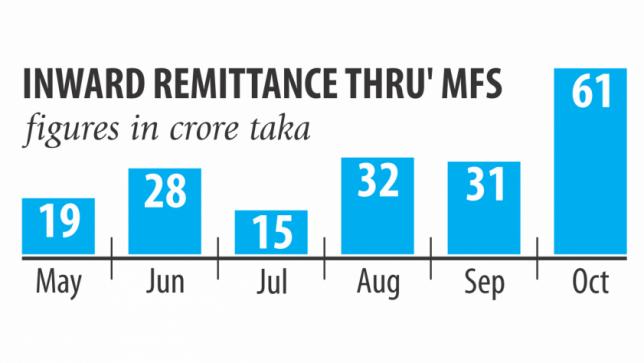

Remittance through MFS doubles in Oct

Remittance disbursement through mobile financial services (MFS) more than doubled in October compared to the previous month due to growing popularity of the alternative payment channel among expatriates.

The MFS providers disbursed remittance amounting to Tk 61 crore in October, which was Tk 30.78 crore in September and only Tk 6.26 crore in October last year, according to Bangladesh Bank data.

The MFS providers go into an arrangement with different banks to disburse remittance through mobile accounts to facilitate remitters, said Dasgupta Asim Kumar, an adviser of bKash, the largest MFS provider in the country.

Such arrangement with the banks helped to pick up remittance inflow through the MFS channel and the uptrend will continue in the coming days, he added. The arrangements were taken as the central bank raised concerns over illegal inflow of remittance through the MFS channel, Kumar said.

The MFS providers have no operation outside the country but some agents were misusing the services by channeling remittance through the mobile accounts.

From this perspective, different MFS operators went into the new arrangement where banks work as a gateway to deal with foreign currency and the MFS operators act as the medium for distribution, he said.

bKash is working to develop a new solution to facilitate remitters so that they can send money directly to mobile accounts at home, he added.

A recent survey conducted jointly by Bangladesh Bank and the University of Dhaka showed that remittance was illegally coming in mainly from eight countries.

The survey—titled “An impact study on mobile financial services (MFSs) in Bangladesh”—pointed out that Saudi Arabia, Malaysia and the United Arab Emirates are the prime sourcing points from where remittance was being illegally sent.

The respondents also spoke of Canada, USA, India, Kuwait and Qatar as the sources.

The survey found a group of people collecting money from expatriates abroad and then instructing local agents to disburse the amounts among relatives of the senders.

This illegal remittance inflow through the MFS channel has become a serious concern for the central bank as it significantly pushed down remittance inflow through official channels.

The country saw a sharp fall in remittance inflow, as it decreased 14.47 percent year-on-year to $12.77 billion in 2016-17.

The sharp fall prompted the central bank to start searching for ways to legalise the way remittance comes in through the MFS channels, said a senior executive of Bangladesh Bank.

In the past one year, the MFS providers were asked to go into partnerships with banks to preventing misuse of the money transfer method, he said.

The remittance inflow, which remained slow for the past two years, started to rise since the beginning of this year.

In the first 10 months of the current year, the country received some $13.15 billion as remittance, an 18 percent year-on-year rise, according to central bank data.