Vibrant bond market to beef up financial sector: analysts

The absence of a vibrant bond market is putting pressure on the country's financial sector as the business community largely depends on banks to get their requisite financing, analysts said yesterday.

The weak bond market has also affected the banks' financial operations as it means heavy dependence on common depositors for funds, they said.

Entrepreneurs of many countries frequently collect their funds through the bond market but Bangladesh's scenario is completely different, they said at a seminar on the development of the bond market in Bangladesh.

The event was organised by the Bangladesh Institute of Bank Management at its office in the capital.

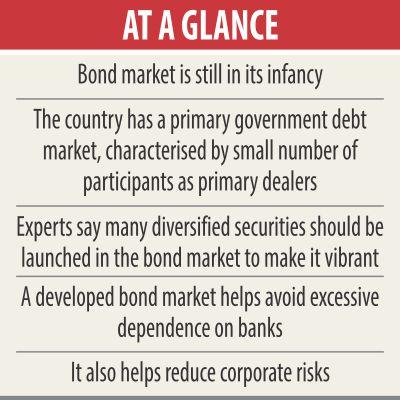

A developed bond market helps avoid excessive dependence on banks and facilitates diversification of corporate risks beyond the banking system, said SK Sur Chowdhury, a former deputy governor of the central bank.

But Asian financial sectors including Bangladesh's are heavily dominated by banks. As a result, these are not well suited to finance long-term investments on a large scale as the tenure of bank deposits is usually short.

The existence of a robust bond market mitigates the potential maturity mismatch of a bank dominated financial sector, reduces financial sector fragility and provides long-term capital for investment at a lower rate, Chowdhury said.

The bond market in Bangladesh is still in its infancy with only a primary government debt market, which is characterised by a small number of participants as primary dealers, especially the dominant commercial banks.

A rudimentary secondary market does exist with only two corporate bonds. After realising the issues, the government with support from the Asian Development Bank is in the process of amending several corporate bond issuance regulations to enhance the supply of bonds, Chowdhury added.

Many diversified securities should be launched to make the bond market vibrant, said Prashanta Kumar Banerjee, professor of the BIBM, in his keynote speech.

The investors will show a keen interest in the bond market if the products like fixed coupon and sukuk bond are introduced here, he added.

There is a requirement for long-term investment to achieve the country's vision 2041, said Barkat-e-Khuda, chair professor of the BIBM.

Coordination among the policymaking agencies should be important to extend the bond market, said Helal Ahmed Chowdhury, supernumerary professor of the BIBM.

“We cannot depend on only the banking sector to achieve the targets of sustainable development goals. A vibrant bond market will play an important role in reaching the goals.” Chowdhury, also a former managing director of Pubali Bank, called for skilled manpower to operate the market.

Toufic Ahmad Choudhury, director general of the BIBM, presided over the discussion. No liquidity crisis in the financial sector will remain if a strong coordination among bond market, banking sector and capital market could be established, he said.