High-flying insurance shares may put marketplace in trouble

The stock price of virtually all general insurance companies has a lot more than doubled within the last year riding on speculation, putting the complete market at risk.

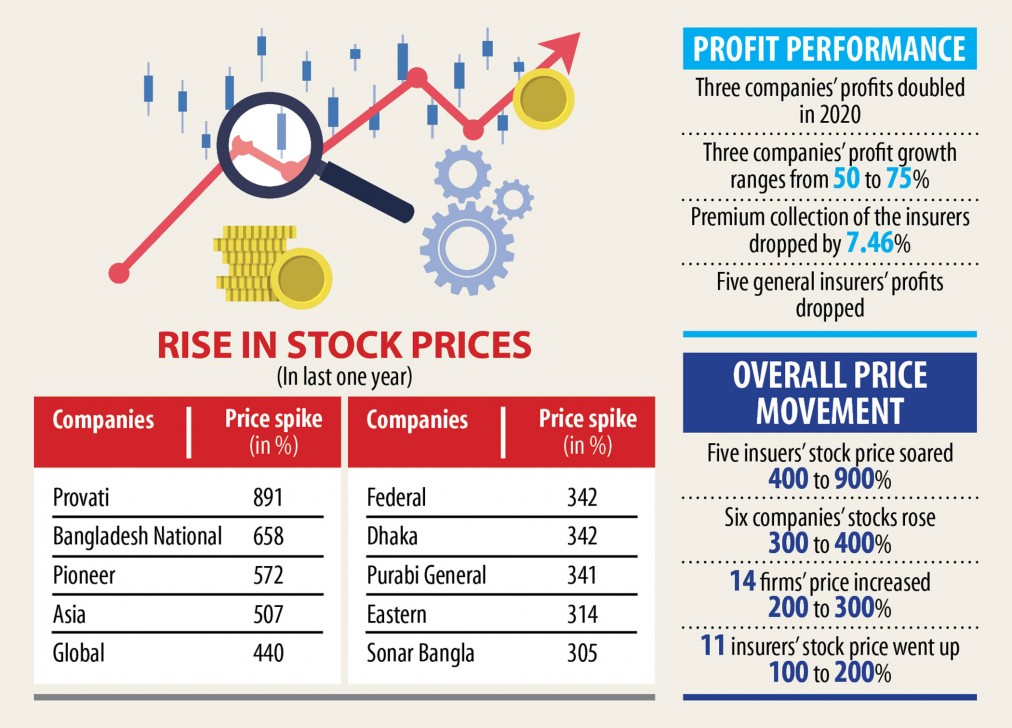

Besides, 26 standard insurance companies, or 68 % of the sector, found their share values a lot more than triple through the same period.

Most of these corporations logged higher income amid the ongoing Covid-19 pandemic, however the sharp rise found in the stock value is disproportionate to their profit growth.

So, these overvalued stocks are putting the complete market in risk, according to market analysts.

If these stocks face corrections, basic investors will be the losers, that will dent their self-assurance, they added.

"The surge in the insurance shares is not a good sign for the marketplace," said Mirza Azizul Islam, a ex - chairman of the Bangladesh Securities and Exchange Commission (BSEC).

Investors are actually blindly rushing towards insurance shares without conducting an effective analysis when they start to see the rise in values.

"The over-cost of insurance stocks can not be sustainable," he added.

When low-performing companies rise abnormally, it spooks the self-assurance of other investors since it seems as even if the marketplace lacks monitoring.

There's not been virtually any big news for the insurance sector that could have resulted in such a sharp spike in inventory prices in comparison to profits.

"Thus, the country's bourses should emphasise improving their monitoring devices," Islam said.

Sharif Anwar Hossain, president of the DSE Agents' Association, said there were some known reasons for the rise of the insurance stocks and shares. But the tempo of the increase was abnormal.

"Since the government says that everyone will come to be brought under insurance coverage, it positively impacts the sector.

The decision to fix the commission for agents at 15 % also boosted insurers' profits," he said.

In 2012, the Insurance Creation and Regulatory Authority banned insurers from paying out more than 15 per cent of the top quality as commission with their agents.

However, virtually all insurers disregarded the directive, prompting the regulator to issue a notice in 2019 that ordered them to comply with regard to the sector's wellbeing.

Subsequently, in a gathering with the Bangladesh Insurance Association the same year, insurance firms collectively decided to follow the order.

Various companies previously offered just as much as 60 % of the top quality as commission to safe and sound business, which hurt the insurers' profits.

However, the methods cannot justify the jump in the stock prices as their revenue rose at a slower pace, Hossain said.

Twenty-five of 30 listed insurance firms saw higher profits rise in 2020 when compared to a calendar year ago, according to info from the Dhaka STOCK MARKET (DSE).

The gains of three insurers grew a lot more than 50 per cent this past year, whereas the stocks of 12 companies surged more than 300 %, DSE data showed.

"There are companies that already are giving larger dividends although their rates are at a lesser level," said Hossain.

But investors are more focused on insurance shares as the purchase price has risen over the past few months.

"If these stocks find corrections, the sector will drop, and the entire market will come to be impacted," added Hossain, as well the managing director of Md Sahidullah Securities.

Insurance stocks have been undervalued for a long time, but investors didn't invest in them back then. Now they will be rushing to the sector despite the fact that the stocks have surged, stated Sayedur Rahman, president of the Bangladesh Merchant Bankers' Association (BMBA).

"We have no to bar them. But shareholders should be very careful because insurance stocks have already risen a lot," he added.

However, insurance firms have potential due to the cut in commission repayments and the attempts of the federal government and private businesses to expand coverage.

Only 0.3 % of Bangladesh's people was covered by life insurance coverage in 2019, when the average for emerging countries was 1.7 %, according to info from Swiss Re, a worldwide reinsurer.

When it comes to non-life insurance, the coverage was 0.1 % in Bangladesh in comparison to 1.5 % in emerging nations.

The insurance penetration slipped below 0.5 per cent in 2019. It had been 0.57 per cent in 2018 and 0.55 per cent the year before, info from Swiss Re showed.

"Many investors seek corporations with higher gains and lower paid-up capital. But these risks could yield profit or loss, so they have to be mindful,'' Rahman said.

There are lots of companies that are available at lower prices, nonetheless they provide good dividends.

"Investors could spend money on these stocks. But persons are not following basics of the currency markets, which must be seen as an investment application rather than a business place," he added.

Mohammad Rezaul Karim, a spokesperson of the BSEC, said that the marketplace regulator was not worried about any stock's upward or downward trend.

Rather, it monitors whether there have been any wrongdoings in trading, such as for example insider trading or cost manipulation.

The DSE has recently reported some irregularities, and the BSEC is attempting to address them.

"But the hearing method has been slower amid the pandemic, so that it cannot take any guidelines against the persons who are involved in the wrongdoings," he stated.

"We have improved our surveillance, which include monitoring social media pages that spread rumours," Karim added.