Renata to set foot in the US this year

Renata is set to become the third local drug maker to export products to the tightly regulated US market, in a testament of the advances Bangladesh’s pharmaceutical industry have made over the years.

“I hope it will create a huge opportunity for us,” said Md Jubayer Alam, Renata’s company secretary.

The company got the approval from the US Food & Drug Administration (USFDA) for three products: Risperidone, Metoprolol Tartrate, and Glycopyrrolate, which are prescribed for schizophrenia, hypertension and peptic ulcer respectively.

At present, the pharmaceutical arms of local business giants Square and Beximco have the approval of the USFDA to export their products.

“The US market is so big and so different from us,” Alam said.

The task ahead for Renata is to reach out to pharmacists in the US.

“If the pharmacists prescribe our products, consumers will buy them. So, our consultants are working on this area now,” he added.

Renata, which raked in Tk 46.68 crore in its last financial year by exporting to 27 countries, is hopeful that shipments to the US will kick off from this year, according to Zaki Chowdhury, the drug makers’ general manager for international regulatory affairs.

Asked whether the drugs that are being exported are of superior quality than the ones sold locally, Chowdhury said: “The quality of our drugs are one and the same. There is no reason to think the makers are maintaining separate standards for the two markets.”

Some other Renata medicines are in the pipeline for USFDA’s approval, he added.

The listed drug maker, which was born out of the American drug maker Pfizer’s Bangladesh operations in 1993, currently ships four products to the UK.

In 2013 it set up Renata UK, from which it could ship to the entire EU.

However, following Brexit, the UK entity would no longer be eligible for this purpose as EU regulations stipulate that only European corporate entities may conduct medicines business within its borders.

So, in the middle of last year, it set up Renata Pharmaceutical (Ireland).

Its business is growing briskly at home too.

In the human pharmaceutical products, Renata’s net sales soared 19 per cent last year, outperforming a buoyant market that registered a 16.3 per cent growth.

Renata remains market leader in the animal health sector: its sales grew 10.8 per cent against the industry growth of 9.4 per cent.

As a result, it is constructing an animal nutrition factory in Bhaluka upazila of Mymensingh.

Despite the all-round solid performance, the company’s stock began nosediving from November 13 last year, when it traded at Tk 1,345.

On January 12, it sank to a 54-month low of Tk 1,019. The stock recovered a little from there, closing at Tk 1,153 yesterday.

“Renata’s slide was not related to its performance but for the overall depressed state of the market,” said a market analyst requesting anonymity.

The pharmaceuticals sector as a whole has great potential ahead given the country’s population of 16 crore and the high economic growth.

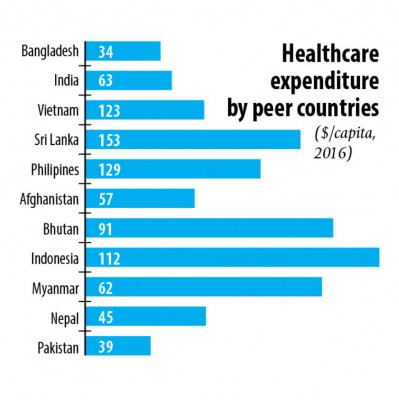

Bangladesh’s per capita healthcare spending is nearer the bottom of the list among the Asian countries.

“The country is amongst the fastest growing in the continent. Typically, when people’s per capita income rises their spending on healthcare also goes up. This will create opportunities for the drug makers,” he added.

Bangladesh’s per capita income hit $1,909 in last fiscal year from $1,751 a year earlier.

Hong Kong-based investment firm Asia Frontier Capital (AFC) is equally bullish about the potential of Bangladesh’s pharmaceutical market.

In its annual publication -- AFC Asia Frontier Fund: 2019 Review and Outlook For 2020 -- it said the sector has a bright future: the market is under penetrated.