Insurance stocks: Sponsors selling, investors still on a buying spree

While insurance stocks were skyrocketing riding on rumors within the last 8 weeks, their sponsors wasted virtually no time in making an instant buck.

Eight sponsors and directors of seven listed insurers sold 23.73 lakh shares to general investors at prices that have been prevailing at that time available in the market, which had a cumulative value of around Tk 15 crore.

When sponsors and directors of the companies were selling shares and saying that there is no undisclosed reason for the unusual price hike, general investors were buying insurance stocks predicated on rumors, according to market insiders.

"The rumor is that gamblers are staying with the stocks, so these stocks would rise," they said.

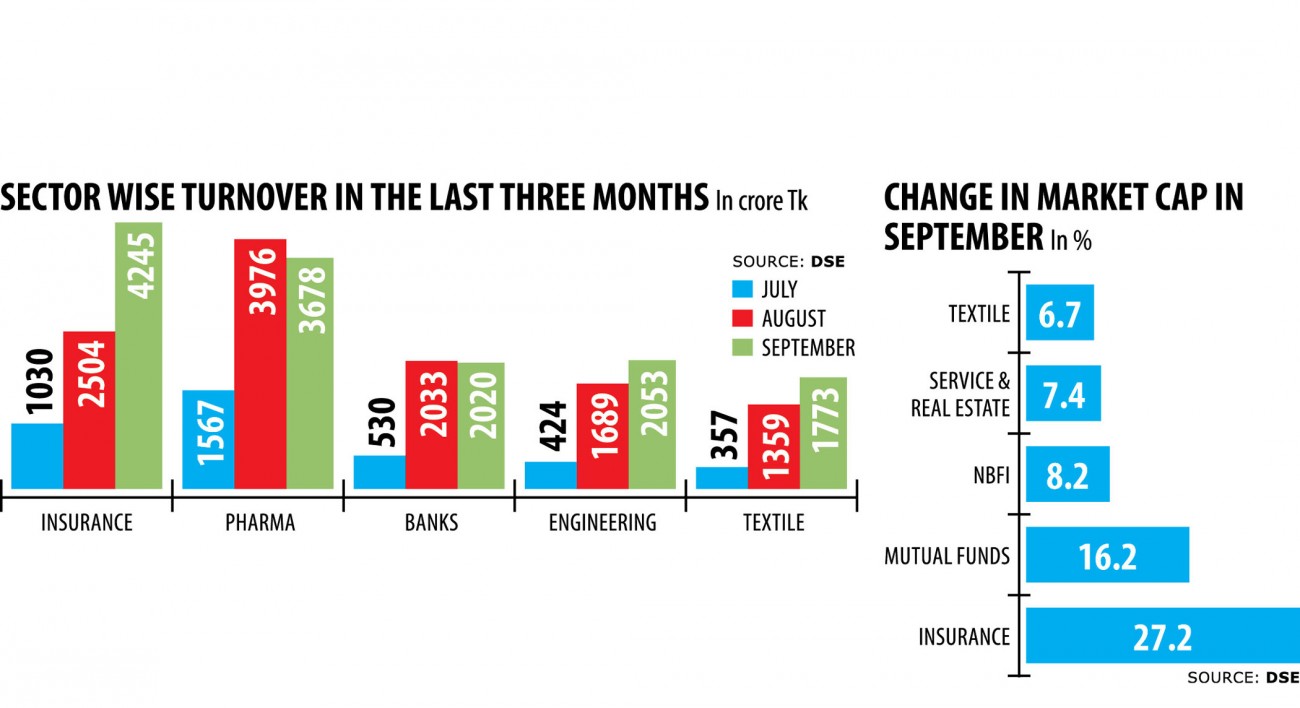

The insurance sector topped the turnover list combined with the top gainers' list within the last 8 weeks, data from the Dhaka STOCK MARKET (DSE).

General investors ought to be much more educated on the problem and exhibit more common sense, said a high official of the Bangladesh Securities and Exchange Commission (BSEC).

He expressed frustration and bewilderment at investors going wild over owning these shares when the company sponsors themselves were selling their stakes.

"Investors should be wary of their investment, otherwise their investment will fall into problems," the BSEC official said.

Sponsors can sell their shares while maintaining due procedure for declaration and there is nothing against the law about it but the condition lies in investors not realizing that it could possibly be risky to allow them to invest in overvalued insurance stocks, he added.

Virtually all insurance stocks doubled over the last two months and the sponsors sold their shares when prices were at their peak.

This scenario was witnessed regarding Central Insurance, Agrani Insurance, National Life Insurance, Pioneer Insurance, Reliance Insurance, Rupali LIFE INSURANCE COVERAGE, and United Insurance.

Meanwhile, a stockbroker said that insurance firms were likely to witness higher profits due to lower commission payments to agents.

In 2012, the Insurance Development and Regulatory Authority (IDRA) issued a circular, barring insurers from paying a lot more than 15 % of the premium as commission.

However, most insurers disregarded the directive, prompting the regulator to issue a notice in late 2019, urging compliance for the sake of the sector's well-being.

Many companies offered as high as 60 % of the premium as commission to secure business which includes hurt the industry, especially insurers with good performance records, industry insiders said.

However, in a positive development, insurance companies agreed in a gathering of the Bangladesh Insurance Association this past year to check out the order in a bid to keep carefully the sector alive.

The lower commission increases insurers' profits, so investors are buying the stocks, the broker said, adding that the price has increased to an overvalued level that was not supportive of the low commission logic.

A high official of a listed insurer, preferring anonymity, said that sponsors sold their shares conducting due diligence.

When they see a huge profit in shares, each goes for sales which is normal, he said, adding that the sponsors believe they can log higher profits by selling shares instead of retaining those regardless of the commission issue.

However, there have been some sponsors of the listed insurers who bought shares from the overall investors to meet up with the BSEC's directive.

The BSEC within an earlier directive said the directors of the listed companies would need to keep at least 2 % of their own company's shares.