Smartphone import plummets 21pc

Smartphone imports through the legal channel declined for the first time last year as the government's move to hike import duties to 32 percent last fiscal year appear to have sent illegal imports soaring.

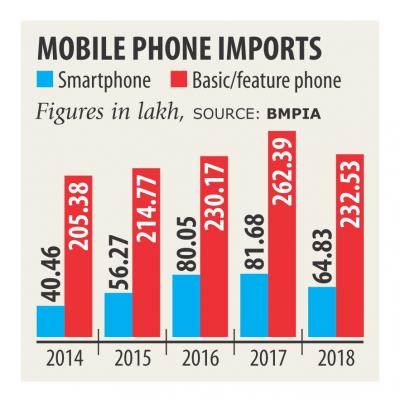

In 2018, 64.83 lakh units of smartphones were imported, down about 21 percent year-on-year, according to the Bangladesh Mobile Phone Importers Association. Feature phone imports also dropped: by 11 percent to 2.33 crore units.

Overall, 2.97 units of mobile phones were brought into the country in 2018 -- 38 lakh units less than what the importers had planned to. The amount is down 15.82 percent year-on-year.

At present, illegal imports account for 25 to 30 percent of the market, up from 20 percent a year ago, according to the BMPIA's estimate.

“While there has always been a notable presence of illegally imported handsets in the market, the trend has picked up pace in recent years,” said Ruhul Alam Al Mahbub, president of the BMPIA.

The local handset industry is worth about Tk 10,000 crore, of which almost one-third is now taken up by illegally imported handsets, said Mahbub, also the chairman of Fair Group, which started assembling Samsung-branded smartphones in Bangladesh from the middle of 2018.

About 23 lakh units of handsets, both smart and feature phones, were assembled locally last year.

“Despite the local assembly we could have logged in positive growth for imports as the demand is huge. But illegal imports halted it,” he added.

Such a high import duty ultimately increases the prices of legally-imported phones while making the illegal shipments a more viable option for a vested quarter, said Rezwanul Haque, chief executive officer of Transsion Bangladesh, which sells the iTel-branded handsets in Bangladesh.

“Imports are our main source for meeting local demand -- we are only catering to 7 percent from local assembling. The fact that imports have declined indicates there are problems in the channel,” said Haque, a former general secretary of the BMPIA.

Smartphones accounted for 22 percent of the total imports last year, in contrast to 24 percent in 2017 and 26 percent in 2016.

The disclosure is set to leave the mobile operators fidgety as their ability to monetise their latest investment on 4G service depends on smartphone penetration.

“The penetration of 4G handsets growth is not up to the mark,” said Shahed Alam, head of corporate and regulatory affairs at Robi.

At present, about 40 percent of the handsets in use are 3G-enabled and the 4G-enabled devices number is only 18 percent to 19 percent.

If the penetration of 4G-enabled handset ends up being the same five years after the rollout of the service, the industry would not have much prospect, said the Robi executive at a discussion held at the InterContinental Hotel in Dhaka on Monday.