Bad loans rise as payment holiday ends partially

As feared, default loans went up substantially in the first quarter of 2021 after the government partially withdrew the loan moratorium facility, which had prevented downgrading borrowers regardless if they didn't pay instalments regularly.

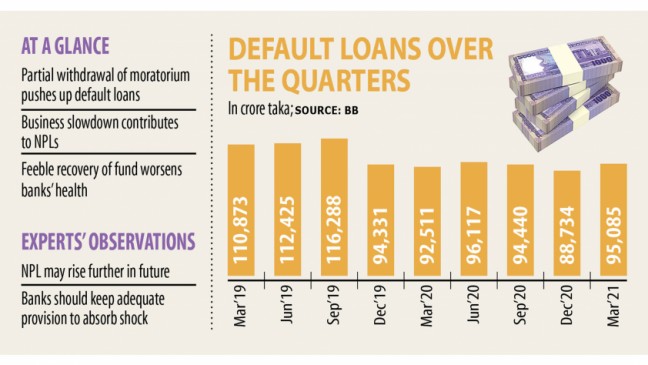

Non-performing loans (NPLs) stood at Tk 95,085 crore in March, up 7.1 per cent from 90 days earlier and 2.8 % year-on-year, data from the Bangladesh Bank showed.

Analysts say the volume of the bad loans would have been much higher had the central bank brought a complete end to the payment holiday, that was introduced in late March this past year to help businesses ride out the unprecedented crisis.

The facility continued throughout 2020 as the pandemic showed no signs of disappearing.

In March this season, the central bank, however, asked banks to extend the repayment deferral support before first quarter of 2021 predicated on the bank-customer relations.

The BB allowed the borrowers who took three types of loans - term, demand and working capital - to enjoy the loan deferral support.

"Default loans will escalate in the months to come as companies are still facing the slowdown," said Ahsan H Mansur, executive director of the Policy Research Institute of Bangladesh.

Many businesses are going right through a hard time as a result of economical slowdown, which pushed higher the NPLs in the first quarter.

The defaulted loans accounted for 8.07 % of the outstanding loans of Tk 11,77,658 crore in the banking industry in Bangladesh in March. The ratio was 7.66 per cent in December.

Companies are not keen to expand their footprint given the worsening coronavirus situation, meaning the depressing situation available sector would continue in the coming months.

"Banks should fortify their provisioning base to soak up the shock deriving from the slowdown," said Mansur, also a former official of the International Monetary Fund.

Syed Mahbubur Rahman, managing director of Mutual Trust Bank, said that banks had didn't treat many loans as defaulted in 2020 as a result of moratorium.

"Lenders have started treating the loans as NPLs following the central bank withdrew the facility partially," he said.

On top of that, some borrowers entered the defaulted zone due to the pandemic, he said.

The country's small and medium enterprises have already been hit hard by the pandemic, and a good part of the loans disbursed to the segment had already become NPLs, Rahman said.

"The upward trend of defaulted loans will continue if we can not stop the spread of Covid-19."

Md Arfan Ali, managing director of Bank Asia, said some borrowers who fared well during the pandemic had kept paying instalments regularly.

"Some habitual defaulters misused the central bank facility," he said, adding that the moratorium support shouldn't be extended in the higher interest of the economy.

Only the pandemic-hit borrowers ought to be permitted to avail of the moratorium, he said.

Nearly 49 % of the defaulted loans belonged to nine state-run banks, whose NPLs grew 2.59 per cent to Tk 47,537 crore in the January to March quarter, when compared to previous quarter.

The bad loans in 41 private commercial banks were up 3.64 % at Tk 45,090 crore. The NPLs for nine foreign banks rose to Tk 2,458 crore from Tk 2,038 crore during the period.