Currency markets almost a man’s world

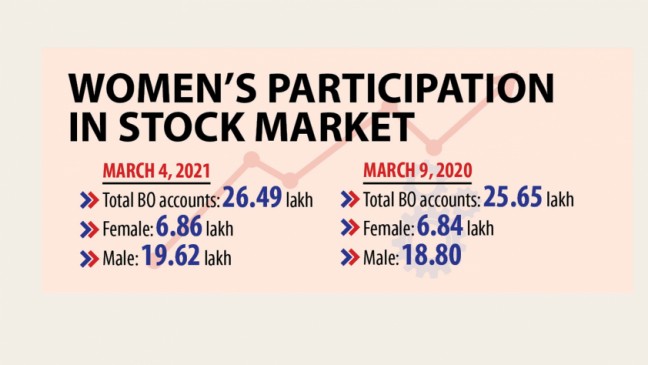

The presence of ladies in Bangladesh's stock market is very low, as only 25 percent of beneficiary owner's (BO) accounts are owned by them as per the Central Depository Bangladesh's data by March 4.

The problem is worse in comparison to that in the last year when it was around 27 %.

The situation is similarly depressing in the brokerage business, when female participation stands at just 8 per cent, based on the Dhaka STOCK MARKET (DSE) data. Most got their licence possession transferred from either their parents or husbands.

The stock market is a good risky place and girls prefer low-risk making tools as they face more problems from families if indeed they incur losses, said Khugesta Nur E Naharin, managing director of Modern Securities.

Whenever a man incurs a loss, he faces hardly any issue from his relatives, said the first elected female director of the DSE.

"As women's profit level is still lower in our country compared to that of males, they face funding challenges aswell," she said.

In the currency markets, an investor must take decisions and guys do not want to permit women of all ages to take decisions, so most of them are working the currency markets businesses on their own, said Naharin.

"So, the main problem is certainly our perception," she described.

Most females who do have a BO bill are active in the primary market, she said, adding that feminine participation found in the secondary market was first very low.

Actually, the situation persists not merely in the stock market but almost everywhere, she added.

"I'm hopeful that the new generation would transformation the situation," said Naharin.

Some persons think the complexity and risky nature of the business enterprise are the key reason behind a lower existence of females in the currency markets but in reality, that is not the case, said stock investor Tashfia Rahman.

The currency markets mainly runs on investments of income-generating persons who've extra funds accessible, said Rahman, a mid-level official of an exclusive bank.

As women need to look after their own families once they are done with their time jobs, they rarely have enough time to ponder over making investments on the currency markets, she said.

So, most girls prefer to invest in savings certificate or banking institutions deposit, she said.

Many carry out not even understand that now currency markets investments can be made totally on the web, so they do not express any appetite for the marketplace, Rahman added.

The image crisis afflicting the stock market is one reason for it being the least demanded investment tool among women, said Latifa Khayer, another stock investor.

Many women have funds but they assume the marketplace is a location for gambling and they do not want to invest here, she said.