Despite jitters, 2020 was first a banner yr for stocks

Despite all the economical uncertainty amid the ongoing coronavirus pandemic, 2020 saw developing investor confidence in the country's currency markets, which rose by a lot more than 20 per cent recently.

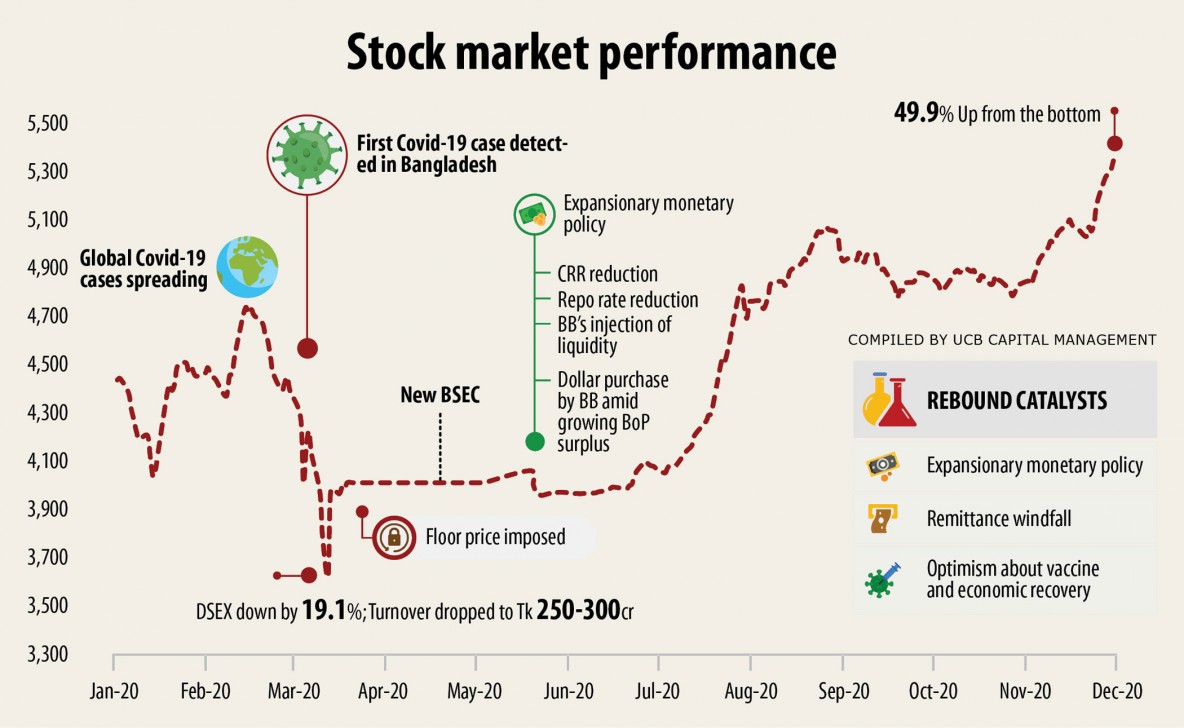

DSEX, the benchmark index of the Dhaka STOCK MARKET, stood at 4,453 points at the beginning of the entire year on January 1 although it was first 5,402 by the end of December.

A number of indications influenced the upward trend in investor confidence, for instance a change to the marketplace regulator's long-standing leadership and policy support from Bangladesh Bank, according to advertise analysts.

The year may also be remembered for the abnormal rise of insurance stocks, which almost doubled in value amid the current crisis.

Lower commission for agents increased the sector's earnings even though stock rumours and gambling fuelled its meteoric rise, the analysts said.

In order to curb the spread of Covid-19, the federal government enforced a nationwide shutdown of all economical activities between March 26 and May 30.

The country's bourses were also shuttered during this two-month period, that was the longest closure of trading in the country because the liberation war in 1971.

As a result, earnings across virtually all sectors dropped by 25 to 30 per cent through the April-June period.

However, the DSEX still managed to hit the 5,400 level simply by the finish of the year.

This happpened due to rising investor confidence alongside certain initiatives taken by the Bangladesh Securities and Exchange Commission (BSEC) beneath the new leadership of Prof Shibli Rubayat Ul Islam, said Masudur Rahman, a stock investor.

