Trade deficit rises 12pc in July

Trade deficit jumped 12.14 percent in July in continuation of the trend seen throughout last fiscal year on the back of higher import payments against slow exports.

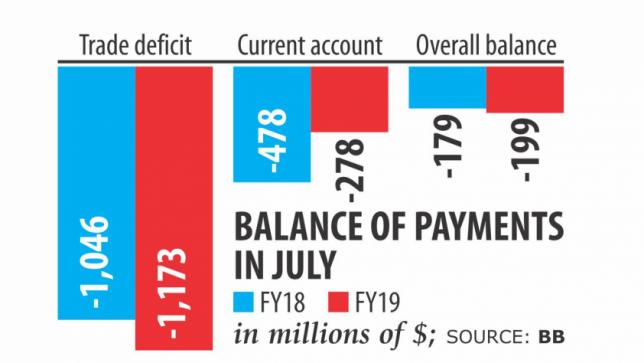

The gap stood at $1.17 billion in the first month of the current fiscal year, up from $1.04 billion in July last year, according to the latest data from the central bank.

The country's trade deficit hit $18.25 billion in fiscal 2017-18, the highest in its history.

Bankers and experts called for diversifying export basket and exploring new markets in a bid to contain the rising trade deficit.

Imports stood at $4.7 billion in July, up 17.44 percent year-on-year. At the same time, exports rose 19.32 percent to $3.52 billion.

AB Mirza Azizul Islam, a former finance adviser to the caretaker government, said the government should take measures to boost export earnings in order to ease the tight situation in the balance of payments.

Export earnings in July rose but it was not up to the mark, given the large trade gap in the recent times, he said. “Exports should be diversified as the country is largely reliant on garments.”

Export earnings from garment items accounted for 86 percent of the total export income in July.

New export markets should also be explored since Bangladesh's items have long been going to some selected countries, said Islam.

The former adviser said some unscrupulous people might be laundering money in the name of imports through over-invoicing, which has also increased import payments.

The central bank should strengthen its monitoring and supervision to rein in the practice of over-invoicing, he said.

Syed Mahbubur Rahman, chairman of the Association of Bankers, Bangladesh, a platform of the managing directors of private banks, said import payments have continued to rise to meet the need of the ongoing mega infrastructure projects.

Imports of unessential products should be discouraged to reduce the trade deficit, said Rahman, also the managing director of Dhaka Bank.

The trade gap negatively impacted the current account deficit, which slightly came down in July but was still high mainly because of the higher import payments.