Many listed firms don’t give cash dividends despite profits

Seeing GBB Power was on a rising streak in the later half of 2017, Motahar Hossain decided to put most of his money in the stock in January 2018 -- anticipating a handsome cash dividend.

But he got a jolt when GBB Power published its annual report in October last year: despite making good profit the company’s board announced no dividend for its shareholders.

And the board did not give any reason for the decision. Had it retained the profit earned to invest in the company’s growth to attain better rate of returns in future, the retail investors would have been unruffled.

But the radio silence meant the company’s share price tumbled to Tk 8.5 from Tk 19.80, sinking Hossain’s investment along the way.

“Was I wrong to invest in this company?” asked a crestfallen Hossain.

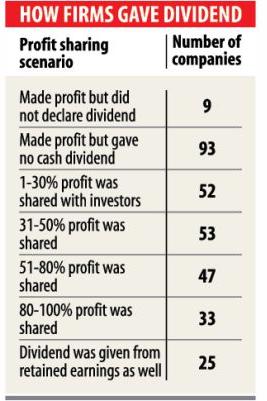

GBB Power though is not alone. There were eight other companies that did not share their gains with their retail investors: AB Bank, People’s Leasing, Prime Finance, BD Welding, Evince Textile, Information Services Network, Samata Leather, and Shinepukur Ceramics.

Then there were 93 other companies that logged in profits -- with 18 registering more than Tk 50 crore -- but declared only stock dividend, according to data from the Dhaka Stock Exchange.

A stock dividend is an additional number of shares given to retail investors instead of cash payment at the end of the financial year.

One key benefit of getting stock dividend is choice: the shareholder can either keep the shares and hope that the company will be able to use the money not paid out in a cash dividend to earn a better rate of return, or he/she can sell some of the new shares to create his/her own cash dividend.

But the 93 companies gave very little amount of stock dividend in comparison with the profit made for the payout to be much useful for the retail investors.

Hossain said he had to incur huge amount of losses due to the company’s unreasonable behaviour.

And yet, neither the stock market regulator nor the exchanges are taking any action to arrest the trend, he added.

The listed companies’ growing tendency to retain profits is a double whammy for retail investors: on one hand, they do not get any dividend money, and on the other, the value of their holdings shrivel thanks to stock’s price nosediving following the no-dividend announcement.

“This is one of the main reasons for our stock market’s gloominess,” said Abu Ahmed, a stock market analyst.

What is worse is that the companies are not re-investing the profits into gainful projects, so their profitability is shrinking as the years go by.

“And with it, their stock prices are declining. It is the investors who are the sufferers in the end,” he added.

In another curious development, most of the companies that did not pay dividend after a profitable year had low shareholding by their sponsors.

For instance, as of April 30, sponsors held 23.21 percent of the stakes in People’s Leasing, 21.62 percent in Information Services Network, 31.01 percent in BD Welding, 32.01 percent in GBB Power, 36.67 percent in Evince Textiles and 36.47 percent in AB Bank.

However, sponsors hold more than 50 percent stakes in Samata Leather, Shinepukur Ceramics and Prime Finance.

“Since sponsors’ shareholding is minimal, they do not want to pay dividend and keep the spoils for themselves,” said Ahmed, also a former chairman of the Dhaka University’s economics department.

And when they do decide to give out dividend, they tend to raise their stakes on the sly ahead of the announcement so as to get a bigger slice of the pie, he added.

KAM Majedur Rahman, managing director of the DSE, said the bourse cannot give any instruction to the companies regarding dividends.

The company itself must have a responsibility towards its investors and articulate clearly why the profit is being retained.

“It’s a part of the company’s accountability too,” he added.

The stock market regulator is already working to address the issue of stock dividend, said Saifur Rahman, spokesperson of the Bangladesh Securities Exchange and Commission.

“It is the company’s prerogative to retain earnings. The BSEC cannot do anything about it.”

Rahman, also an executive director of the BSEC, however, advised the shareholders not to pass the no-dividend agenda in the annual general meetings.

The BSEC though has taken a step to enforce greater transparency when it comes to stock dividend.

Earlier on May 21, it sent out a missive instructing companies giving stock dividend to inform its shareholders what they are doing with the money not being handed out as cash.

Anwar-ul Alam Chowdhury, chairman of Evince Textiles, said the company decided to reinvest the profit last year and hence no dividend was declared.

But the company did not disclose the information to its retail investors, which is why its share price tanked to Tk 9.1 from Tk 18.20 within a period of one and a half months.

GBB Power has not responded to emails from the correspondent.

Meanwhile, 25 companies provided cash dividends more than their profit and most of them are multinationals.