Bangladesh to graduate ‘with flying colours’

Just as it have been for earlier LDC status graduates, Bangladesh will also not face a whole lot of challenges later on for already having confirmed its economical resilience and prospect of sustainable growth, according to a federal government study.

It can be confidently mentioned that Bangladesh will probably graduate from its least developed region (LDC) position with flying colors and can keep progressing, on state there are no extremely disruptive situations, it said.

Just five countries have were able to graduate from the category because the formation of the LDC group in 1971. However, when it comes to economic composition, these five countries are very different from Bangladesh.

Among these former LDCs, Cape Verde and Samoa fall in to the group of small island growing claims (SIDS) while Botswana and Equatorial Guinea are countries with abundant herbal resources.

Equatorial Guinea may be the only region to graduate having completed just simply the income criterion as the rest fulfilled two -- Gross National Income (GNI) per capita and Individual Asset Index (HAI).

However, every one of them got weaker than desirable ratings in the Economic Vulnerability Index (EVI).

In comparison, Bangladesh includes a huge population, isn't dependent on pure resources and meets the graduation thresholds for all three criteria, said the report.

General Economics Division (GED), a wing under the Ministry of Planning, ready the "Impact Evaluation and Coping up Strategies of Graduation from LDC Position for Bangladesh".

The encounters of former LDCs will not be extremely helpful in predicting outcomes of Bangladesh's post-graduation era. Nonetheless, they can offer different insights about how exactly a region can maintain progress smoothly after graduation.

In the years after their graduation, all five countries have improved on the HAI and EVI.

Except for Equatorial Guinea, all of the former LDCs possess maintained steady progress in the GNI per capita. Equatorial Guinea's fall in income level can be attributed to price instability of its principal export, crude oil.

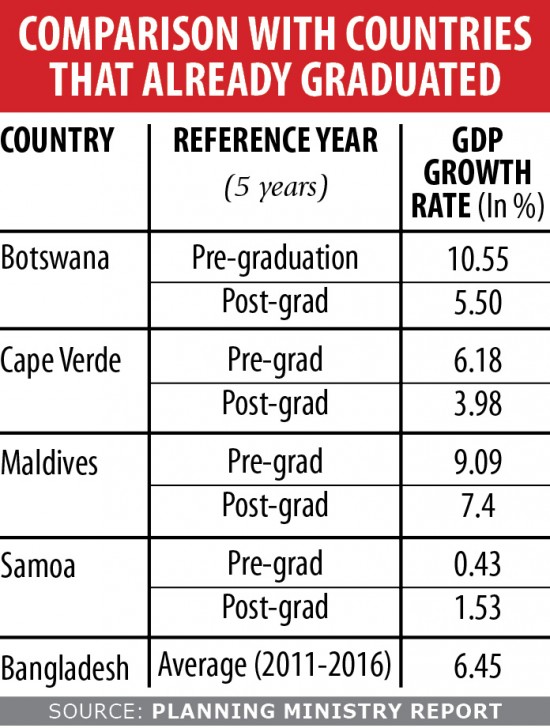

The few primary indicators for these countries five years both prior and post the graduation gives a great idea about how precisely LDC graduation shaped their monetary performances.

A basic theme for Botswana, Cape Verde and the Maldives throughout their respective transition intervals is a slowdown of economic growth. In the quick post-graduation period, Botswana saw its progress cut down by one half while Cape Verde by a lot more than one-third.

The Maldives also experienced slow growth, particularly due to the slow performance of its primary export items (fish fillets and frozen fish) to key export destinations (European Union and Japan). Lack of Duty No cost and Quota Free of charge (DFQF) position in the European marketplace created adverse pressure on the Maldivian economy.

Despite a fall in gross household product (GDP) growth amount, Botswana's mining industry experienced a boom and the federal government maintained a higher current account surplus and high tax revenue earning owing to the successful diamond mining industry.

The country is closely integrated with global trade and cyclical factors are determinants of growth. But overall, the monetary performance of the united states has been very good since graduation.

One issue which has remained historically challenging for Bangladesh may be the assortment of tax and earnings in conditions of the GDP.

Evidence suggests, through the preparation period, former LDCs had a higher starting tax-GDP ratio. And in the post-graduation transition period, they maintained near to 20 per cent.

Overall, the tax earnings collection attempts of Bangladesh will have to head out up significantly over time.

An interesting issue which can be learned from previous LDCs are the shares of official production assistance (ODA) regarding national income and share of foreign direct investment (FDI) against GDP during the transition period.

The proportion of the ODA against income fell whenever any country created.

Aside from Cape Verde, all other four countries had a three-year grace period for preferential gain access to, international support methods (ISMs) and various other LDC-specific choices. Cape Verde undertook very good planning ahead of graduation.

The united states successfully negotiated with the EU for yet another two-year grace period for Everything But Arms (EBA), the EU's gracious Generalised System of Preferences (GSP) above the initial three-year grace period, plus some other transition period handles prominent trade partners like China.

Malaysia and Botswana also planned about the potential negative effect of graduation.

It is to end up being noted that only the EU and Turkey have an explicit coverage for extending LDC particular trade preferences for a good changeover period. The same is not necessarily true for different countries giving unilateral trade preferences.

For example, there are no even transition provisions in case of Japan's or Canada's GSP scheme.

"Therefore, one option for Bangladesh is to start out planning for the near future in advance and negotiate for changeover period preferential access, with options for post-graduation trade deals or free-trade agreements with countries of curiosity," the GED document also said.

All graduated LDCs have experienced more powerful inflow of FDI found in the post-graduation era. It has helped them to recuperate from the early lack of preferential gain access to. Convinced that FDI is critical for achieving robust export expansion, Bangladesh is proactively seeking FDI from all countries in the East and West.

Vietnam has shown the way by learning to be a dynamic export overall economy on the trunk of major FDI integration in to the export sector. For instance, its garment sector is normally 60 % FDI driven.

Three strategic measures are underway to mobilise more FDIs into the economy to attain a target of $10 billion by FY2024. The steps include establishing 100 special financial zones (SEZs), enhance the business and investment climate and take away barriers to access of FDI in virtually any particular sectors like garments, footwear or ceramics.

From Bangladesh's perspective, remittance earning has always been a subject of key curiosity. A solid remittance inflow helps create a good reserve of foreign currency, which gives significant leverage to central banks in retaining favourable exchange rates.

Ex - LDCs also faced different problems just like unemployment, underemployment, automation and inadequate working opportunities.

They also faced the challenge of declining need for remittance income (as proportionate with their GDP). As a result, Bangladesh must put focus on maximising the remittance earning opportunities to deal with any adverse implications of LDC graduation.

It is imperative to keep in mind that all countries will vary and more likely to have their distinct versions of post-graduation difficulties. But a prevalent theme for just about any graduating nation will be lack of trade preferences.

Bangladesh is way better advanced on the advancement path. The country has a very diversified market with huge domestic needs for different goods while its export overall performance and remittance inflows happen to be substantial.

Bangladesh includes a buoyant personal sector with strong entrepreneurial expertise. The social fabric is powerful and the formation of human capital has considered root.

Therefore, with further plan reforms and investments in human capital, technology and organizations, Bangladesh can smoothly transition from an LDC to the street of upper middle class, said the report.