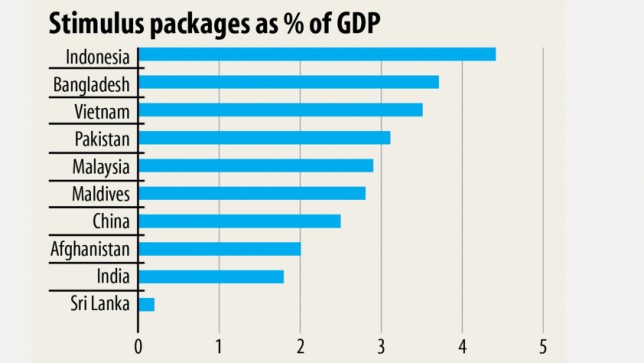

Bangladesh’s stimulus bundle second highest among peer countries

Bangladesh's stimulus packages targeted at mitigating the affect of the coronavirus pandemic happen to be one of the highest among a selective band of countries in Asia, according to a government paper.

The federal government has announced 19 stimulus packages amounting to Tk 103,117 crore because it reported the country's maiden cases of coronavirus infections on March 8.

The combined assist accounted for 3.7 % of the country's gross domestic product (GDP), in line with the mid-term macroeconomic policy assertion of the finance ministry.

Among the select band of countries, Bangladesh only lags behind Indonesia with regards to stimulus packages in comparison to GDP.

The Southeast Asian country has announced stimulus packages worth 4 per cent of GDP.

Vietnam has declared stimulus plans amounting to 3.4 per cent of GDP, Pakistan 3.1 %, Malaysia 2.8 per cent, the Maldives 2.8 %, China 2.5 %, Afghanistan 2 %, India 1.1 per cent and Sri Lanka 0.2 per cent.

Bangladesh's stimulus plans have been provided found in the form of low-expense loans to damaged micro, small, method and large industries and services, foodstuff security, social protection, particular allowances and incentives while the pandemic-induced shutdown paralysed the overall economy, destroyed millions of jobs and created new poor.

"The fiscal and fiscal package is the largest in the Southern Asia region," said Financing Minister AHM Mustafa Kamal in his funds speech on Thursday.

Amidst this unprecedented global crisis, the prime minister has announced several stimulus plans to stand by the poor and helpless people, keep the momentum in monetary activities and bring back the trend in expansion and development, he said.

"These are comparable to the bold methods she took to save lots of the country through the Asian Financial Crisis found in 1997 and the Global Recession in 2009 2009."

Of the stimulus packages, Tk 5,000 crore visited the export industry, Tk 20,000crore to the micro, small and medium enterprises, Tk 30,000 crore to large industries and services, and Tk 5,000 crore to the agriculture sector.

Offered the huge demand from enterprises, such allocation is not apt to be adequate.

Enterprises with shortages of performing capital, which, subsequently, could push them to choose downward adjustment and operate with fewer people, said the Center for Plan Dialogue on Friday.

Timely disbursement of credit among the influenced farmers, vegetable producers, small dairy and livestock farmers, fruit-growers and shrimp farmers are urgently needed, the think-tank said.

Altogether, Bangladesh must put in place a good support measure amounting to 6 % of GDP, said SR Osmani, professor of development economics in Ulster University, throughout a virtual discussion recently.

The true challenges lie in implementing the stimulus packages, according to experts.

Of the stimulus packages, only Tk 3,000 crore would come from the government's coffer, as the rest would result from the central bank or lenders themselves, said Ahsan H Mansur, executive director of the Policy Research Institute of Bangladesh.

It's the banks that could take the chance, lend money and put into practice the deals, he said.

Based on the economist, it would not be possible for the targeted beneficiaries to get the funds as a result of various challenges. It will be troublesome to lend funds to the SMEs at 9 % interest, a cap the lender has applied since April.

"How do banks implement the package for the SMEs if they mobilise funds at 6 % interest rate?" said Mansur, likewise the chairman of Brac Lender.

The default rate is saturated in the SME segment and the rate will be even higher in today's circumstances, he said.

The central bank has stepped directly into provide insurance for funds going to the SMEs but banks need to pay 2 per cent for the insurance, he said. The means, banks would get only one 1 per cent if they lend to the SMEs.

"Banks wouldn't normally be interested unless a good change is made."

Another Tk 3,000 crore has been reserve for micro and small industries and service which will be distributed through microfinance institutes (MFIs).

Under the package, business banks would lend to MFIs at 5 %. MFIs normally charge 20 to 25 %, so if they need to lend this fund at 9 %, they will be unlikely to come ahead, said the past economist of the International Monetary Fund.

"We need to revisit these issues," he said. The costs have to be reasonably market-based; normally, the packages wouldn't normally be implemented.

The stimulus package for the large industries could be implemented at 9 per cent interest rate, however the concern is that the bank loan defaulters are incredibly powerful and some of these are also directors of banking institutions and they may eat up the package, while legitimate businesses would get nothing, according to Mansur.

Banking institutions would only lend when they think that the loans will be repaid.

He suggested the government constitute an operating committee immediately to oversee the implementation of the deals.

The committee should contain representatives from banks, the central bank and the finance ministry and would identify problems in the implementation process.

The committee would acquire info from banks on loans and beneficiaries every day, analyse them and publish a weekly report to ensure that the government and the public will come to know what is happening, he said.

"Close monitoring of the committee is crucial and the funds need to be disbursed transparently."