NBR introduces lottery to improve VAT collection

Buying a product right from a store could help win Tk 100,000.

Sounds bizarre? Well you do have the chance to win this volume after buying any product or seeking any provider if you gather a receipt made from the Electronic Fiscal Machine (EFD), a kind of cash register, as proof payment to the store.

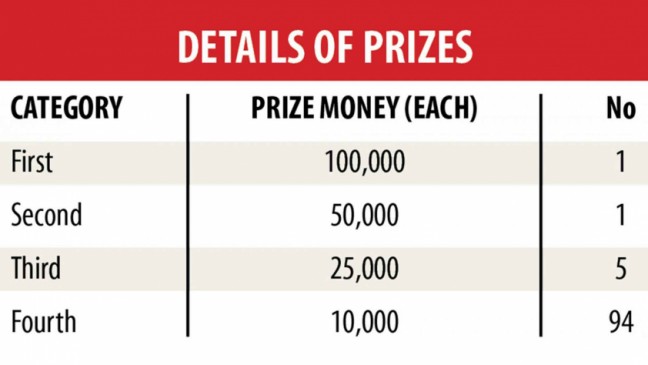

The National Board of Revenue (NBR) announced this prize along with 100 more prizes on Sunday to motivate buyers to ask sellers for receipts against purchases.

The income authority made the approach with an try to boost benefit added tax (VAT) collection from retail and plug the scope for individuals to evade this fee.

With the cheapest amount being Tk 10,000, the prizes, a first time-initiative by the NBR, will be distributed on a monthly basis based on VAT receipts to be issued through the EFDs from the earliest day of the month to the last, based on the insurance policy on lottery by receipts of the EFD administration system issued by the NBR.

By March next year, the NBR really wants to install 4,000 EFDs across the country and 10,000 by June.

"We are thinking about conducting the lottery from the following month," stated Bashir Ahmed, 1st secretary (VAT Execution) to the NBR.

The earnings authority's declaration employs it installed practically 1,000 EFDs at retailers in Dhaka and different major cities as part of its attempts to make sure that VAT expenses properly reach the point out coffer.

VAT is the biggest resource of earnings for the express and revenue officials and analysts on several situations said the government will not get using the sum of VAT paid by buyers owing to unscrupulous business practices.

The NBR started installing the devices from August this season and primarily installed 100 EFDs at stores and businesses in Dhaka and Chattogram to see the results before getting into a nationwide rollout.

The EFDs are provided for free to 25 types of businesses, including shops, hotels, restaurants, sweet stores, clothing, furniture and electronics outlets and jewelers.

The earnings administration started rolling away the devices three years ago after its previous bid to enforce the utilization of electronic cash registers (ECRs) failed mainly as a result of an lack of any electronic system to monitor transactions at shops through the products to ensure actual assortment of the tax.

The NBR said it connects the EFDs at stores to a central server at the NBR in order to screen sales as the equipment will create real-time data.

In its policy, the revenue authority said it will hold lottery on the 5th of each month and can publicise the winning coupon numbers within three business days in various media.

The next highest prize will be Tk 50,000 and the NBR gives one prize because of this category. The money for the third prize will become Tk 25,000 and the NBR will issue five prizes because of this category.

The prize cash for the remaining 94 prizes will be Tk 10,000 each.

The NBR said a six-member management committee, headed by NBR Member VAT Execution and It again, will oversee the overall task.