Cashless transactions get yourself a fillip

After obtaining his monthly income through a bank-account, Siddique Ahmed Rubel, an employee of a nongovernmental organisation, used to withdraw a sizable part of his earnings through ATM booths so that you can meet expenses.

Nevertheless, the ongoing coronavirus pandemic has brought drastic improvements to his lifestyle simply because he now hardly bears cash.

"Although I had a debit cards before the beginning of the pandemic, I did not discover how to use mobile banking applications," Rubel stated.

"I was compelled to understand the utilization of these applications after the government imposed a nationwide lockdown between March and May," he added.

Initially, Rubel applied digital financial providers (DFS) in order to avoid leaving real estate in concern with infection but he nowadays likes the convenience supplied by these facilities.

"Around 70 per cent of my month to month earnings happen to be spent through DFS platforms, which certainly are a highly secured and comfortable means to produce transactions," he said.

Rubel isn't a solitary case though as a sizable number of people include joined the DFS bandwagon.

Due to this fact, cashless transactions have increased drastically in recent months and this has had a positive impact on the economy all together.

For instance, the country has to count more than Tk 9,000 crore in transactions every year due to its heavy dependence on funds, according to a Bangladesh Bank report prepared in 2019.

Shops and banks have to bear the most-33 % each-for using cash followed by corporate entities 13 per cent, the government 10 % and individuals 6 per cent, the report said.

The report styled "Cutting down the cash transaction" mentioned that the maintenance cost of printed money is almost 0.5 % of the country's gross domestic product.

The central bank made this calculation based on a survey by McKinsey & Company, a consultancy firm from the US.

Although Bangladesh Lender is yet to get ready a article on the cost of maintaining cash this past year, this expense has surely decreased due to the expansion of DFS, according to an official of the banking regulator.

"The deepening recession due to the pandemic provides taken its toll on the global economy, including Bangladesh, but there is a ray of trust in the upward trend of DFS consumption," said Md Arfan Ali, managing director of Lender Asia.

The make use of all payment modes under DFS increased significantly throughout 2020 and the trend continues to be ongoing, he added.

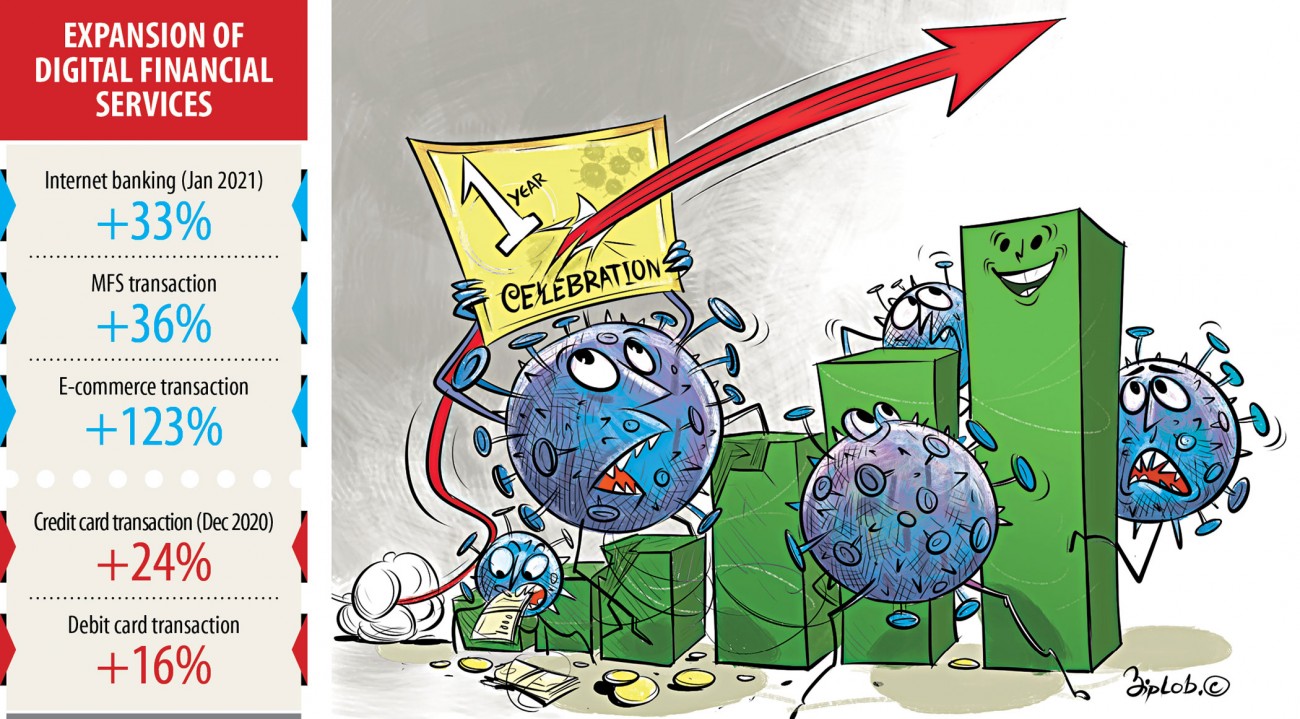

Ecommerce transactions, a essential element of DFS, totalled Tk 598 crore in December this past year, up 123 % year-on-year.

Transactions through mobile phone financial services (MFSs) also posted magnificent expansion during the same period due to underprivileged people are now embracing branchless banking windows in bigger figures than ever.

MFS transaction grew 36 per cent year-on-year to Tk 57,253 crore found in January, central bank info shows.

"The banking sector achieved unprecedented success in the arena of DFS amid the pandemic," Ali said. "It has received the same achievements that the country's finance institutions handled in five years before the pandemic."

"Clients is now able to frequently use different on-line tools to settle their transactions and the development will continue found in the days to arrive," he added.

DFS can not only reduce the cost of keeping cash but also expedite the economy's development, according to a report by the International Monetary Fund (IMF).

The analysis titled, "The promise of Fintech: financial inclusion in the post-Covid-19 era", gave the message that digital financial inclusion would support underprivileged borrowers smoothly control funds.

Banks can disburse loans through Fintech such as MFS suppliers, the IMF article said.

Some Bangladeshi lenders and one MFS service provider have previously taken initiatives to the end.

Mahiul Islam, brain of retail banking at Brac Lender, said growth on the country's personal sector has advanced by at least five years amid the pandemic as dependency over digital means has increased significantly.

"The make use of both credit rating and debit cards features been on a fantastic rise, and therefore we are moving towards a cashless society," Islam added.

The make use of both credit and debit cards did indeed hit an all-time saturated in December this past year, Bangladesh Bank info shows.

Total card loans placed by lenders stood at Tk 1,561 crore in December, that is a refreshing record when it comes to the lending amount.

December's statistics are up 8.84 per cent from that of a month earlier and 23.78 per cent year-on-year.

Clientele also posted a fresh spending record through debit cards seeing as the figure stood in Tk 18,795 crore, up 8.44 % from that of a month earlier and 16.51 % year-on-year.

Syed Mohammad Kamal, country manager of MasterCard Bangladesh, explained the existing monetary transactions made through DFS would witness a significant increase if the federal government paid cash incentives against digital payments.

The Bangladesh Association of Program and Information Companies, a national trade body for the neighborhood software and IT-enabled service industry, recently proposed 5 % cash incentives for clients and merchants against payments for goods and services made through digital means.