MFS reach widens

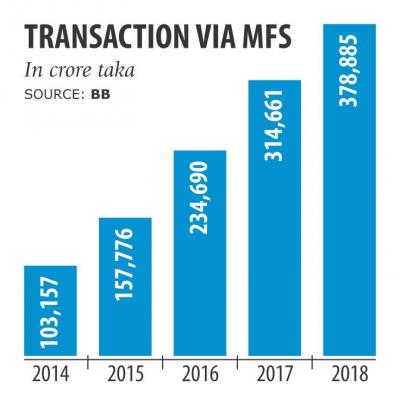

Transactions through mobile financial services (MFS) grew 20.41 percent year-on-year to Tk 378,885 crore in 2018 thanks to the rising acceptance of digital payments by private and public entities.

By the end of December 2018, the number of active accounts availing the service also grew by about 77.68 percent to 3.73 crore compared to what was at the start of the year, according to a report of Bangladesh Bank.

The BB has been collecting data on MFS from 2014 and that year about Tk 103,157 crore was transacted through the channel. It was Tk 157,776 crore in 2015 and Tk 234,690 crore in 2016.

Industry insiders said government offices were increasingly accepting this new mode of payment while different private sectors have been using this platform for salary disbursement.

Initially customers mostly used this platform for sending money and now more than Tk 1,000 crore is being transacted for payment of different bills and payments every day.

Bringing ease to lives, this platform saw a boom in 2018 with people using it for mobile credit top-ups alongside utility bill, online and digital service payments and for paying merchants associated with e-commerce.

The MFS operators are also trying to introduce new services, to clear payments for ride sharing, school tuition fees and disbursement of government stipends among students, industry insiders said.

“It is an excellent achievement for the MFS sector as it logged 20 percent growth,” said Md Mahbubur Rahman Alam, associate professor of the Bangladesh Institute of Bank Management.

He, however, forecast that the growth would not be that lucrative in the coming days if new associated services and products are not introduced.

“We observed the presence of only a few select products for mobile payments and that is why the number of transactions might become constant at one point -- might be within the next two years,” said Alam, who has conducted different studies on MFS. He said Bangladesh has failed in its objective of providing the full range of mobile money services.

“Till today in most of the cases, we only use this platform for sending money from one place to another, one person to another and that demand has been met under this structure. The MFS operators have failed to design any real product.”

For instance, MFS operators do not have any product for farmers and insurance payments so far while there is no loan or savings scheme either, he said. “We also found the playing field was not level when it came to regulation. That is why the sector did not see real investments,” Alam opined.

Refuting Alam, Sirajul Islam, spokesperson of the central bank, said 20 percent growth was huge enough and the market was evolving at a very moderate rate.

“See lots of payment options now are available and, on facing these challenges, mobile financial services are securing huge growth which we need to salute,” he said.

Market leader bKash said after eight years of growth, it's not unusual to have a comparatively lower growth rate.

“Moreover, the mobile financial service providers had to implement a central bank directive of lowering the transaction ceilings, which might have put an impact on declining transaction value despite the number of active accounts soared,” said ShamsuddinHaiderDalim, head of corporate communications of bKash.

In 2017 the central bank lowering down the transaction volume from Tk 25,000 to Tk 15,000 for a customer in a month.

bKash also have seen strong impact on their remittances solutions where their partner banks such as MTBL, Bank Asia, City Bank and BRAC Bank are bringing foreign remittances and bKash is working as their agent to provide the last mile solutions by delivering local currency in their individual accounts. Not only in transaction volume and user number, the MFS is also booming with regard to all other indicators related to this kind of financial service.

For instance, the number of agents involved in the service has reached 886,473 whereas it was 786,459 a year before.

The total number of registered accounts is now 6.75 crore, which was 5.88 crore at the end of December 2017.

The number of daily transactions on an average was 53.65 lakh, which reached 67.77 lakh at the end of last December, according to Bangladesh Bank data.

The financial service was launched in Bangladesh in 2011 and at one point in 2016 there were 28 MFS licence holders.

Currently only 18 banks have approval for it and a good number of them has rolled out the service so far.

There are two leading operators—bKash and Rocket—who hold around 94 percent of the market share, according to a survey report run by the BIBM two months back.

However, new players are coming to the field. The postal department introduced an MFS platform called Nagad a few months ago which is also leaving an impact on the transaction volume.

Two years ago, there were 28 MFS licence holders who were waiting to launch the service, according to Alam.

But now the number has dropped as the prospect for the industry is bleak, he added.