Slowing exports stretching trade deficit

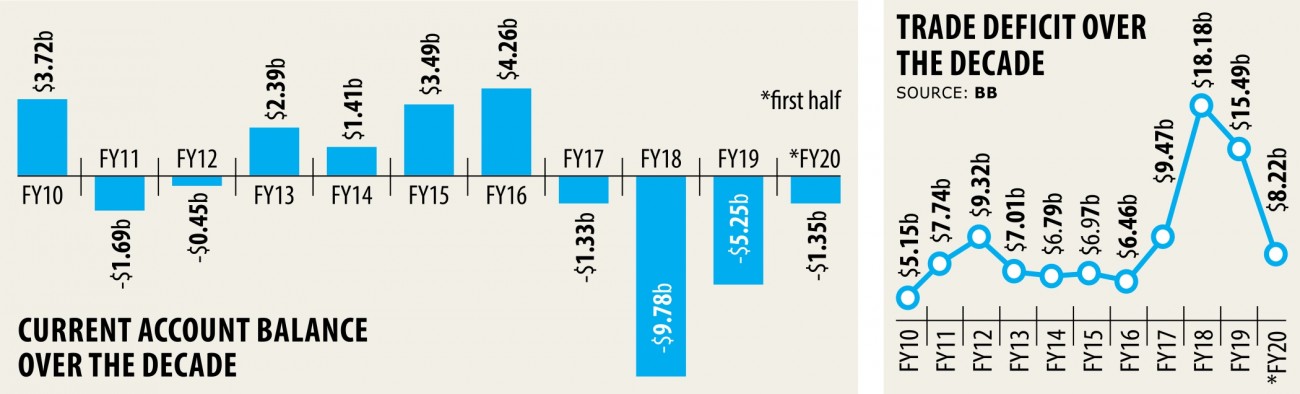

Bangladesh’s trade deficit widened slightly in the first half of the fiscal year on the back of sluggish exports, in a worrying development for the government.

Between the months of July and December of last year, the trade deficit, which occurs when imports outweigh exports, stood at $8.22 billion, up 5.41 per cent year-on-year, according to data from the central bank.

During the period, imports declined 2.72 per cent and exports 5.89 per cent.

Falling exports means that the demand for Bangladeshi products is decreasing in the outside world. Domestic consumption has also failed to get a pickup as import growth has been waning in recent months, said Ahsan H Mansur, executive director of the Policy Research Institute.

“The stagnant situation has already sounded an alarm in the private sector.”

Private sector credit growth recently dropped below 10 per cent.

“This is a worrisome development for the economy as it is a pivotal financial indicator that shows whether or not businesses are expanding,” Mansur said.

However, the current account balance deficit decreased by more than half to $1.34 billion in the first six months of the fiscal year due to remarkable growth in remittance.

Remittance is now being used to offset the other deficits in the balance of payments.

“This is not a good sign at all for a growing economy like Bangladesh,” said Mansur, also a former official of the International Monetary Fund.

Remittance could be used more productively if foreign direct investment (FDI) and medium- and long-term loans increase as expected.

FDIs increased 3.94 per cent year-on-year to $2.74 billion in the first half of fiscal 2019-20, while medium- and long-term foreign loans decreased to $2.57 billion.

The slow pace in FDI generation has had a negative impact on the volume of Bangladesh’ foreign exchange reserves, which has remained static in recent years.

“The volume of the economy has widened significantly during the period but it will not be sustainable if the foreign exchange reserves cannot be increased,” Mansur said.

Foreign exchange reserves stood at $32.68 billion as of December last year, up 1.12 per cent year-on-year.

Mustafizur Rahman, a distinguished fellow of the Centre for Policy Dialogue, echoed the same.

The weak condition of the balance of payments reflects the sluggishness of the country’s economy, he said, adding that Bangladesh has failed to diversify both its export market and basket.

“This has had an adverse impact on our exports. Imports automatically decrease when export face a similar situation.”

Bangladesh’s private sector investment to GDP ratio has been hovering at 23-24 per cent for a while and the situation has only worsened in recent times.

The overall balance of the balance of payments could be stronger if there is a greater inflow of foreign aid and if FDIs gain momentum.

The overall balance stood at $27 million in December last year while it was $513 million in the negative a year earlier, Rahman added.

Both the feeble situation of the current account and the overall balance indicate that the country’s dependence on the external sector is on the rise, said Salehuddin Ahmed, a former governor of the central bank.

An inflationary pressure usually hits the economy when the current account remains negative for too long.

In such situations, the central bank is forced to print money to tackle economic sluggishness.

“So, the authority concerned should concentrate on sidestepping the ongoing bitter situation stemming from the external sector,” Ahmed said.