Gamblers having a field day at bourse

At a time when the premier bourse and well-performing stocks are sinking, at least six stocks are swimming against the tide.

Between January 1 and 15, DSEX, the benchmark index of the Dhaka Stock Exchange, shed 385.02 points, or 8.64 percent.

But the stocks, some of which have shuttered already and some have nothing going for them, keep soaring -- a development that rises suspicion of foul play.

“Is not it weird? This is how investors’ confidence got battered,” said a merchant banker yesterday preferring anonymity.

A vested group spread rumours that junk stocks will rise and heeding the reports some people bought these shares. In most of the cases, general investors have lost money, so the regulator should take strict steps to stop gambling, he added.

“The junk stocks’ prevalence in the gainers’ list proves that the stocks have been gambled with,” said a stock broker.

General investors should not invest in such stocks, he added.

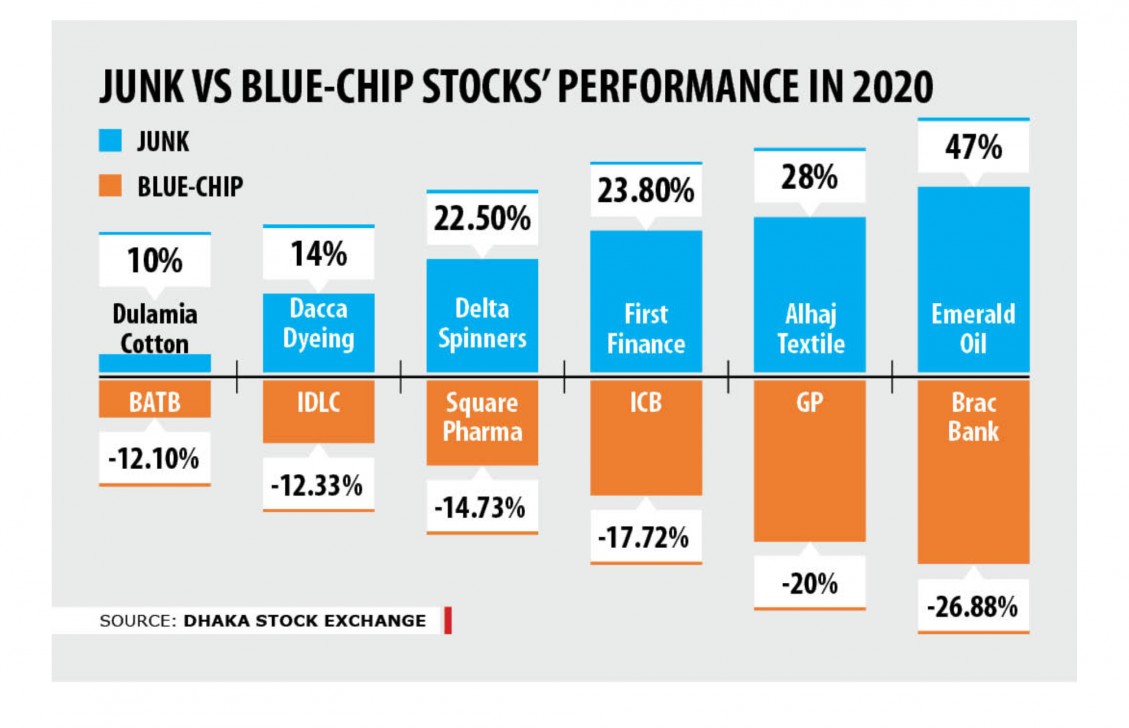

Data from the Dhaka Stock Exchange shows Emerald Oil, one of the junk stocks, rose about 47 percent in the first half of the current month.

And the company informed its stock investors that it has no undisclosed information for which its stock is soaring.

At the same time, blue-chip stocks including Grameenphone and Square Pharma sank to their five-year low.

“If general investors do not invest in junk stocks, gamblers will not be successful,” said Abu Ahmed, a stock market analyst, while advising retail investors to put their money in stocks after doing their due diligence.

The stock market regulator should be overly vigilant as gambling hurt investor confidence, the main reason for the sliding stock market, said Ahmed, also a former chairman of the University of Dhaka’s economics department. A top official of the Bangladesh Securities and Exchange Commission yesterday said they keep a close watch on the market and whenever they spot unusual activity or violation of rules and regulations they take actions.

“Already we have done it many times in the recent past,” he said requesting anonymity as he is not authorised to speak to the media.

Investors also should be careful because at the end of the day it is their own money that they are putting in the stocks, he added.