Junk stocks go wild

Investors are being duped with illusions of quick profits from junk stocks although these securities have failed to pay dividends to their shareholders for long, analysts said yesterday.

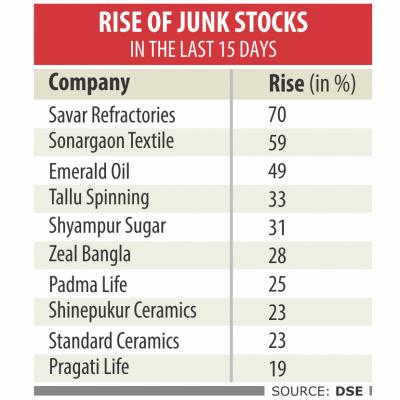

These stocks have continued to dominate the top gainers' lists for the past few days.

For instance, Savar Refractories gained 9.95 percent yesterday while Emerald Oil 9.63 percent and Tallu Spinning 9.59 percent. In the last 15 days, the three stocks rose 70.58 percent, 49 percent and 33.33 percent respectively.

Their peer Jute Spinners was the top gainer on Dhaka Stock Exchange (DSE) yesterday rising 9.99 percent. It went up 9.84 percent in the last fortnight.

Analysts sounded the alarm, saying investors will lose money and, consequently, confidence in the market if the trend continues.

“If investors pour money into water even knowing it's a waste then how can anyone prevent them?” AB Mirza Azizul Islam, a former chairman of the Bangladesh Securities and Exchange Commission (BSEC) told The Daily Star.

He says investors know that junk stocks are the riskiest securities to put money on and analysts warn investors not to invest on them, but many do not pay heed.

Market insiders say a vested interest group spread rumours centring junk shares claiming upcoming changes in company ownerships or of decisions being taken for expansion. But the companies have informed the DSE that they have no undisclosed price sensitive information.

The insiders say if these stocks start falling, it will create a hue and cry in the market.

One of the junk stocks, Information Services Network (ISN) has again come to the DSE's attention as the bourse yesterday decided to review the company's potential. The IT firm has failed to give any dividend in the last five years.

In August last year, the bourse had decided to review the performance of 15 junk stocks, including the ISN. On October 29, the ISN declared 5 percent dividend, prompting the DSE to exempt it from the assessment. However, the ISN cancelled the dividend in an annual general meeting on December 9 after finding out that the dividend was announced without following regulatory rules.

If a company's retained earnings account balance is in the negative, it can not declare dividend as per the rules of the BSEC.

Islam, also a former adviser to a caretaker government, says investors have to be careful about their investment as they would ultimately be the losers as the junk stocks will certainly fall at some point.

Speaking about the upward movement of the market, he said, “There are some reasons for the stockmarket to go up but it should not get inflated into a bubble like the one witnessed by the market in 2010.”

The DSEX, the key index of the bourse, yesterday crossed the 5,800-point mark after it added 62.91 points, or 1.08 percent, to end the day at 5,860.21.

Turnover, another important indicator of the market, rose 8.5 percent to Tk 973.94 crore.

BBS Cables dominated the turnover chart with 38.18 lakh shares worth Tk 42.76 crore changing hands, followed by Khulna Power Generation, Olympic Industries, CVO Petrochemical and Dhaka Bank.

The top three index contributors were Brac Bank, Summit Power and LafargeHolcim Bangladesh, according to IDLC Securities data.

Of the traded issues, 228 advanced, 76 declined and 40 closed unchanged.

Chittagong stocks also rose with the bourse's benchmark index, CSCX, advancing 109.38 points, or 1.01 percent, to finish at 10,836.29.

Gainers beat losers as 179 securities advanced, 70 declined and 25 finished unchanged on Chittagong Stock Exchange. The port city bourse traded 1.80 crore shares and mutual fund units worth Tk 65.23 crore.