Keya up the creek

Keya Cosmetics is currently in deep issues, as potential debt of around Tk 705 crore in the form of trade receivables loom more than the once popular household name.

Trade receivables are sums owed to a organization by customers following sales of goods or offerings on credit.

The company kept a provision for the "remarkable amount" in its financial reports for the entire year ending on June 30, 2019 as bad and doubtful debts against recovery of trade receivable, said the business's auditor within an observation.

"It is now in mind for your final declaration as negative credit debt after detailed investigation by the management," browse the remark published by Dhaka Stock Exchange (DSE) on its web page yesterday.

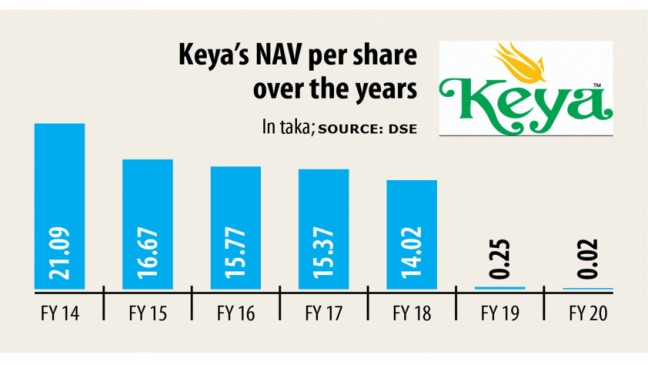

Incorporated in 1996, the business came to stick out as one of the preferred cosmetics brands but its glory days are now fading.

Subsequently, repeated announcements had been made for its shareholders informing that its sponsors, including Chairman Abdul Khaleque Pathan, want to offload their shares.

Though it declared 2 % stock dividend for the year ending on June 30, 2020, the auditor revealed that it's been suffering from a huge amount of trade receivables.

The dividend declaration caused its stocks to go up to Tk 8 from Tk 2. Even so, the stocks dropped 1.56 % to Tk 6.30 yesterday.

"We want to recover the total amount so if it returns afterward it could show in profits. But if it is not possible a last declaration would come," stated its chief personal officer, Humayun Kabir.

Responding to a issue, Kabir said the total amount was not thanks from any specific or perhaps few entities but rather from "scattered" debtors.

The auditor also observed that the business declared a huge amount of stock to be obsolete, amounting to Tk 711.75 crore, proceeds against the sales of which had earned Tk 24.98 crore.

About Keya Cosmetics' loans, the auditor said the financial studies showed Tk 157.25 crore availed from Pubali Bank staying carried over from past years but without reference to associated interest.

The same circumstances surrounded another Tk 12 crore extracted from Sonali Lender and Tk 16 crore from Premier Bank.

The company fell in big trouble for many reasons but the doubtful loans increased its woes, said a top official of a merchant bank.

The failure of the company is now leading to sufferings for general investors and the stock market, so that it should try core to recover the total amount, said the official.