Insurance stocks a double-edged sword for investors

Stocks of virtually all non-life insurance companies have significantly more than doubled over the past year while the benchmark index of the Dhaka STOCK MARKET (DSE) rose 38 %.

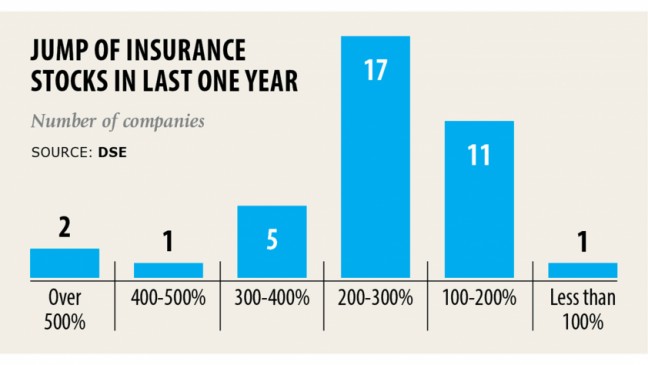

At least two insurance firms saw their stock prices grow over five times the initial value although it was 3 to 4 times for 17 others, shows the DSE data.

However, this rise in value isn't supported by an increase in earnings.

For instance, Provati Insurance surged eight times from its original value but declared only 17 per cent stock dividend for 2020. The company's earnings per share rose 85 per cent to Tk 1.26 in the first quarter of 2021.

The same scenario prevailed for nearly all the non-life insurers.

"The insurance stocks are rising abnormally but I don't find any justification for such a rise," said currency markets analyst Prof Abu Ahmed.

Despite the fact that banks provide higher dividends than the insurance sector, their stock price hovers at around face value while insurance stocks are jumping.

"That is insane. The investors who bought these stocks will need to face the reality though when the gamblers complete their sell-offs," he said, adding a stock can't be overvalued for long without maintaining the basics.

Bangladesh's currency markets is gambler-driven, so investors are rushing towards such stocks.

The alarming thing is that people are taking margin loans to purchase these stocks.

"Most of our investors' behaviour contradicts what we read in textbooks," said Ahmed, also a former chairman of the economics department at the University of Dhaka.

Lower commission for agents is one cause of the surge in insurance stocks but this alone isn't enough, as proven by their recent earnings, according to market analysts.

Insurance firms saw their earnings rise by around 30 to 40 % in the first quarter of the year.

In 2012, the Insurance Development & Regulatory Authority (IDRA) issued a circular barring insurance firms from paying more than 15 % of premiums as commission with their agents.

However, most insurers disregarded the directive, prompting the regulator to issue a notice in late 2019, urging compliance with regard to the sector's well-being.

Many companies offered up to 60 % of the premium as commission to secure business, hurting the industry along the way. This is especially the case for organizations with good performance records, said industry insiders.

But in a meeting with Bangladesh Insurance Association in 2019, insurance firms collectively agreed to follow the order in a bid to keep carefully the sector alive.

Sharif Anwar Hossain, president of DSE Brokers Association, agreed with Prof Ahmed, saying that the insurance stocks were rising peculiarly at an increased pace than that of higher dividend-paying companies.

"What has suddenly happened to these businesses that during the pandemic period their share price rose by 3 to 4 times?" he questioned.

The DSE and BSEC should properly investigate the problem as the purchase price hike is creating risks for the entire market.

"When general investors incur losses by buying these stocks, they leave the marketplace, which eventually leaves a dent," he added.

The DSE Brokers Association president continued to say that they can not stop general investors from purchasing the stocks though it could have a "boomerang effect".

"This is simply not good as gambling isn't a sustainable way to survive in the currency markets," said Hossain, also managing director of Sahidullah Securities.

An interesting thing is that while all non-life insurance stocks of low performance at least doubled within the last year, among the top performing organizations -- Green Delta Insurance -- rose only 25 %.

A merchant banker preferring anonymity said gamblers started toying with insurance stocks at least seven or eight months ago.

"But they could not complete their sales and exit properly, so now they have began to gamble again to allure general investors," he said.

"If general investors do not take up these stocks, the gamblers will be profoundly struck but nonetheless investors are taking on these risky scripts each day," he added.