GPH Ispat recovers from Covid-19 hiccup

GPH Ispat, among the top steel manufacturers in Bangladesh, has made a turnaround in profits in the first quarter of the ongoing fiscal year.

The Chattogram-based company's sales rose 66.77 % year-on-year to Tk 439 crore in the July-September period.

Profits jumped 67.5 % to Tk 27.47 crore at the same time, according to its quarterly report.

"Sales have grown due mainly to an increased share of the domestic market, where we provide top quality products for the same price as others," said Kamrul Islam, executive director for finance and business development at GPH Group.

"Our plan for the last two years was to sell more of the products from the new plant. Now, we are getting the effect," he added.

The company's twelve-monthly billet production capacity rose from 2.1 lakh tonnes in 2018 to a lot more than 10 lakh tonnes this season.

Rod production capacity grew from 1.5 lakh tonnes to 7.60 lakh tonnes over the same period because of the new facility.

"As our new plant's production has started, our plan has been working. So, you will notice higher sales in the coming years," Islam said.

Product deliveries disrupted in the fourth quarter (April-June) of the last fiscal year when a nationwide lockdown was declared by the federal government in a bid to stop the spread of the Covid-19.

The deliveries were executed in the first quarter of the existing fiscal, boosting sales, the executive director said.

GPH Ispat also produces low and medium carbon and alloy billets, which are recyclables of steel.

Last month, the company exported 25,000 tonnes of mild-steel (MS) billet worth $10.17 million to China.

The listed steel-maker is a well-performing stock in fact it is very good news for investors that the business's profits rose amid the pandemic, according to Rahman Kayser, a stock investor.

"Nonetheless it should announce more dividends," he said, adding that GPH Ispat has disbursed around 10 to 15 per cent dividends going back few years.

The business's turnaround in fortune is a welcoming development for the sector, which was hit hard by the pandemic in the April-June quarter.

Profits fell by almost Tk 3,000 crore during that period, according to industry insiders.

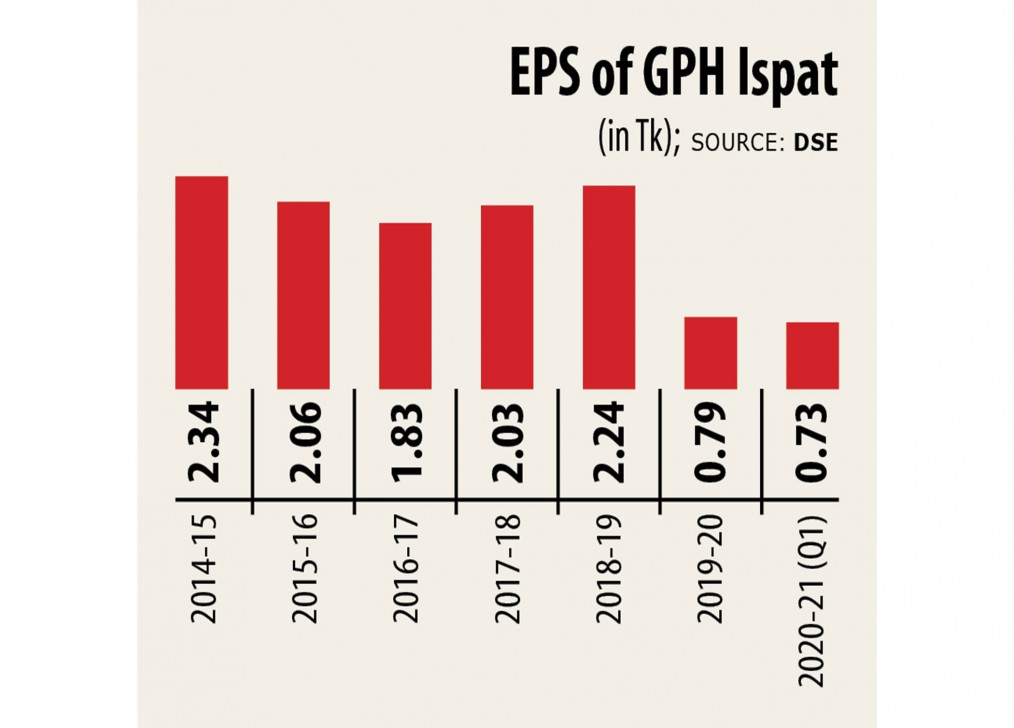

The gains of Bangladesh Steel Re-Rolling Mills (BSRM) dropped 57 % year-on-year in 2019-20, while GPH Ispat had witnessed a 64.7 % fall.

RSRM's profit plunged 81 per cent, according to data from the Dhaka STOCK MARKET. SS Steel, another listed steel-maker, is yet to create its yearly financial reports.

With regards to the demand for steel in the first quarter for the existing fiscal, Islam said that demand has not returned to pre-pandemic levels.

"GPH wants to get a higher market share by giving high-quality products at equal prices," the state said.

"So, GPH is acquiring market share while some are losing," he added.

Create in 2006, GPH commenced commercial production in August 2008. It is currently the third-largest manufacturer of billet after AKS and BSRM in Bangladesh.

Following the news of the business's first-quarter earnings broke, GPH Ispat's stocks rose 3.28 % to Tk 28.30 at the DSE.

GPH Ispat's paid-up capital was Tk 378 crore and it declared 10 per cent dividends for the year that ended on June 30, 2020.