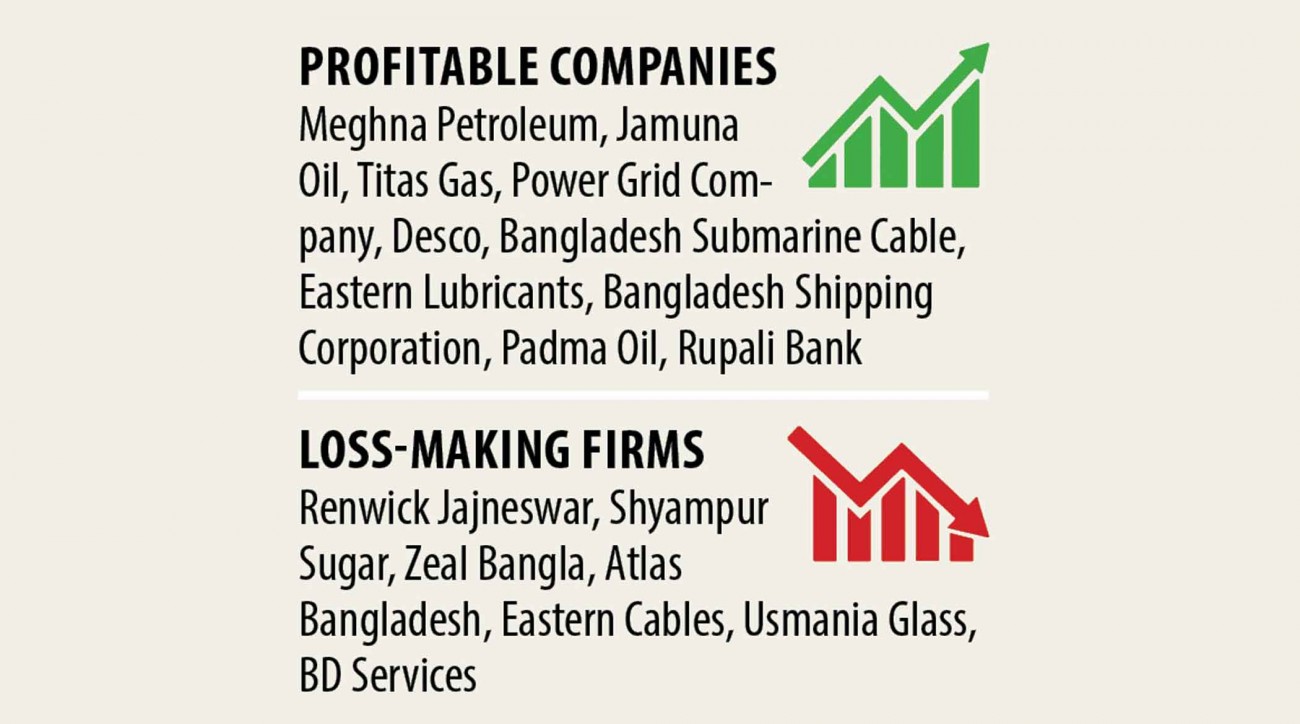

Of the full total 18, seven are incurring losses as the rest booked profits in 2019-20, according to the data of the Dhaka STOCK MARKET (DSE).

State-run companies, which enjoy natural monopoly and conduct business in strictly regulated markets, are booking profits.However, those running in a competitive atmosphere are mostly incurring losses, in line with the companies' business analysis.

The seven loss-incurring companies cope with creating sugar, motorcycles, hotel services, cables and glass sheets.

A big number of government-run companies aren't giving any dividends for several years therefore the stocks are providing nothing with their investors, said stock investor Abdul Alim.

Renwick Jajneswar and Usmania Glass did not provide any dividend going back two years.

Moreover, Shyampur Sugar and Zeal Bangla Sugar have not paid any dividends in at least for the past 2 decades, the DSE data shows.

The state-run sugar mills are 60 years old but their economical lifespan ended at least 30 years back, said Sanat Kumar Saha, chairman of the Bangladesh Sugar and Food Industries Corporation (BSFIC).

So they are incurring losses for several years, he said.

The listed three state-run companies named Shyampur Sugar, Zeal Bangla and Renwick Jajneswar are beneath the BSFIC.

Now, modernisation is required to ensure their commercial viability, Saha added.

Atlas Bangladesh was once a profit-making state-run motorcycle producer and distributor however now it's been incurring losses for days gone by five years.

The situation became so very bad that its auditor expressed uncertainty about future continuation of business.

Too little competitiveness is the key reason of the state-run companies' fallouts, Alim said, adding that the majority of the companies did not try modernisation and product diversification over the years.

The drive to achieve profitability is rare in the firms, the stock investor added.

A high official of a secured asset management company said they avoid buying state-run companies' stocks because their performance gets hampered by the federal government decisions at any time, a thing that was witnessed in the event of Titas Gas.

In 2015, the energy regulator made a decision to reduce its service charge so its earnings fell suddenly. Thus the stock price of the gas distribution company dropped.

Some state-run companies have huge potential because many of them work within an uncompetitive but possible fields, he said.

About the loss-making state-run companies, he said inefficiency and too little competitiveness and accountability were the main reasons for the state-run companies' fall.

So almost all of them are lucrative only in regulated markets however, not in the competitive arena, the asset manager added.

Eleven listed state-run companies are making profits. Of the 11, seven are conducting business in strictly regulated areas where in fact the private sector had not been allowed to conduct business.

The firms are Meghna Petroleum, Jamuna Oil, Padma Oil, Titas Gas, Powergrid, DESCO, and Bangladesh Submarine Cable.

Only four state-run listed companies are making money competing with the private sector. The firms are National Tubes, Eastern Lubricants, Bangladesh Shipping Corporation and Rupali Bank.

The federal government should bring companies with good performance records to the marketplace instead of companies with bad records, said a top official of a respected merchant bank.

Otherwise, the primary objective of bringing them would be spoiled, he said.

The federal government has taken steps to bring some state-run companies to the currency markets so as to boost stock investors' confidence.

Already, three state-owned commercial banks announced their commitment to get listed and Rupali wished to offload more shares within the existing year though it has been delayed because of the pandemic.

Some banks are not in a good condition due to higher non-performing loans therefore the government should reconsider such decisions in order that their listing does not increase woes of the stock investors, said the merchant banker.

After the listed state-run companies were profitable, nonetheless they became loss-making entities because of too little efficiency and monitoring, said Prof Abu Ahmed, a currency markets analyst.

The government must have offloaded their shares and controlling power so that efficient people found the boards. However the government holds many share for unknown reason, he said, adding that bureaucrats usually do not want to stop power to the private sector.

"What the majority power is giving to the federal government is yearly losses," he said.

If the federal government sold the shares, it might get a large amount of money back, however, efficient directors could generate profits for the firms that could pay them tax at the year's end, Ahmed said.

The firms have huge idle resources that may be used for making the firms profitable, he added.