Govt mulling overeating the rich

The government may increase excise duty on big-ticket account balances in banks in its bid to accumulate more taxes from relatively well-offs to achieve increased income collection target for next fiscal year and take the economy on the path of recovery from the COVID-19-induced slowdown.

Account holders who've bank balances of more than Tk 10 lakh anytime of the year regardless of debit or credit could see up to 20 % hike in excise duty from fiscal 2020-21, said officials of the finance ministry.

Currently, members with bank balances exceeding Tk 10 lakh but significantly less than Tk 1 crore any moment during a year face a Tk 2,500 deduction as excise duty by banks based on the government rules.

The rate of excise duty rises to Tk 12,000 per account annually for balances up to Tk 1 crore but significantly less than Tk 5 crore.

The excise duty goes up to Tk 25,000 per account in case debit or credit balances in the account exceeds Tk 5 crore at any time, in line with the NBR.

However, small ticket account holders, who have up to Tk 1 lakh balance at any time during a year, are exempted from excise duty. Members with a balance between Tk 1 lakh and Tk 5 lakh have to pay Tk 150 excise duty a year.

And bankers deduct Tk 500 as excise tax from accounts with debit or credit balances from above Tk 5 lakh to Tk 10 lakh.

Officials said the excise tax rates for account balances as high as Tk 10 lakh are unlikely to improve to give relief to lower-middle-income people, a lot of whom suffered income losses and salary cuts as monetary activities nosedived when confronted with the 65-day general shutdown to fight the deadly COVID-19 in Bangladesh.

The NBR data showed that it collected Tk 1,285 crore as excise tax from bank balances in fiscal 2017-18, down from Tk 1,295 crore a year earlier.

"We've seen that most of the excise duty originates from accounts with high bank balances," said an official of the finance ministry requesting anonymity as he is not authorised to speak with the media.

He expects that the measure to hike excise duty would generate a couple of a huge selection of crores in earnings next fiscal year.

The fresh hike is likely to come three years after the government increased excise duty on bank balances to attain higher revenue goal.

Initially, the government wanted to hike the duty on bank balances of up to Tk 1 lakh.

But following public outcry, it stepped back from increasing the tax on account balances as high as Tk 10 lakh in virtually any bank-account, thus averting saddling the lower-income persons with higher tax burden and discouraging savings in banking channel.

Until December 31, this past year, there were 10.65 crore bank accounts and Tk 12.14 lakh crore in balance.

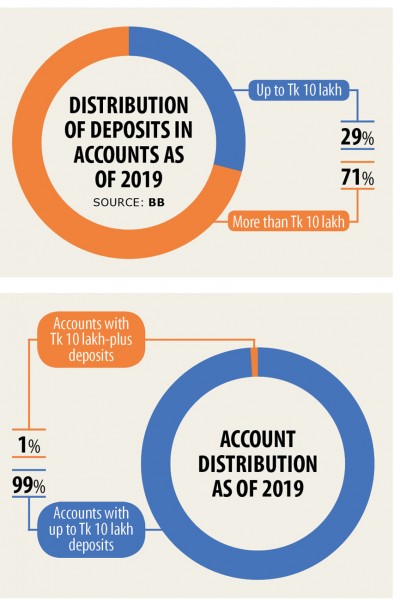

And only one % of the account holders had a lot more than Tk 10 lakh in deposits within their accounts. And in terms of balances, these accounts accounted for 71 % of the full total deposits, according to data from the Bangladesh Bank.