"The marketplace was under-valued so investors invested money despite the earnings fall," he added.

If relationship trading in the secondary marketplace begins this year, it could further energy investor confidence and increase the market depth, the investor said, adding that BSEC should be strict to avoid gambling.

Stock gambling was a good common problem over summer and winter that saw a junk stock just like Zeal Bangla Sugar Mills to major the gainers' list with a good 392 per cent rise even though the company offers given nothing to its investors going back two decades.

"Insurance companies likewise have no big news apart from the impression of the pandemic as a result their share cost doubling or perhaps tripling was only caused by gambling," Rahman said.

Asia Insurance took second place found in the gainers' list, increasing by 358 % through the year. Meanwhile, Provati Insurance and Asia Pacific Insurance edged up by 210 and 209 % respectively.

"Insurers' earnings will end up being positively impacted with the lower commission regime since it will reduce their costing," said Khairul Bashar Abu Taher Mohammad, CEO of MTB Capital.

In 2012, the Insurance Advancement and Regulatory Authority (IDRA) issued a circular, barring insurers from paying more than 15 % of the high quality as commission.

However, virtually all insurers disregarded the directive, prompting the marketplace regulator to issue a notice in late 2019, urging compliance for the sake of the sectors' well-being.

And in a great development, the insurance firms decided to follow the order throughout a meeting of the Bangladesh Insurance Association found in 2019.

"However the commission reduction can't be the reason for doubling their organization therefore the price fluctuation was not grounded," Mohammad added.

Apart from the commission, Md Sayedur Rahman, managing director of EBL Securities, brought various other problems to light, which include keeping lower vehicle insurance costs.

Earlier, vehicle insurance expense around Tk 500-600 through third party insurance providers but it would now cost about Tk 20,000 as a result of insurance regulators' new plan.

"The insurance companies' stock market investment capacity likewise doubled as the policy changes as well boosted their shares," added Rahman, also president of the Bangladesh Merchant Bankers' Association.

Regarding the climb of insurance shares, Shahidul Islam, CEO of the VIPB Asset Administration Company stated that they manage around Tk 300 crore out of their funds but don't have a single tell any insurance company.

"It shows how we treat the sector," he added.

The fact that companies with poor fundamentals like Zeal Bangla were in the gainers' list throughout the year was not an excellent indication and was a result of pure rumour-based speculations.

"Only when people burn their finger carry out they learn," Islam said, adding that the BSEC could collection some governance conditions and financial indicators that a company must follow in order to avoid delisting.

Asked about Covid-19's effect on the stock market, he explained the index acquired dropped to a historical low when the deadly pathogen first began to spread.

"But it rebounded thanks to the expansionary monetary policy plus some regulatory changes from the currency markets regulator," Islam added.

In July, the central bank brought down the lender rate to 4 % from 5 per cent. It also dropped the repurchase agreement rate from 5.25 % to 4.75 per cent to make funds available for banks at a cheaper rate.

The BSEC imposed a floor price to deter a further fall of stock prices when the index dropped to 3,603 points in March because of

pandemic induced slow overall economy.

A top official of the BSEC preferring anonymity said that it has tried its best to recreate investor confidence so that it punished various gamblers at a large amount.

"We've taken the initiative against sponsors as well so many of them previously fulfilled minimum shareholding requirements, which was not met for the last at least eight years," he said.

The BSEC eased the process to secure a short public offering as well so that very well performing companies did not need to wait long to raise funds.

"But it is still true that one players will be actively gambling consequently our investigation is ongoing," the BSEC official explained.

"Our aim for is to deliver discipline back to the stock market but general investors also have to watch out for their investment, otherwise they'll continue steadily to lose," he added.

The marketplace witnessed turnover of over Tk 1,500 crore in 2020, which is uncommon compared to the last three years.

The turnover rose because of increased participation from institutional investors and banks.

As of December 10, banks had invested around Tk 700 crore and focused on invest another Tk 1,350 crore by firmly taking the central bank's incentive.

On February 10, Bangladesh Bank rolled out a program that allows lenders to create a Tk 200 crore fund by firmly taking it from the central bank through a repurchase agreement against the treasury bills and bonds owned by them.

The banks must pay 5 % interest for the fund and the credit tenure will be until February 2025.