BD Finance eyes $2b US investment

Bangladesh Finance and Investment Company Ltd (BD Finance) has signed a manage US-structured Sovereign Infrastructure Group (SIG) to attract $2 billion worth of investment in infrastructure projects in the next two years.

BD Finance, a problem of Anwar Group, inked the contract on Washington on Thursday, according to a joint press release.

The embassy of Bangladesh in Washington hosted the deal signing ceremony to commemorate the execution of a memorandum, that will serve as a long-term collaboration framework designed to enable SIG to get American capital industry investors to infrastructure projects in Bangladesh through BD Financing. "This is a commitment for the largest-ever before foreign funding brought by a Bangladeshi lender," Manwar Hossain, chairman of BD Financing and group controlling director of Anwar Group, advised The Daily Star on Thursday.

With a job pipeline greater than $2 billion, BD Finance has mandated SIG on the initial financing of a direct loan of $40 million to be used for on-lending to SMEs, green energy tasks, women entrepreneurs, social housing, economic empowerment initiatives for transgender individuals, and the refinancing of existing BD Finance obligations.

"We will finance numerous banks and financial institutions beneath the fund. BD Financing will utilise around$150 million from this fund," Hossain said.

"This is a historic function for the banking and personal sector of Bangladesh. Here is the largest foreign investment effort by a financial institution in Bangladesh.

We are focused on making lending incredibly competitive and borrowing very affordable."

BD Financing is a lender and public limited company listed both about Dhaka and Chattogram share exchanges. It offers financial providers to a diversified basic of clientele and businesses to contribute to Bangladesh's public and economic development.

SIG is a worldwide structured financing organization that works together with project sponsors and development finance institutions, and national and hometown governments in originating and structuring infrastructure investments found in growth markets.

If SIG maintains at least 4 % shares in BD Finance through the term of the memorandum, the united states company will be guaranteed a chair on the board of the Bangladeshi organization.

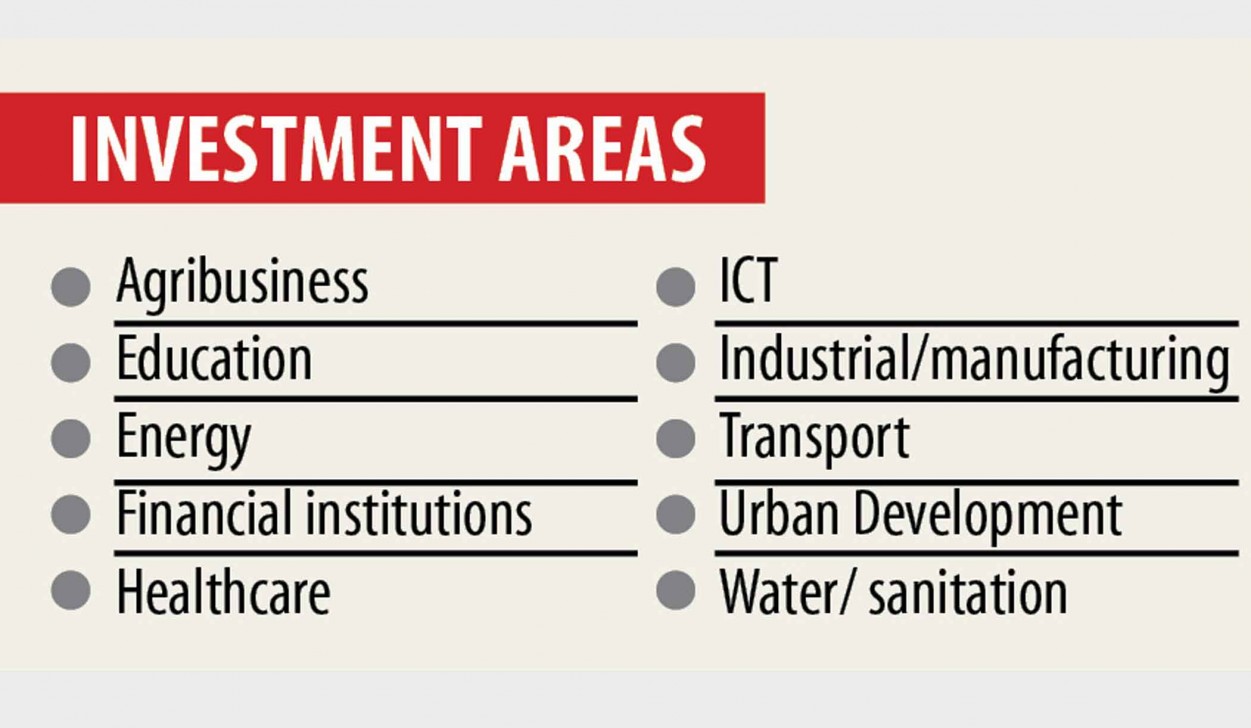

BD Financing and SIG gives priority to the assignments that are supported by the federal government of Bangladesh, assignments in economic zones and export processing zones.

Projects preferably structured while a public-exclusive partnership and that reap the benefits of an off-take arrangement, availability payments, power purchase agreements, or other arrangements from a good mutually accepted sovereign, sub-sovereign, or municipal federal government will receive focus.

Direct overseas investment nexus in the sort of equity or debt co-financing, guarantee, or job structuring will be recommended to finance the tasks, according to the statement.

Lerry Knox, co-founder and CEO of SIG, said SIG was first founded to bridge the global infrastructure expenditure gap by mobilising US institutional investor capital into growth markets such as for example Bangladesh.

Bangladesh is a high priority for SIG and is among the fastest-growing economies on the globe, said Knox.

Bangladesh is currently on the right track to investing an extraordinary $417 billion found in infrastructure by 2040, he said in the affirmation.

"Through our engagement with BD Finance, SIG hopes to take up a leading role with this partners to aid the country's tremendous expansion."

Benjamin Levine, vice-president of SIG, said the function commemorating the memorandum between SIG and BD Financing was the beginning of a good worthy endeavour-one which will support Bangladesh's monetary growth for a long time to come.

Waeez Hossain, deputy managing director of Anwar Group of Sectors, said the agreement was orchestrated to help strengthen the foundation of Bangladesh's infrastructure to compete on a worldwide scale.

"I am hoping relationships like these could be a version for our competitors in Bangladesh, to aid the ever-increasing requirements of the industrial sector."

Shares of BD Finance closed 0.65 per cent higher at Tk 30.90 on the Dhaka Stock Exchange on Thursday.