Edible oil import to rise: USDA

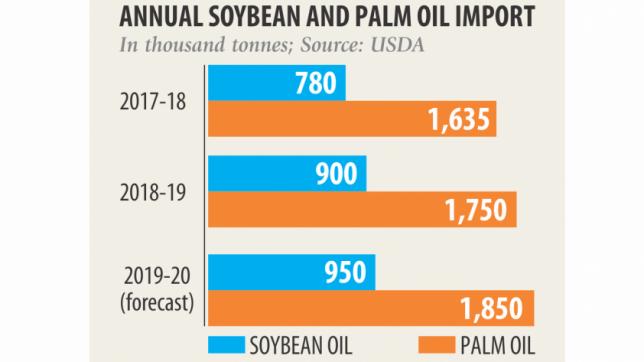

Soybean and palm oil imports are likely to increase by 10 percent to 26.50 lakh tonnes in the year ending in June, buoyed by rising consumption, the US Department of Agriculture (USDA) said.

It also forecasted that edible oil imports might grow 6 percent year-on-year to 28 lakh tonnes in the next marketing year of 2019-20, beginning in July.

Continuing population increase, changing consumer behaviour to dine out, increasing urbanisation and an increase in bakery and processed food production drives the consumption of both soybean and palm oil in Bangladesh.

With the country producing an insignificant amount of soybean and no palm oil, Bangladesh has to meet the domestic requirement through imports, mostly in crude form. Palm oil accounts for the majority of the import and the consumption.

Bangladesh spent Tk 14,448 crore in fiscal 2017-18, up 22 percent year-on-year from Tk 11,838 crore, according to Bangladesh Bank. The USDA estimates the spike in import of both soybean and palm oil in the next marketing year on assumption of increased consumption for home and industrial uses in processed food production.

Bangladesh's annual edible oil consumption is estimated to grow by 11 percent year-on-year to 28.50 lakh tonnes in the current marketing year from that a year ago, said USDA Foreign Agricultural Service in its report on the Bangladesh Oilseeds and Products Annual 2019.

Consumption is also predicted to go up next year with the demand for soybean oil rising at a faster pace.

The agency forecasted an increase in soybean acreage and production in the next marketing year.

In 2019-20, soybean area and production are estimated to increase to 82,000 hectares and 1.58 lakh tonnes, said the USDA. Soybean production grew 25 percent year-on-year to 1.50 lakh tonnes in 2018-19, data showed.

The agency said poor soil and competing crops limit the availability of the area for soybean cultivation. Soybean competes with crops like winter rice (Boro season rice), watermelon and groundnuts in the river islands (charland) of the southern coastal part of the country.

It said river islands are available for soybean cultivation because of poor irrigation facilities and an increasing salinity in late winter and summer seasons make river islands unsuitable for Boro season rice production.

Soybean cultivation in general requires less irrigation and fertiliser. Lower production costs, coupled with favourable market prices, give farmers a premium for soybeans, watermelon and groundnuts compared to Boro rice, it added.

The agency also predicted a 4 percent increase in soybean import to 13.50 lakh tonnes as a result of high soymeal demand in order to meet the feed requirements for the livestock and fisheries sectors and soybean oil for human consumption.

In 2018-19, soybean import is estimated at 13 lakh tonnes. The US soybean accounted for 99 percent of the total import of oilseed in the July-December period of 2018.