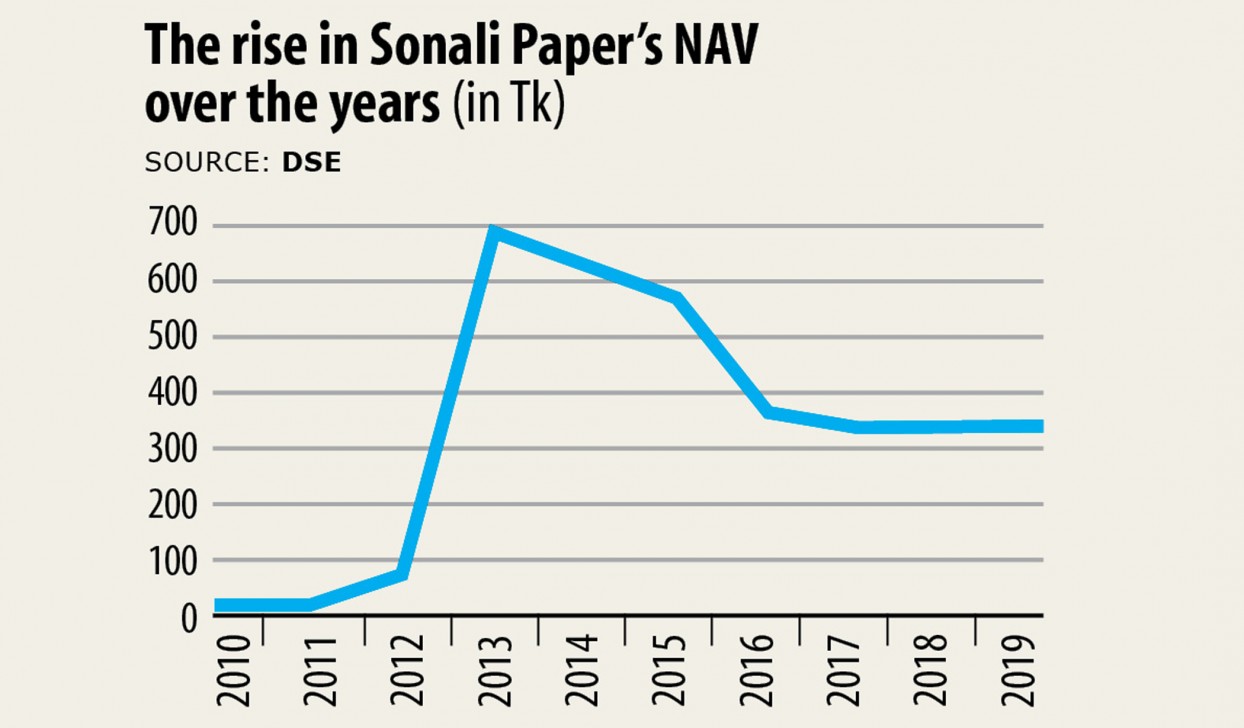

Sonali Paper is definitely returning on DSE mainboard. But its gain isn't without controversy

Small capital-established Sonali Paper & Table Mill's re-listing in the mainboard of the Dhaka Stock Exchange has raised questions as the regulator granted an exemption to it to pave just how for the resumption of its trading.

Sonali Paper will start trading on the mainboard from Thursday, stated the premier bourse yesterday.

The currency markets regulator amended the listing regulations in July this past year so that companies, whose paid-up capital is significantly less than Tk 30 crore, can not be stated with the mainboard as gamblers target the firms to generate a quick buck.

However, the prior commission of the Bangladesh Securities and Exchange Commission (BSEC), whose tenure finished just lately, approved the re-listing of Sonali Paper by simply exempting it from fulfilling the problem on the paid-up capital.

Sonali Paper's paid-up capital stood by Tk 16.63 crore in 2019, regarding to DSE data.

In response to the company's request, the commission as well gave another exemption. Due to this fact, it did not need to comply with the guideline on net positive cashflow in the quick three financial years.

The company did not declare a dividend in 2017 and 2018. It announced a 10 % stock dividend last year.

The company's gross annual report is not published on the website of the DSE and its own website. But DSE info showed it manufactured a revenue of Tk 6.34 crore in 2019.

Sonali Paper will be traded as a "Z" category company and the status would continue until that holds its annual standard meeting, the DSE said.

The ground price of the business will be the previous closing price on the over-the-counter (OTC) market on January 30, when it was Tk 273. The price is almost seven occasions that of Bashundhara Paper Mills, the top rated peer organization. Yesterday, Bashundhara Paper's shares traded at Tk 39.

"This is clear that Sonali Paper will be another item for gamblers due to its lower amount of shares," said a good merchant banker requesting anonymity to speak candidly on the matter.

It should have already been listed with the small-cap board. Then the key market would certainly not have observed another gambling item.

"At a time whenever we need to transfer small-cap firms from the mainboard to the small-cap plank to slice the scope for gambling, the re-listing of this sort of companies is only going to give place to gamblers," the merchant banker added.

The company was delivered to the OTC marketplace a decade ago after it failed to comply with rules.

The previous commission made a decision to re-list it according to its consideration and the current commission can't say anything now, said a top official of the BSEC, preferring anonymity.

Maybe, the previous commission allowed the business since it returned to gains recently, he added.