Banks’ provision shortfall widens

The provision foot of the banks in Bangladesh deteriorated heavily in the first quarter of 2021 as a result of the surging bad loans, highlighting the worsening health of the banking industry.

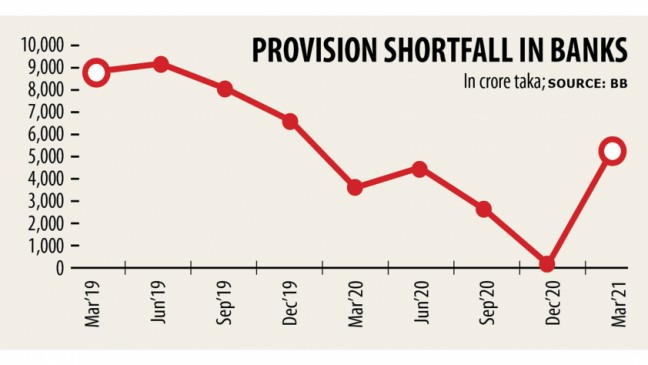

The shortfall ballooned a lot more than 42 times to Tk 5,228 crore in March in comparison to Tk 123 crore 90 days ago, data from Bangladesh Bank showed.

The deficit was up 45 per cent year-on-year. Experts say banks must have strengthened their provision base last year in order to avoid the widening of the shortfall.

A provision shortfall occurs when a financial obligation exceeds the quantity of cash available. It really is temporary, arising out of a distinctive set of circumstances, or persistent, indicating poor financial management practices.

Banks need to earmark 0.50 per cent to 5 % of their operating profit as a provision against general category loans, 20 % against classified loans of substandard category, and 50 % against classified loans of doubtful category.

It has to reserve 100 per cent against classified loans of bad or loss category.

The provision situation may erode further as default loans may escalate in the coming days due to the ongoing business slowdown.

Between January and March, the shortfall increased as a result of lacklustre performance of 11 banks, which faced a combined deficit of Tk 12,650 crore.

The banks are Agrani, BASIC, Janata, Rupali, Bangladesh Commerce, Dhaka, Mutual Trust, National, Social Islami, Standard and Bangladesh Krishi.

Some banks fared well through the quarter, preventing the shortfall from soaring further.

Some of the 11 banks have already been facing a shortfall for a long time due to too little corporate governance.

The shortfall of the state-run banks stood at Tk 10,727 crore, which resulted from a wide range of financial scams. Janata Bank alone had a shortfall of Tk 5,255 crore, central bank data showed.

Md Abdus Salam Azad, managing director of Janata Bank, said his bank had recently secured a regulatory forbearance from Bangladesh Bank to keep the required provision in phases.

"So, we are in a balanced position, and there is absolutely no reason to feel discomfort at this moment," he said.

The provision shortfall narrowed throughout 2020 when borrowers were granted moratorium support from the central bank as a result of economic hardship brought on by the coronavirus pandemic.

The payment holiday had barred banks from downgrading the credit score status of their borrowers even if they didn't pay instalments regularly. Subsequently, defaulted loans did not increase in writing, allowing lenders to put aside a lesser amount of funds to cover bad loans.

The central bank withdrew the moratorium partially in March, which pushed up both non-performing loans (NPLs) and the provision shortfall.

NPLs stood at Tk 95,085 crore in March, up 7.1 % from 90 days earlier and 2.8 % year-on-year.

Salehuddin Ahmed, a former governor of the central bank, said that the escalation of the provision shortfall indicated that the banking sector have been in trouble.

"Still, the government is yet to take any measure to handle the problem," he said.

Corporate governance in many banks have weakened recently due to financial irregularities, Ahmed said.

The shortfall usually sent a poor signal to the global community, tarnishing the banking sector's image, he said.

"The weak banks should be merged with better ones."

Ahsan H Mansur, executive director of the Policy Research Institute of Bangladesh, said the financial condition of the banking industry might worsen further in the days to come.

"Provision will become an integral factor through the difficult period. Experts have already been urging banks for long to strengthen the provision base to the absorb shock."

"But some banks didn't take the problem seriously. They should do something immediately."