Excess liquidity falls after 8 months

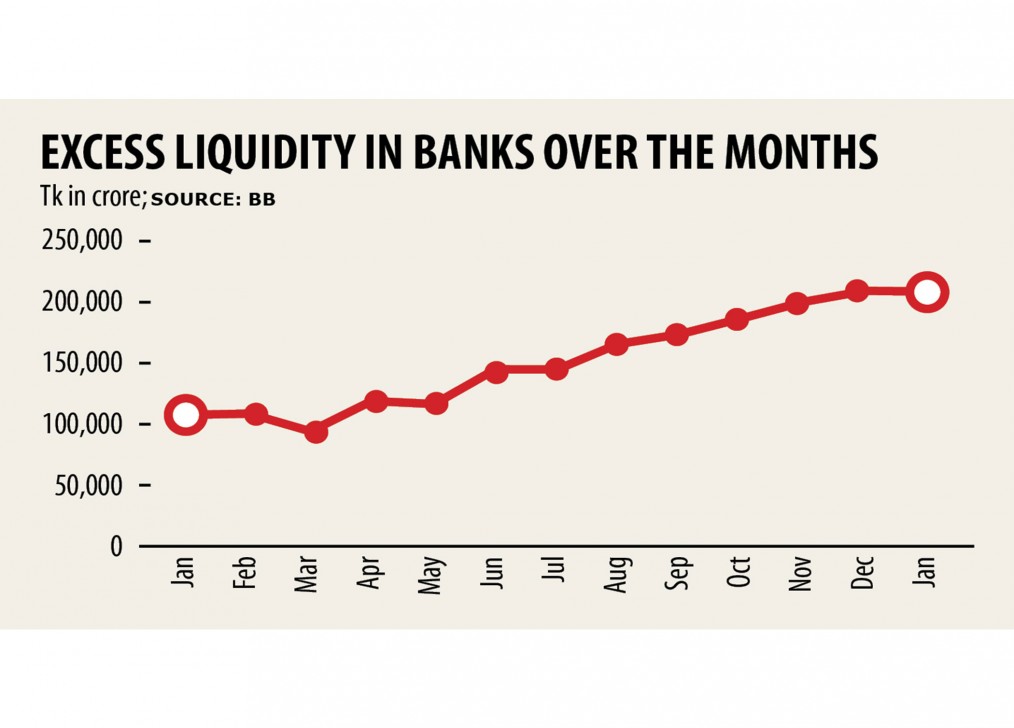

Excess liquidity in the banking industry that ballooned because of pandemic-induced lower credit demand and an injection of funds under a massive stimulus package fell in January, the first time in eight months.

The surplus liquidity stood at Tk 204,070 crore as of January in contrast to Tk 204,700 crore a month ago.

The excess fund, however, surged 97 per cent in January compared to the same month a year ago, when the amount stood at Tk 103,358 crore.

The Daily Star talked to four managing directors of banks and the CEO of a non-banking financial institution to know why the excess liquidity had narrowed.

Some of them argued that investment was yet to turn around. And depositors had shied away from banks because of a lower interest rate on deposit products.

The other MDs thought that credit demand rose a bit, putting a positive impact on the liquidity situation in the banking industry.

Between June and December last year, the excess fund increased by Tk 10,000 crore to Tk 12,000 crore per month on average.

Despite the fall in January, private sector credit growth went down to 8.32 per cent in the first month of 2021, down from 8.37 per cent a month earlier, said Syed Mahbubur Rahman, managing director of Mutual Trust Bank.

"It showed that investment demand from the private sector is still feeble," he said.

The majority of lenders now offer 3-4 per cent interest rate on fixed deposit schemes, upsetting depositors. Inflation stood at 5.02 per cent in January, meaning that the real interest rate is in negative.

"Such a phenomenon may create an asset bubble in an economy," Rahman said.

People now explore alternative ways to invest, such as capital market, land and savings certificates, to get higher returns than depositing money in banks.

"This helped lessen the excess liquidity in January," Rahman said.

Faruq Mainuddin, an immediate past managing director of Trust Bank, said credit demand showed no signs of improvement.

Some banks disbursed funds in January that were sanctioned earlier to keep lower the provision against the disbursed fund, he said.

Selim RF Hussain, managing director of Brac Bank, said credit demand from businesses had increased slightly, but the trend was yet to reach a satisfactory level.

Many businesses are still adopting a slow-go policy to expand businesses as they think that there will be uncertainties in the days to come, he said.

Many garment factories are struggling to survive as the majority of countries in North America, and Europe still face economic hardship.

Abul Kashem Md Shirin, managing director of Dutch-Bangla Bank Ltd, said that his bank witnessed an increase in credit demand in January.

"But, there is no scope to be complacent as the trend of credit demand is still insufficient given the size of the economy," he said.

Arif Khan, managing director of IDLC Finance, termed the decline in excess liquidity a positive indication.

He went on to express the hope that the surplus fund would decrease to a large extent within June this year.

Both the government and the central bank rolled out a number of stimulus packages as part of their efforts to tackle the economic meltdown deriving from the pandemic.

The total amount of financial assistance now stands at Tk 124,053 crore, which is 4.44 per cent of the GDP.

This has contributed to the growth of excess liquidity at a time when the credit demand has sharply declined.