ICB’s baffling investment decision

Some 8 per cent of state-owned ICB Asset Management Company’s funds are tied in stocks that have shuttered production or have not been providing dividend for many years now, in what can be viewed as an emblem of the slapdash nature of the country’s bourse.

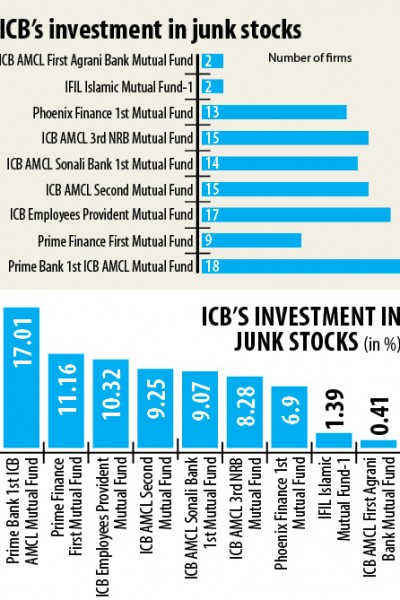

ICB manages nine closed-end mutual funds.

A closed-end fund is an investment fund that gathers a fixed pool of money for a certain duration from investors and re-invest them into stocks, bonds and other assets. A professional manager oversees the fund and actively buys and sells holding assets.

Once its tenure ends, it is liquidated and split among unitholders.

“It is unexpected that an institutional investor would be investing in stocks that become junks,” said Ahmed Kabir, a stock investor.

General investors pay asset managers as they do their due diligence before making any investment.

“But when asset managers put their money in junk stocks, it is just plain irresponsible behaviour.”

Asset managers should have analysis on whether a company may become non-performing or junk, he said.

“This is why a general investor depends on asset manager,” he said, adding that if a listed company becomes junk suddenly then it is understandable.

By analysing the company’s closed end funds’ portfolio statement as on December of 30, 2019, it was found that Tk 56.58 crore, or 8.2 per cent, of ICB’s investment in listed securities have become junks.

“We did not buy these stocks recently,” said Md. Golam Rabbani, chief executive officer (additional charge) of ICB Asset Management.

The stocks were purchased circa 2010-11 to support the market -- when they were not junks.

“With the passage of time, the stocks have become junk. But we have some bindings: we cannot sell shares when their prices fall below the level we bought them,” he added.

Mizanur Rahman, a stock market analyst, dismissed Rabbani’s rationale.

“This is not the right argument. Its losses would have been lower. ICB AMCL’s investment decisions prove its inefficiency.”

Besides, the asset manager sometimes bought well-performing companies’ stocks at a high price, so their share value diminished over the years, said Rahman, also the professor of accounting and information systems of Dhaka University.

ICB AMCL’s net asset value (NAV) return was 1.7 per cent during 2015 and 2019.

Between 2017 and 2019, NAV dropped 2.1 per cent, according to IDLC Asset Management mutual funds review.

If the state-run company behaves professionally, it would play a vital role in building investor confidence in the mutual fund sector, Rahman added.

Thanks to these unfathomable investment decisions along with recent stock market slide, the returns of the funds managed by the state-run company have come down substantially.

If any ICB official sells shares at a loss his job benefits come under pressure, said an official of ICB Asset Management requesting anonymity to speak candidly on the matter.

Besides, the officials have to answer to the Bangladesh Securities and Exchange Commission if he sells shares at losses.

“We are continuously ordered to support the market, so our target become to support the market rather than make profits. If we can run our business without any intervention then we can could perform better.”

In 2019, return of net asset value (NAV) dropped 7.6 per cent for all the closed-end mutual funds on an average, whereas ICB AMCL’s NAV dropped 12.2 per cent, according to the review.

During the period, DSEX, the benchmark index of the Dhaka Stock Exchange, plunged by 18 per cent.

So, ICB ranked eighth out of the total of nine closed-end fund managers on the basis of NAV return in 2019.

As some asset managers’ performance hurt stock investors, the overall mutual fund sector is struggling to attract investors, said a top official of an asset manager preferring anonymity.

“Investors don’t want to purchase mutual funds even after their price becomes lucrative compared with the NAV,” he added.

At present, closed-end mutual funds’ aggregate price is 57.3 per cent compared to the NAV.

As many as 33 of the 37 listed mutual funds traded under their face value on Thursday last week.