Airlines borrow USD 31bn to withstand COVID-19 hit on travel

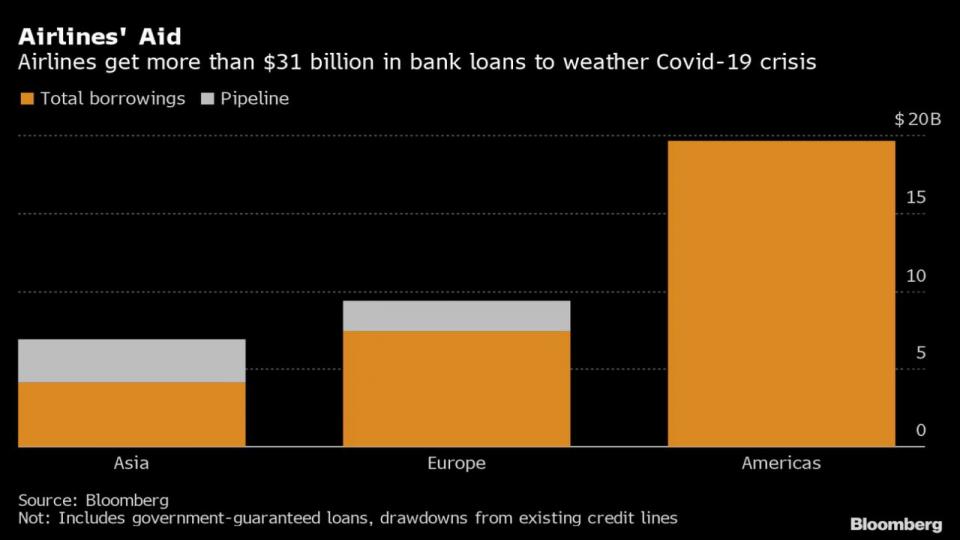

Major airlines across the world have borrowed over USD 31 billion of loans from lenders because they scrabble to obtain funding due to having to ground their fleets following coronavirus outbreak.

Companies from the Americas account for lion share of the borrowings with almost USD 20 billion altogether, according to data collated by Bloomberg. In the dash to secure financing, airlines have either been drawing down from on existing lines of credit or dealing with new loans, the report said.

Aviation and tourism worldwide is facing an unprecedented challenge posed by the pandemic as governments have shuttered the airports in efforts to support the spread of the virus.

It has caused the airlines to stampede, as a response, to borrow from governments and banks. Besides US carriers, European airlines also have raised USD 7.4 billion since March 9, while Asian companies have prearranged USD 4.1 billion, the report added.

The International Air Transport Association has repeatedly warned medical crisis could bankrupt half of the world’s airlines, pushing countries such as France and the Netherlands to get ready state bailouts.

The report by Bloomberg states that Air France-KLM, the greatest borrower from the sector, got a USD 4.35 billion loan from six banks with the French state guaranteeing to up to 90 %. In addition, the airline arranged a USD 3.26 billion loan from the federal government, which is a direct shareholder. The business had previously drawn down on an existing USD 120 billion- credit line.

The UK’s EasyJet Plc also raised USD 744 million from the government’s COVID-19 Corporate Finance Facility in addition to a roughly USD 500 million mortgage. The carrier has also drawn down on a preexisting USD 500 million revolving facility.

In Asia, borrowers have already been tapping funds from domestic lenders. Bank of Taiwan provided USD 666 million of direct loans each to China Airlines Ltd and Eva Airways Corp, while Singapore Airlines Ltd arranged a USD 2.8 billion loan with DBS Bank Ltd.

Meanwhile, at least USD 5 billion of deals are still in the pipeline, including loans for Emirates Airline, Japan’s ANA Holdings and Iberia, the Spanish unit of British Airways owner IAG SA.

The major borrowers from the sector and their respective total borrowings are the following: Air France-KLM USD 5.96 billion, Delta Air Lines USD 5.6 billion, American Airlines USD 3.73 billion, Southwest Airlines USD 3.3 billion, Singapore Airlines USD 2.82 billion, United Airlines USD 2.75 billion, easyJet USD 1.74 billion, Air Canada USD 1.6 billion, Alaska Air USD 1.22 billion and JetBlue Airways USD 1 billion.