Use software to keep accounts

In a bid to automate the value-added tax system, the revenue authority has ordered businesses clocking more than Tk 5 crore in annual turnover to use software in maintaining accounts and keeping tax-related records.

The National Board of Revenue said companies would have to install software meeting criteria it has set and comply with its directive from January 1, 2019 so that businesses can furnish returns and other documents electronically to VAT offices.

The NBR issued an order last week, asking businesses to collect such software.

The NBR has been bringing changes to its VAT software in line with the VAT Act 1991 in order to go online.

“If businesses maintain records and accounts in an automated system, they will be able send information to us automatically. So, the objective is to make their life easier,” said Syed Mushfequr Rahman, deputy project director of the NBR's VAT Online Project.

Another goal is to ensure data integrity so that none can submit concocted data, he said.

However, if businesses are not prepared to submit returns and record sales in an automated manner, they will have to submit papers manually.

The NBR said software makers would have to apply to a five-member panel headed by the commissioner of the Large Taxpayers' Unit of VAT to get approval of their software.

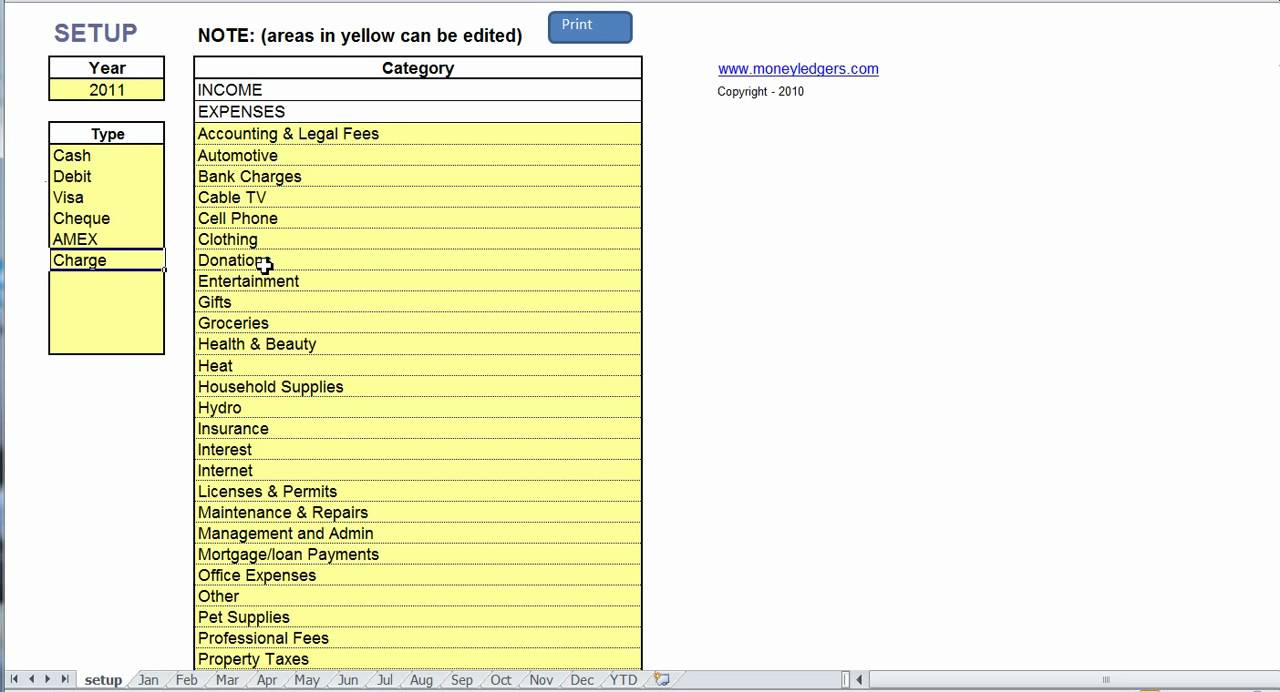

The software should be capable of keeping records of accounts and issuing chalans (receipts).

It said software makers whose software is already being used by businesses upon approval from commissioners will now have to update it and apply to the panel by September 30 for examination and listing.

The NBR plans to automate the VAT system based on the VAT Act 1991 after businesses opposed the new VAT law framed in 2012. “We have already aligned the software with the VAT law of 1991. A demo on this will take place on Wednesday,” Rahman added.