Bangladesh should aim to join Asean

Bangladesh must join the Association of Southeast Asian Nations (Asean) as a way to boost the country's trade as this single market can be the world's fourth largest economy by 2030 following US, China and EU, according to Rubana Huq, president of the Bangladesh Garment Makers and Exporters Association (BGMEA).

"Our trade will grow significantly if we join the Asean," Huq explained yesterday while speaking at a virtual discussion on the 'logistics concerns and challenges found in cross border trade of Bangladesh', organised by the Dhaka Chamber of Commerce and Sector (DCCI).

Various government officials, exporters, researchers, trade body and business association representatives participated on the meeting.

In Bangladesh's context, joining the Asean will be greatly beneficial as a number of its member nations have turned into very good destinations for raw materials sent to and from the country, she added.

Petrapole, the Indian area of the Petrapole-Benapole area port and Bangladesh's major and most active border crossing, is a very important aspect of the country's trade, the BGMEA chief as well said.

For instance, a huge selection of trucks loaded with goods were stranded at the Petrapole end for three days and nights earlier this week, creating untold sufferings to the neighborhood businessmen as shipment delays caused the products to deteriorate in quality over time.

And so, port activities ought to be expedited too much to improve trade, Huq said, adding that certain initiatives have been taken up to improve the simple doing business and overall port performance but those measures don't get more than enough publicity either locally or internationally.

Therefore, strong inter-ministerial coordination among the finance, commerce, National Plank of Revenue (NBR), port authorities and other related ministries is crucial to improve logistics services, Huq said.

While discussing the indegent talk about of logistic support for trade growth, Masrur Reaz, chairman of the Insurance plan Exchange, said the port charge for an individual consignment in Bangladesh is $408 as the price in Vietnam is $290 and $211 in Indonesia.

Besides, these rates are declining found in both Vietnam and Indonesia, he added.

It takes 168 time to secure slot clearance for a good consignment in Bangladesh however in Vietnam, it takes just 55 hours, said Masrur, a past economist for the International Finance Corporation (IFC).

Meanwhile, the combined space for storage of most warehouses across Bangladesh happens to be about 4.2 million square ft, which is set to improve to around 6.7million square feet by 2022. Due to too little formal warehousing conveniences in the country, most importers and exporters take it upon themselves to shop their products, usually inside their own factories or various other private property.

Far away though, there are alternative party warehousing facilities, which provide a secured environment and several other services to maintain product quality.

These inefficiencies in the country's warehousing and logistics products and services are the real cause of increased procedure costs and expanded lead situations, which badly impacts a business's competitiveness, Masrur said.

Echoing the sentiment, Zaidi Sattar, chairman of the Insurance plan Research Institute (PRI), said Bangladesh needs to expedite the production of logistics services.

Modernising the country's port customs services is also had a need to facilitate trade expansion but not as a way to solely increase earnings, this individual added. The PRI chief likewise said Bangladesh ships 1,400 various goods overseas every year while 100 new products are put into the export list each year.

"However, 80 different products happen to be excluded from the export list because they cannot compete in the business. So, we need to incentivise the exporters of these goods therefore that they can maintain their businesses," Sattar explained.

Of the country's total export basket, only 290 different items have a yearly export value of above $1 million.

But the remaining goods remain extremely valuable for the overall economy and so, the federal government should facilitate their expansion, he added.

Mahbubul Alam, president of the Chittagong Chamber of Commerce and Sector, said practically 10,000 goods laden trucks from Dhaka enter Chattogram everyday to offload export-oriented products.

Nevertheless, since there is no truck terminal in the port metropolis, mile-long tailbacks in the roads and highways of Chattogram constantly hamper the trade.

Therefore, the federal government should build a big truck terminal in Chattogram to accommodate those carriers while being offloaded, he said, while suggesting that the engineering of a bay terminal at Chattogram Port and upgrading the Dhaka-Chattogram highway to eight lanes ought to be completed immediately.

In 2019, the country's premier port handled three million container units, up from two million in the last year, said Md Zafar Alam, an associate of the Chittagong Interface Authority.

By that one can recognize that although the port's container handling ability has risen considerably in a short span of period, the handling services themselves have not really improved as substantially, he added.

