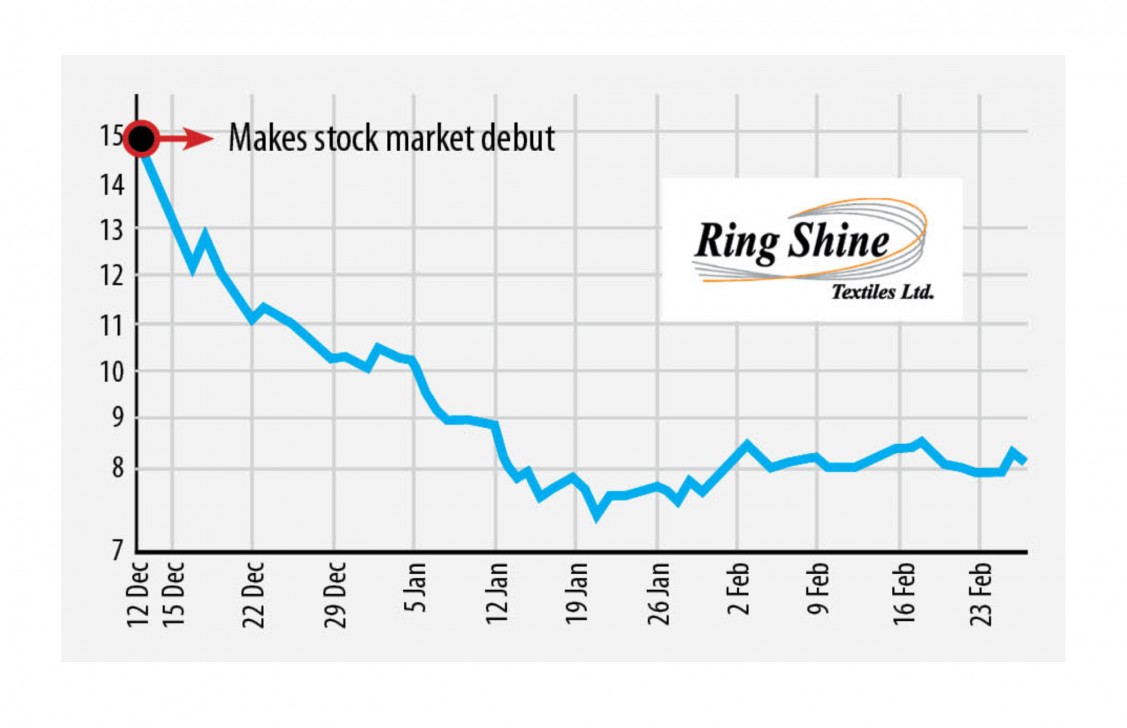

More bad news for Ring Shine investors

The news headlines of offloading of shares by an integral sponsor of Ring Shine Textile yesterday, in a matter of two and a half months after its listing on the Dhaka and Chattogram bourses, is another blow to the general investors, who've seeing the worthiness of their holdings plummet by the day.

Universe Knitting Garments, whose owner Sung Wey Min is the sponsor and managing director of Ring Shine Textile, announced yesterday its intend to sell 36.86 lakh shares of the textile company.

Sung also holds 6.52 %, or 1.85 crore, shares of Ring Shine Textile individually.

The news headlines dragged down the textile maker's stocks by 3.61 per cent to Tk 8 yesterday.

Market analysts said when a company's sponsor sell shares just after listing it offers a bad signal to the overall shareholders.

Ring Shine Textile debuted on the bourses on December 12 this past year to improve Tk 150 crore from general shareholders.

Immediately after the listing rumours have already been running rife that the textile maker's foreign staff, directors and managing director were abandoning the venture and leaving the country for good.

However, they returned to work later.

Amid the situation, Universe Knitting Garments yesterday expressed its intent to offload 13 % of its total holdings of 2.82 crore shares at prevailing market price.

Universe Knitting didn't inform the textile maker why it was selling the shares, said Asraf Ali, company secretary of Ring Shine.

"This is an interior decision of the owners," he added.

Abdul Mannan, a stock investor, said the stock tumbled to significantly less than its face value when the rumours of its foreign owners jumping ship spread.

Now, the main element sponsor's share selling will have bigger effect on general investors.

"So, its stock price is declining," he said.

A top official of the Bangladesh Securities and Exchange Commission (BSEC) said the regulator cannot deter a sponsor from selling his/her shares if they're doing so by abiding by the laws.

Under this circumstances, stock investors ought to be cautious about buying the stock, he said, adding that the BSEC is currently giving approval to initial public offerings on a disclosure basis.

A merchant banker said such share selling by a sponsor at a cost of beneath the face value means the company's stakeholders themselves do not think it has a bright future.

And their selling so immediately after the company's debut on the bourse does mean sponsors always had the plan to cash out right after listing.

"A sponsor can sell his/her shares. But when he does so under face value then it raises questions about the business's potential," he added.

In line with the company's annual report for the 2018-19 financial year, its sales dropped 1.72 % to Tk 982.37 crore from a year earlier.

The net profit percentage also decreased from 5.54 % to 5 % during the period.

Sung said in the annual report of the 2018-19 financial year that the business's sales and profitability decreased as a result of a rise in production cost by almost 1 per cent, and a decline in the price tag on goods sold in market.

Ring Shine's capital raising has been shrouded in controversy from the very beginning because it raised a huge amount of money, said Sharif Anwar Hossain, president of DSE Brokers Association of Bangladesh.

"Many stock brokers were saying that the business was coming to the market in order to dump its shares on the general shareholders."

So, general investors must have been more cautious, Hossain said, adding if investors didn't buy its shares the business would not have already been in a position to come to the market.

"However, our investors rushed to snap up Ring Shine shares. In addition they need to examine what shares they should buy and what never to."