United Airways shareholders in distress

Over 95 percent shareholders of the once top private airline United Airways are in great anxiety because of the nose-diving share price and no tangible signs of resumption of services two and a half years on.

Stocks of the airline have become so cheap that a shareholder has to sell as many as 5,000 of them to buy a Dhaka-Cox's Bazar round ticket.

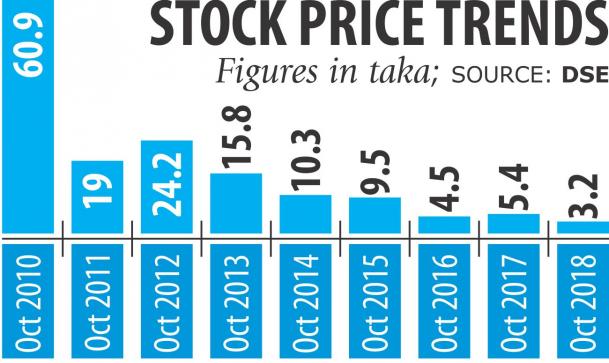

At present, each United Airways stock is selling at Tk 3.20 -- one-third the face value of Tk 10.

The sinking price is particularly concerning given that general public holds 70.42 percent of the airline's shares, institutes 13.24 percent and foreigners 12.18 percent shares.

Sponsors of the airline had long jumped off the sinking ship. In 2011-12, sponsors had 12.34 percent stakes in United Airways, according to data from the Dhaka Stock Exchange. That percentage now stands at just 4.16 percent.

“I don't know how I will get back the money I invested in the United Airways stocks,” said a shareholder whose holdings of the airline's stock sank 50 percent in value within a year.

Another stockholder regrets buying the shares in July 2014, just two months before the airline's announcement of indefinitely grounding its fleet.

Within two months of the announcement on September 25, 2014, he sold off all his stocks.

“I lost 40 percent of my investment. Had I waited longer, the loss would have been much bigger,” he added.

The present management of the company blames the then management of the Civil Aviation Authority of Bangladesh (CAAB) for their current sorry state: the airline was given the stepsister treatment.

“We didn't get hanger space to maintain our aircraft and enough counters, which raised our maintenance costs and brought customer dissatisfaction,” said Tasbirul Ahmed Choudhury, chairman of United Airways.

Not only that, there were intentional delays in inspection of aircraft and giving airline operating certificate (AOC) and so on, he said.

The absence of a level playing field for private operators is a great ailment of Bangladesh's aviation sector, he said.

“Most of the airline companies of Bangladesh have been suffering financially due to the same problem. Some of the companies have shut down their operations and the others are not in a good position now.”

United's flight operations were suspended on March 7, 2016, but Choudhury is hopeful that the airline will fly again.

Now the company is trying to add six more aircraft to the existing fleet of two Airbus, five Boeing, two ATR-72 and one Dash 8 by issuing shares to a company that leases planes.

Bangladesh Securities and Exchange Commission approved the issuance of 31.28 crore ordinary shares to get aircraft worth of Tk 312.80 crore on December 21, 2016.

Choudhury is optimistic that the new team in charge of CAAB will be fair towards United Airways. “So it will re-open again,” he added.

Established on June 28, 2005, United Airways flagged off its commercial operation on July 10, 2007 with a Dash-8 aircraft.

Within a very short span it spread its wings to international airspace, with flights to Kolkata, Dubai, Kathmandu, Kuala Lumpur, Jeddah, Muscat and London.

United Airways operated more than 65,000 international flights and at one point had cornered 60 percent of domestic air travel.

On July 12, 2010 it was listed with the DSE and Chittagong Stock Exchange. The company raised Tk 100 crore from the capital market through the initial public offering.

In 2011 it issued rights shares at Tk 15 including a premium of Tk 5 per share on the basis of 1:1. The total number of rights shares issued were 21 crore, which brought in Tk 315 crore.

The paid-up capital of United Airways is Tk 828.09 crore, according to DSE data.

The company last declared dividend, of 10 percent, for the 2014-15 financial year.

Though the company is incurring huge losses it still has a large number of employees on its payroll: in its 2016-17 financial year the number stood at 426. Now, the employee count is 200 and they are being paid.

United Airways incurred losses of Tk 139.17 crore in the 2016-17 financial year, up 8.11 percent year-on-year. On June 30, 2017, its accumulated loss stood at Tk 277.41 crore.

The company has term loan of Tk 32.98 crore and short-term loan of Tk 120.75 crore, according to DSE data.

The net asset value of the company eroded to Tk 7.14 on June 30, 2017 from Tk 12.87 four years earlier.