NBR to create all-out effort to make amnesty to black money successful this time

The government is set to create an all-out effort from the following month to generate an elevated amount of income from the legalisation of untaxed money since it needs the sum to kickstart the coronavirus-ravaged economy.

Following the upcoming Eid holiday, the National Board of Revenue (NBR) would get right down to work to use the funds whitening tool to boost earnings for the state coffer.

Under the initiative, the tax administration would function advertisings in newspapers and tvs, work TV programmes and publish leaflets and brochures to encourage people to take their untaxed funds, popularly referred to as black funds, to the mainstream market.

The NBR would particularly highlight the opportunities introduced in the current finances that no questions will be asked about the sources of the money disclosed, said an official of the federal government agency.

Black money is largely related to tax evasion and its own direct impact may be the loss of government revenue.

Until the ongoing fiscal year, black money-holders have been in a position to whiten their assets by buying residential structures by paying a tax of 10 % on the total amount invested, which for frequent taxpayers is between 10 and 30 %.

An addition was manufactured in the last fiscal yr -- black money holders won't face any questions about the resources of their income if they invest in economic zones and hi-tech parks.

In fiscal 2020-21, the amnesty has been widened as the instrument has up to now didn't achieve its objectives of increasing revenue for the government and induce investment.

Now, individual taxpayers will be permitted to disclose any sort of undisclosed house houses, including land, building, flat and apartment by paying tax at a particular rate on per sq . metre.

Individual taxpayers may also be able to make any disclosure of undisclosed cash, bank deposits, financial savings certificates, shares, bonds or any kind of other securities on paying out taxes at a rate of 10 per cent.

They can also spend money on the administrative centre market and show it within their tax returns. They have to maintain a lock-in period for a 12 months.

No authorities, like the NBR and the Anti-Corruption Commission, can raise any question on such declarations.

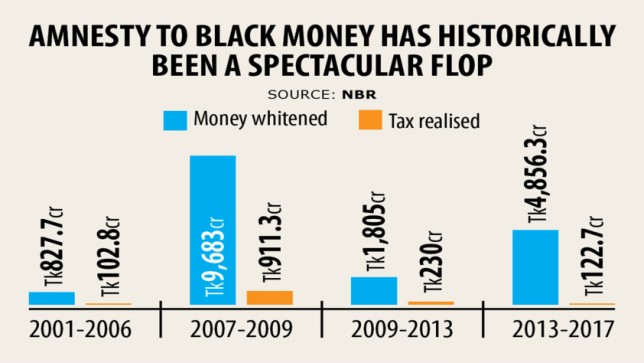

In fiscals 2007-08 and 2008-09, Tk 9,682.99 crore was legalised through the regime of the Army-backed caretaker government, that was the best in the country's history, NBR data showed.

In the previous two governments of the Awami League, Tk 1,805 crore and Tk 4,856 crore were respectively legalised.

The NBR has built tax return submission mandatory for all tax identification number (TIN) from the existing fiscal year to create revenues in a country which has among the lowest tax-GDP ratios in the world.

Because of lax in the prevailing provisions of regulations, about 50 per cent of the TIN-holders is now able to easily afford never to submit taxation statements, said Financing Minister AHM Mustafa Kamal in his budget speech on June 11.

Taking undue good thing about the situation, various eligible taxpayers are now avoiding submission of the taxes return and evading repayment of taxes, he explained.

The amount of taxpayers in Bangladesh is 20-22 lakh.

To increase the amount of taxpayers, the income tax department discovered 5 lakh brand-new taxpayers last fiscal year.

As a result of pandemic, earnings collection dropped 2.26 % to Tk 218,406 crore in the just-concluded fiscal year against the revised target of Tk 300,500 crore.

This is the first-ever negative growth in Bangladesh's history.

Bangladesh's budget deficit may shoot to as large as 10 % of the GDP this fiscal yr as the government would need to hold spending more to tackle the brunt of the coronavirus pandemic amid a good drastic fall in earnings generation, the World Lender said recently.