Make prompt LC payment or face the music

The central back yesterday instructed banks to make their import payment to corresponding foreign banks on time or else strict actions will be taken against the errant lenders.

A good number of banks have recently showed an unwillingness to make import payments on time, which has had an adverse impact on the country’s international image, according to a study done by the Bangladesh Bank.

A BB official said that the monetary authority had earlier imposed penalties on certain banks, which helped bring in corporate governance.

“But the lenders have started the malpractice once again. This time the central bank will have a zero tolerance policy against them,” he added.

Senior bankers welcomed the initiative, saying that many foreign banks are reluctant to accept letters of credit (LC) issued from Bangladesh as a few local lenders frequently breach the terms and conditions while making payments.

The banks are also forced to pay additional interest to their corresponding lenders due to their failure to settle LCs promptly.

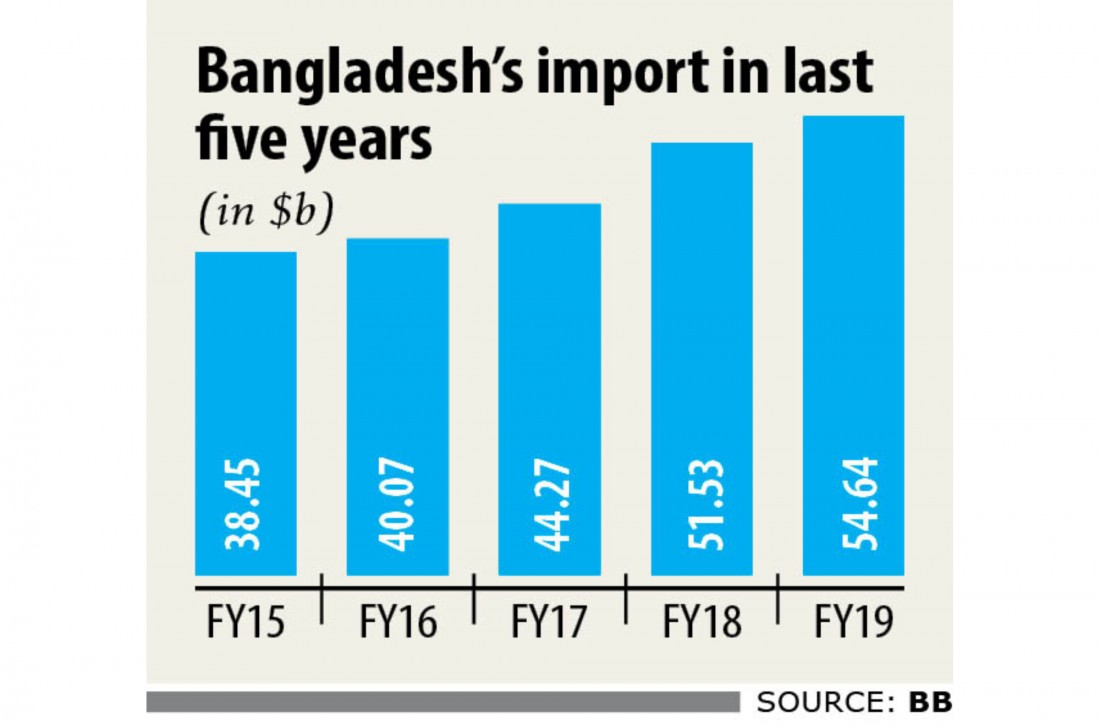

Besides, the confirmation charge for LCs is also on the rise as a result of the added pressure on the country’s foreign exchange reserve.

Confirmation fees are a security mechanism that eliminates risks for exporters.

When exporters are not comfortable with the LC-issuing bank, usually due to insolvency risks or local political factors or sometimes both, they may seek an additional guarantee for the LCs.

Malpractice in the industry has also had a negative impact on the country’s balance of payments, according to the BB notice to all banks.

So, banks have been ordered to make timely import payments while following due diligence; otherwise the central bank will take punitive measures against wrongdoers.

In breach of global norms, some banks do not make import payments in order to provide extra facilities to their clients, said a bank official requesting anonymity as he is not authorised to speak with media.

Clients get extra time to adjust the bank loans against their LCs if their lenders do not duly make import payments, he added.

This is a good initiative as it will help restore the country’s financial image, said Syed Mahbubur Rahman, managing director of Mutual Trust Bank.

“The country’s LC confirmation charge is higher than in Pakistan. Our sovereign credit rating is better but despite that, we have to pay extra charge,” Rahman said.

Foreign banks have a negative image of some local banks as they did not settle their LCs in line with banking rules and regulations, added Rahman, also the previous chairman of the Association of Bankers Bangladesh, a forum for managing directors of banks.

Md Arfan Ali, managing director of Bank Asia, echoed the same.

The illicit collaboration between banks and clients should be stopped for the greater interest of the country’s financial sector, said Ali, who hopes that the central bank’s instructions will help bring discipline to the banking sector.