Small businesses to get stimulus funds at 4pc interest

Small traders, entrepreneurs and farmers who had no usage of finance from banking channels will now have the ability to avail loans at 4 % interest from a brand new Tk 1,500 crore stimulus package.

The government approved a few brand-new packages involving Tk 2,700 crore on January 17 with an try to enhance the living standards of marginalised persons surviving in rural areas.

The finance ministry has recently prepared a policy about the fund for small traders and businesses, which includes been forwarded to the cabinet for approval.

Earlier, the Palli Karma-Sahayak Foundation (PKSF) had received Tk 500 crore under a stimulus package at 18 % interest.

Ministry officials said that the fund will come to be disbursed to small traders, entrepreneurs and farmers who also lack financing from banks.

The lenders can only take 4 % interest from the borrowers beneath the package, they added.

The lenders will need this interest as a cost of transaction and it cannot be more than 4 %, Financing Minister AHM Mustafa Kamal told The Daily Star yesterday.

Only government organisations are certain to get funds from the package free of additional costs.

Micro businesses that cannot take loans from banks given that they fail to provide the necessary documents are certain to get funds under this package.

For example, several entrepreneurs who run their businesses under the Bangladesh

Small and Cottage Industries Corporation (BSCIC) don't get loans from banks because of insufficient necessary documentation.

Farmers will also get loans out of this fund because they cannot get loans for the same cause as micro businesses.

Each representative organisation will make a list according to the rules to disburse the loans, Kamal said.

It is a great initiative to attain out to those who do not have usage of credit rating support, said Zahid Hussain, former business lead economist at the Universe Bank Dhaka office.

"We hope the establishments, including the SME Foundation, with demonstrated ability to effectively reach the unbanked population are certain to get preference over institutions such as the BSCIC, where governance possesses been challenging," Hussain said.

However, these poor and distressed entrepreneurs will still have to pay 4 % interest and many of these are currently not able to undertake additional debt as organization is still dull.

"It is perhaps much better than found in the first half of 2020 though," he added.

Hussain recalled that the garment market got emergency financial support at 2 per cent interest and out of this perspective, the 4 % for micro and cottage business owners is too high.

He suggested that the complete package could be disbursed due to grants for micro and cottage enterprises that are facing existential threats but are fundamentally viable.

A good one shot infusion of grant funds would help recapitalise, and thereby retain these enterprises afloat, he said.

PKSF disbursed Tk 250 crore of a good Tk 500 crore stimulus package because of its beneficiaries.

Of the full total disbursement, 77 per cent was loaned to marginalised and small farmers, 16 per cent to the micro industry and the remaining 7 per cent visited the youth and unemployed.

PKSF provided this mortgage at 18 % interest while its usual mortgage interest is 24 per cent. The loans had been refundable within twelve months but borrowers were allowed to generate early settlements within per month at 1.5 % interest.

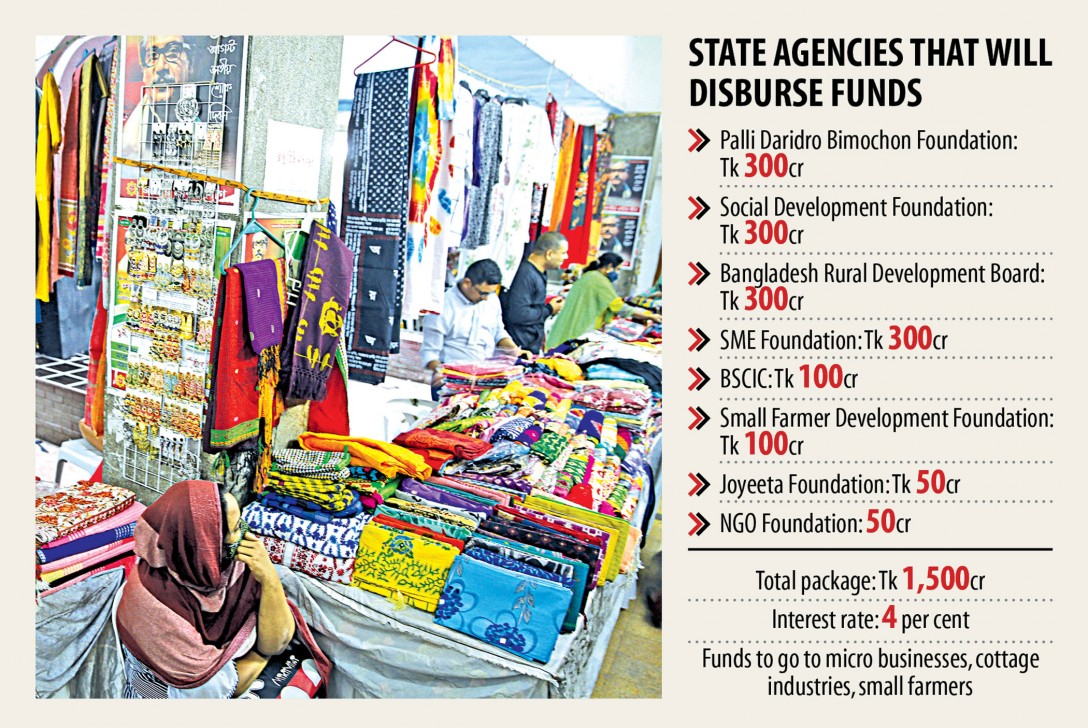

Under the primary package of Tk 1,500 crore, the federal government gives loans to micro and cottage business owners through various government and semi-government agencies just like the SME Foundation, BSCIC and Bangladesh NGO Foundation to infuse dynamism into the rural overall economy amid the ongoing coronavirus pandemic.

Of the amount, Tk 300 crore will be offered to the SME Foundation for expanding its functions for the cottage industry and SMEs alongside helping female entrepreneurs.

The SME Foundation will disburse loans among smaller businesses and entrepreneurs hit hard as a result of economic downturn due to the pandemic, ministry officials said.

Besides, the BSCIC will get Tk 100 crore beneath the package.

The state-run corporation, established to aid small initiatives in the united states, provides loans to small entrepreneurs and commercial units set up in the BSCIC estates under its existing credit programmes.

The package also contains financial support for organization initiatives by women who suffered as a result of economic slowdown.

Joyeeta Foundation, a government initiative to support women's ventures and empower women financially, will get Tk 50 crore. In addition to the loans, the foundation provides training to women entrepreneurs.

The NGO Foundation will get Tk 50 crore for providing small loans through NGOs.

Besides, the Social Development Foundation, Palli Daridro Bimochon Foundation and Bangladesh Palli Development Board are certain to get Tk 300 crore each as the Small Farmers Development Foundation are certain to get Tk 100 crore.