Higher return fuels sales of savings tools

Sales of savings instruments continued its uptrend in the first quarter of the fiscal year thanks to their higher yield in comparison to banks' deposit products.

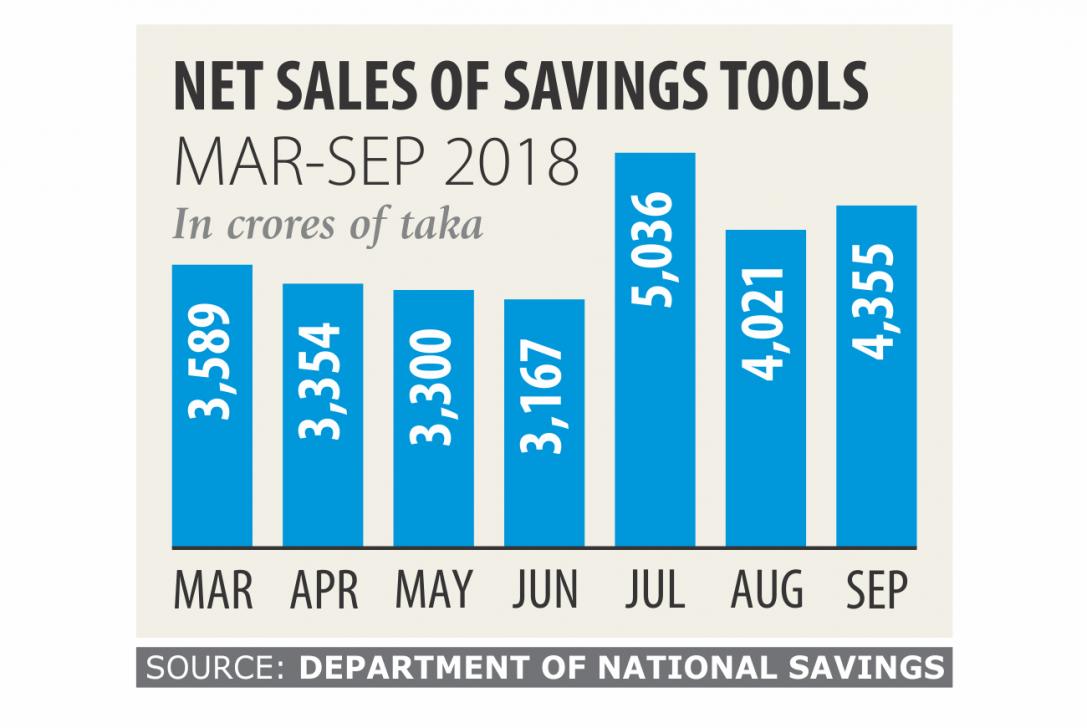

Between the months of July and September, net sales of the government savings tools stood at Tk 13,412 crore, up 5.65 percent from a year earlier, according to data from the Directorate of National Savings.

As a result, many of the lenders' deposit bases are eroding, said Syed Mahbubur Rahman, chairman of the Association of Bankers, Bangladesh, a platform of private banks' managing directors.

Some banks are now offering interest rates as high as 7 to 9 percent on their several fixed deposit products -- going against the decision taken by the sponsors of private banks to keep the interest rate on deposits at 6 percent, he said.

The interest rate of the national savings instrument ranges from 11.04 percent to 11.76 percent.

“This is more attractive to savers,” said Rahman, also the managing director of Dhaka Bank.

Many private banks have been in trouble because of inadequate deposits, said M Kamal Hossain, managing director of Southeast Bank.

Savers are now choosing the government savings tools to avoid the fluctuating interest rates on banks' deposit products, he added. The outsized investment in savings tools will have an adverse impact on the fiscal side, said AB Mirza Azizul Islam, a former finance adviser to a caretaker government.

In recent years, the government allocated more than 20 percent of its expenditure to interest payment for its borrowing from different sources, he said.

“The lion's share of interest payment now goes for the national savings instruments.” And the huge borrowing from savings tools has compelled the government to not take low-cost loans from banks, he said.

In fiscal 2017-18, the government borrowed only Tk 5,666 crore from the banking sector by way of treasury bills and bonds against the annual target of Tk 28,203 crore.

The rate of interest on bank borrowings is between 3.10 percent and 7.97 percent.

The government backtracked several times from its stance to cut the interest rate of the savings tools because of mounting pressure from different corners.

If the government does not cut the rate, it should stop borrowing from the tools once the budgetary target amount is reached, Islam said.

Net sales of savings certificates stood at Tk 46,758 crore last fiscal year against the target of Tk 44,000 crore.