The government has recently implemented up to 45 changes to the customs regulations in a bid to raised facilitate trade.

However, customs officials have to remain vigilant in order to protect the pursuits of domestic sectors, Alam said.

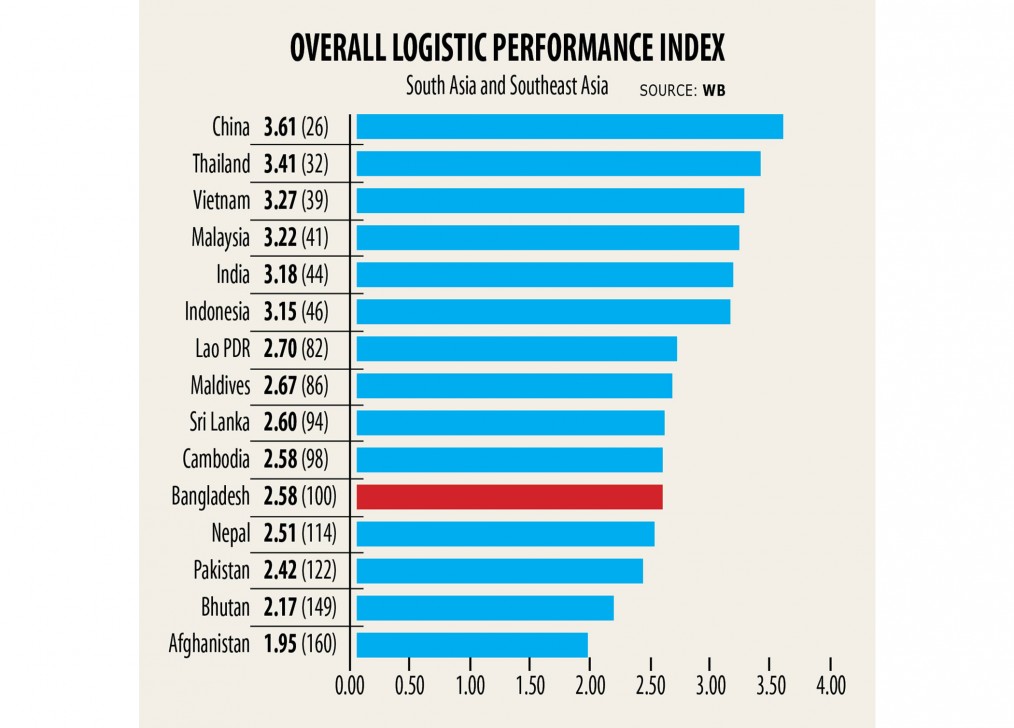

While delivering his keynote paper, Selim Raihan, executive director of the South Asian Network on Economic Model (SANEM), said Bangladesh ranks 100th on the global logistics efficiency index, which is the lowest among all its peer countries.

Tariff and para-tariff found in trade, border problems, non-automation and customs concerns are mainly in charge of Bangladesh's poor ranking found in the index, said Raihan, also a great economics professor in the University of Dhaka.

DCCI President Shams Mahmud, who moderated the discussion, said his organisation's recent study on Covid-19's effect on international trade found that 42 per cent of all local businesses now need over 15 times from start to finish to provide their goods for export to the ocean port.

Similarly, 62 % of all businesses hold out 15 days to get import shipments from the port.

The study also discovered that container congestion, port demurrage charges, delays in the customs clearance process, too little port infrastructure, hinterland connectivity and high shipping costs are major bottlenecks for the import/export process, which finish up increasing operation costs.

Goods shipments are 35 to 50 per cent slower than what they may be due to slow, expensive inland transport, cumbersome customs and border administration functions, inadequate consolidation of terminals, inland clearance depots, trade corridors and a lack of coordination among trade related agencies along the border, Mahmud said.

Abul Kasem Khan, chairperson of the Business Initiative Leading Development, proposed the forming of another ministry for logistics products and services as no particular federal government body is currently responsible for the industry's wellbeing.

Although, many overseas companies want to come to Bangladesh with expenditure proposals, they take into account the lead time aspect because of the indegent logistics services available, said Sameer Sattar, a attorney at the Supreme Court.