BSEC includes a grand plan to crack down on junk stocks

The new governing body of the stock market regulator, it appears, is earnest in its efforts to deal with the bourse that has always been a playground for rogue players.

One such plan it really is focusing on entails appointing administrators in companies whose stocks have turned junk in a way that they are often in the black once again.

"You want to restore discipline in the market. You want to see quality stocks in the market," Shibli Rubayat-Ul Islam, the newly-appointed chairman of the Bangladesh Securities and Exchange Commission (BSEC), told The Daily Star yesterday.

Stocks of companies that contain failed to hold an gross annual general meeting promptly, or didn't declare a dividend in a year or are not operational for more than half a year are termed junk stocks or Z-category companies.

"We will work on an in depth plan which will be implemented according to rules and regulations," he said, adding that the plan will be finalised in a gathering next week.

Several departments of the commission have previously put forward their suggestions in this regard.

"The companies are certain to get all-out cooperation from our end. But the types who intentionally remain junk will face the music," said Islam, who took the helm of the country's stock market regulating body in-may.

The BSEC is likely to focus on the junk stocks in three stages.

In the first phase, it'll upgrade the firms that are very near booking profits, or have large retained earnings or satisfactory cashflow.

There are two to five companies in this stage and a decision will be studied about them by checking the previous few years' financial reports, said Islam, who was simply previously the dean of the Dhaka University's faculty of business studies.

In the second stage, the regulator will support the firms that are struggling but are making a genuine effort to return to profit.

"And in the ultimate stage, we will punish the worst performers by either changing their boards or by deploying administrators," Islam said.

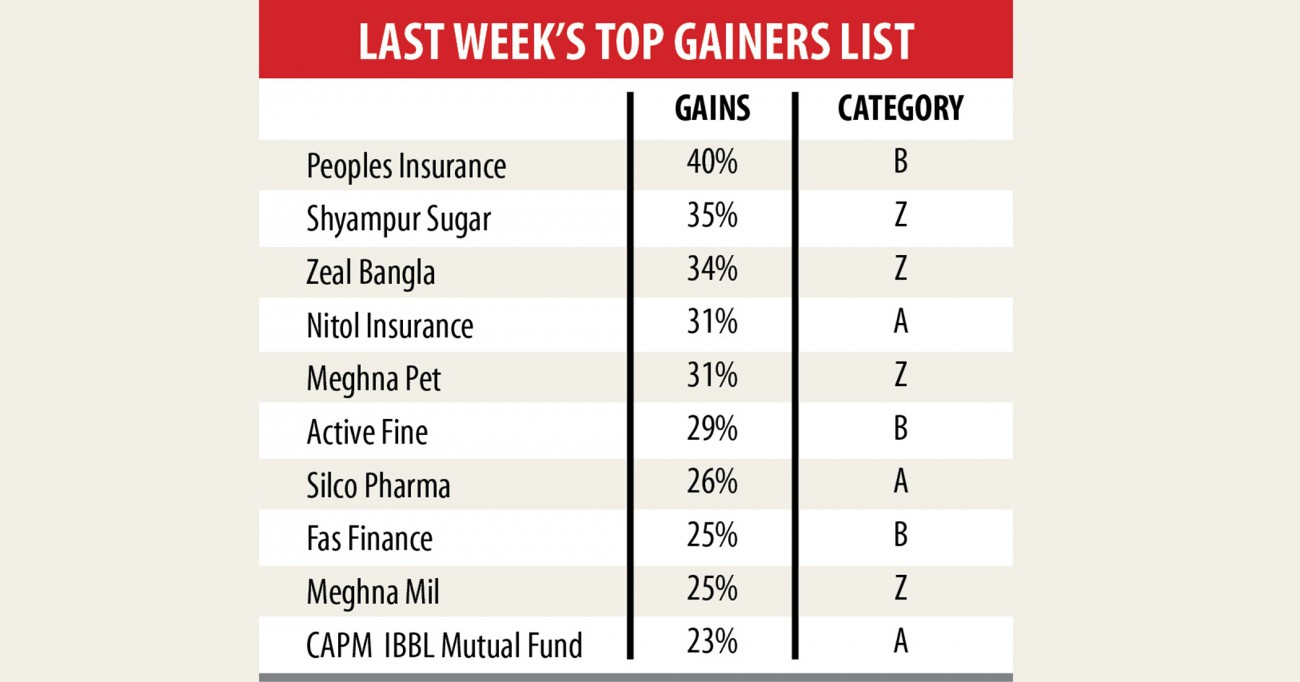

The Dhaka STOCK MARKET now trades 53 junk stocks, of which nine have not been paying any dividend for greater than a decade but they remain in the most notable gainers' chart because of gambling and rumours.

The nine companies are: Dulamia Cotton, ICB Islamic Bank, Jute Spinners, Meghna Condensed Milk, Meghna Pet Industries, Samata Leather Complex, Savar Refractories, Zeal Bangla, and Shyampur Sugar Mills.

"Though the companies are counting losses, their stock prices are high. That is suspicious," Islam said.

The BSEC's plan has been welcomed by merchant banks, who said special audits ought to be run into all the Z-category companies through reputed auditors and check their transactions since listing.

"Then your wrongdoings of the companies could possibly be detected," said a merchant banker requesting anonymity.

The BSEC may fine the errant directors predicated on the findings of the audits.

"This will set a precedent," he added.

The Dhaka bourse in 2018 had cracked down on some junk stocks and delisted Rahima Food Corporation and Modern Dyeing from the DSE board.

However the step drew criticism since it did not help stock investors recoup their losses or could not ensure punishment for the directors who were in charge of the precarious finances of the companies.

In the same year, the DSE discovered 14 companies that hadn't paid a dividend for the prior five years for his or her performance review and see if they have any potential to return to the black.

The bourse found many companies had no such potential but it had not taken any steps against them as it could only delist companies as a punitive action, said a high official of the DSE, preferring anonymity.

"But delisting isn't the answer. It only aggravates the woes of the stock investors because their whole investment goes down the drain because of the delisting."

The then authorities of the BSEC also asked the DSE never to delist the firms but send their findings to the regulator.

"We had sent our findings to the BSEC but did not see any actions."

The new commission will need some fresh measures, which may bring some good results for the market, the DSE official added.

"A company can incur losses for some time. This is normal. However, many companies are fleeing by firmly taking investors' money intentionally. We will punish them," Islam added.