Trade deficit narrows amid rise in exports

Trade deficit narrowed 12 percent in the first five months of the fiscal year thanks to a rise in exports and a slowdown in imports.

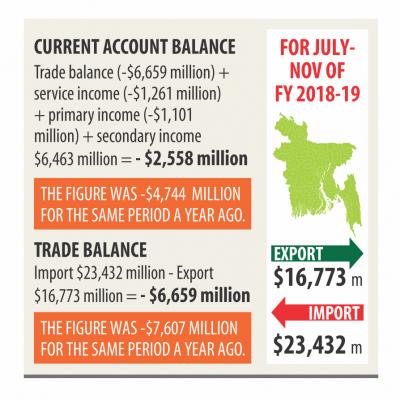

At the end of November, trade deficit stood at $6.65 billion, down from $7.60 billion a year earlier, according to the central bank's latest data.

The development comes as a relief for the government, which has sufficient breathing space now to run the economy. Trade deficit hit an all-time high of $18.25 billion last fiscal year.

While unveiling the monetary policy statement for the second half of 2018 the central bank projected that the trade gap may reach $22.19 billion by the end of the fiscal year, suggesting a stringent state of affairs for the country's macroeconomy.

“But the pickup in remittance and exports is whopping the central bank projection,” said a Bangladesh Bank official.

Export fetched $16.77 billion in the first five months of the fiscal year, up 16.75 percent year-on-year.

“It is a good sign that export earnings are maintaining an upward trend while import payments are posting moderate growth,” said AB Mirza Azizul Islam, a former finance adviser to a caretaker government.

Between the months of July and November of 2018, imports rose 6.64 percent to $23.43 billion.

The import of capital machinery has recently declined, which will not underpin the country's industrial sector, he said.

Islam went on to urge the government to give more importance to importing capital goods as it is the major ingredient for setting up new industrial units and retrofitting the existing ones.

The country's current account deficit also decreased 46 percent year-on-year to $2.55 billion in the first five months of fiscal 2018-19.

“Bangladesh's current account deficit is not too much considering that it is a developing country,” Islam added.

Mustafizur Rahman, distinguished fellow of the Centre for Policy Dialogue, however, said the current account deficit was still high considering the rising economic activities of the country.

“There is a ray of hope that remittance has bounced back in recent months, which will ease the large deficit of current account in the months to come,” he said.

The foreign exchange reserve is now able to make import payments for five months, which is ideal for any economy, he said.

As of November 2018, the reserves stood at $31.05 billion.

“But a year ago the reserves could cover import payments for nine months. We have to keep a close eye on fluctuating reserves.”

The overall balance of payment situation is also not sanguine as it has recently entered the negative territory, he said.

At the end of November, the deficit in overall balance stood at $837 million, up from $479 million a year earlier, according to data from the BB.

The export earnings, foreign direct investment and remittance should increase more for reducing the current and overall deficit, Rahman said.

If the deficit in the two accounts is brought down, the foreign exchange market will also cool down bypassing the existing depreciating trend of the taka against the dollar, he added.