Banks waive Tk 422cr interest in 9 months against default loans

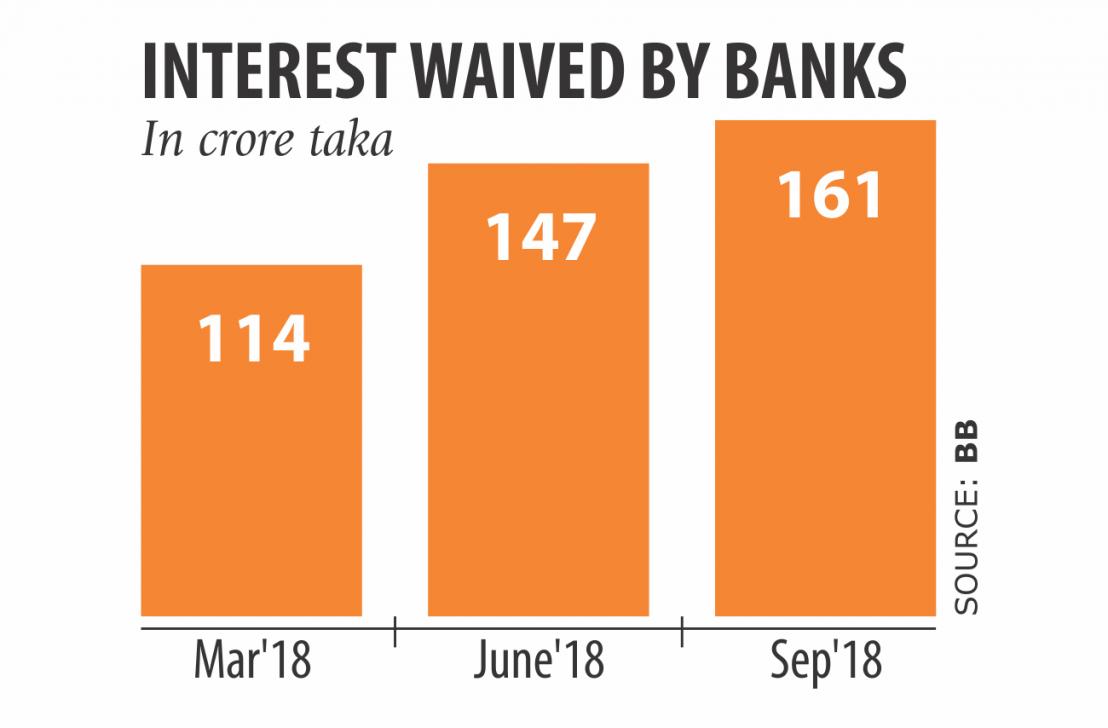

Banks waived interests amounting to Tk 422.14 crore against their bad loans in the first nine months of 2018, as habitual defaulters continue to enjoy impunity for their delinquency.

This is, however, 48 percent down from Tk 819 crore in the same period a year ago, largely because some waivers were not duly reported to the central bank by the lenders.

The practice of handing out interest waiver took off recent years following pressure from influential corners. But, such facilities failed to curb the bulging default loans.

Banks' non-performing loans hit nearly Tk 1 lakh crore at the end of September last year -- the largest yet in Bangladesh's 48-year-history.

In the same quarter, the amount of toxic loans increased 11.23 percent to Tk 99,370 crore. The amount is up 24 percent from a year earlier. Some Tk 764 crore was waived in 2016 and Tk 1,753 crore in 2017, according to data from the central bank.

The interest exemption is usually given to the habitual and influential defaulters that subsequently creates a moral hazard in the financial sector, said AB Mirza Azizul Islam, a former finance adviser to a caretaker government.

“It is ultimately demoralising for good borrowers,” he added.

Meanwhile, a Bangladesh Bank official said the total amount of interest waived in the first nine months of 2018 was more.

In some cases, some state-owned banks did not submit interest waiver-related information to the central bank breaching the rules, he said. For instance, Sonali Bank had waived interest amounting to Tk 72.29 crore to a habitual defaulter in July last year, but the state-lender did not submit the information to the central bank, he said.

Between January and September last year, Sonali waived Tk 28.16 crore, according to its statement submitted to the central bank. “Such unscrupulous practices by banks have misled

the central bank while preparing accurate statement on

the issue.”

The total amount of interest written off in 2018 is set to be way higher as banks usually hand out waivers in the last quarter of a year, he added.

“The interest waiver directly hits banks' profitability as they are lumped under losses,” said Khondker Ibrahim Khaled, a former deputy governor of the central bank.

The sponsors of banks frequently use their influence to waive the interest amount at the meeting of board of directors.

“The directors of banks should take responsibility in this regard as those persons earlier sanctioned the loans, which turned into bad ones later,” Khaled added.