Interoperability across all financial systems this year

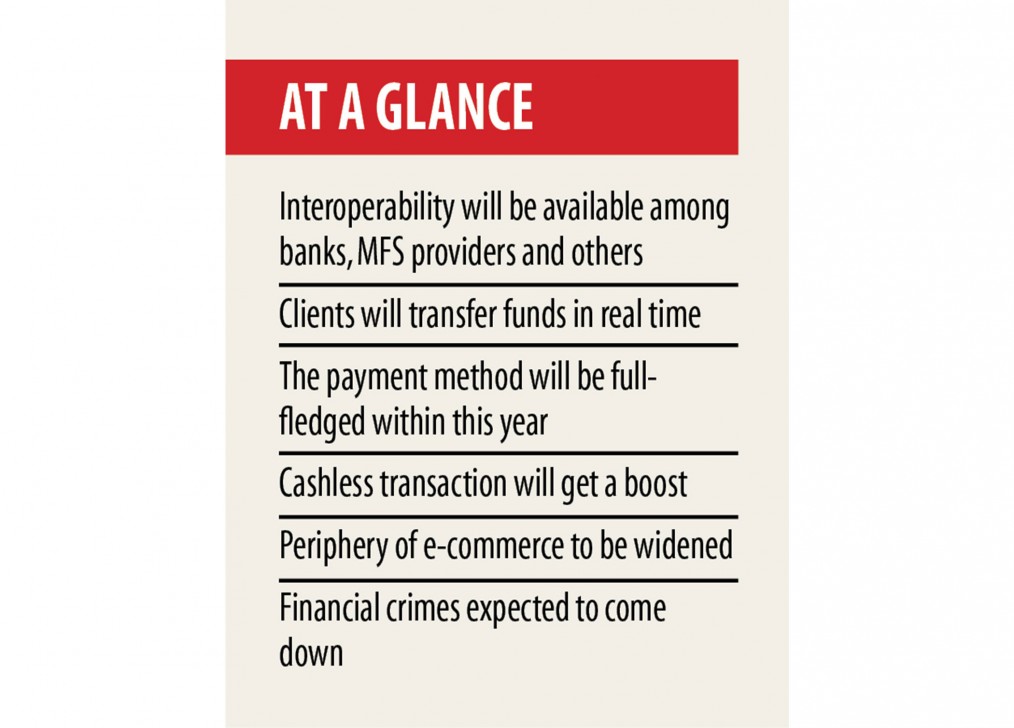

The government has taken an initiative to create all accounts of banks, mobile phone financial services and payment system providers interoperable this season, a development that will allow people to move funds effortlessly within the financial sector on real-time and at lower costs.

The new system -- Interoperable Digital Transaction Platform (IDTP) -- will be create to determine the interoperability among banks, MFS operators and payment companies (PSPs) and would give a significant boost cashless transaction.

The federal government will cough up Tk 56 crore to set up the IDTP and the central bank will govern and operate it, according to a central bank file.

The coronavirus pandemic has recently given a huge push to cashless transaction as persons from all walks of existence are increasingly embracing digital payment tools in order to avoid cash in order to keep carefully the pathogen at bay.

Transaction through MFS rose 41 % year-on-year to Tk 53,598 crore found in November.

The issuance of bank cards stood at 16.31 lakh by October, up 8.73 % year-on-year. The quantity of debit cards grew 8.70 % to 2.10 crore.

The central bank will pilot a study between February 1 and February 14 to implement the IDTP.

Eleven banks, two PSPs and one MFS company will need part in the piloting.

The central bank will create the mandatory hardware and software to start the brand new payment method in a full-fledged manner this season.

A mobile app was already developed to allow clients to join up with the IDTP.

Clients might complete the registration utilizing the mobile app of banks, PSPs and MFS service providers if the organizations attach the app with their internet banking and digital repayment platform.

Banks, PSPs and MFS providers will complete the registration process with respect to their clients.

If a client holds lots accounts with banks, PSPs or MFS providers, they'll not require to join up in the program for every account.

Only one account will be authorized and various other accounts will be added by simply the finance institutions by verifying the countrywide identification card of consumers.

The IDTP will create an account profile of each registered client, that may provide an "alias" to clients.

The alias will be created by using the brand of clients. Because of this, they will not have to disclose the bill amount .The alias will represent all accounts of a client.

"The IDTP can help people transact cash without needing their account number, that will subsequently reduce fraudulent activities," said Syed Mahbubur Rahman, managing director of Mutual Trust Lender, which will be a part of the pilot scheme.

According to Rahman, cashless transaction will receive a big momentum when clients will be able to deposit or withdraw funds on a real-period basis from banking institutions, PSPs and MFS service providers through the IDTP.

The registered customers of the IDTP will have the ability to purchase products from outlets by scanning the QR (quick response) code.

A QR code is a kind of barcode that retailers information as some pixels in a square grid and can certainly be read by smartphones.

The brand new system will be highly secure as clients should be verified through a two-factor authentication for each and every transaction.

Banking institutions, PSPs and MFS services will provide clients a one-period password when they attempt to perform a transaction.

"Money-laundering will get tackled to a great level when the IDTP commences its operation," said Mohammad Ali, an additional managing director of Pubali Lender.

A launderer may make an effort to invest their ill-gotten prosperity in phases in a variety of financial institutions, however the alias of clientele will check the problem, he said.

E-commerce will widen tremendously aswell, Ali said.

Banks and MFS providers often offer discounts. Beneath the new system, clientele will transfer money in one account to another account, which offers the discounts, to get the products.

There is a major gap between your clients of banks and users of MFS providers regarding using fund in a common platform, but the new system provides clients within a uniform payment program, Ali said.

"The price of cash transaction will reduce drastically when the IDTP becomes operational," explained Md Arfan Ali, managing director of Lender Asia.

Clients will not require to withdraw funds from MFS service providers, PSPs and banks because they may easily move money in one channel to another channel. Subsequently, the money will generally circulate in the economic network.