Refrigerator retailers brace for dismal sales this Eid too

Refrigerator manufacturers and retailers could witness poor customer turnout this Eid-ul-Azha, a significant Islamic festival that typically makes up about almost half of the industry's yearly sales, as a result of ongoing coronavirus pandemic, according to advertise players.

"Sales are completely dull in comparison to previous years. The problem could possibly be as bad as this past year," said Manzurul Karim, general manager of Esquire Electronics, the distributor of Japanese brands General and Sharp in Bangladesh.

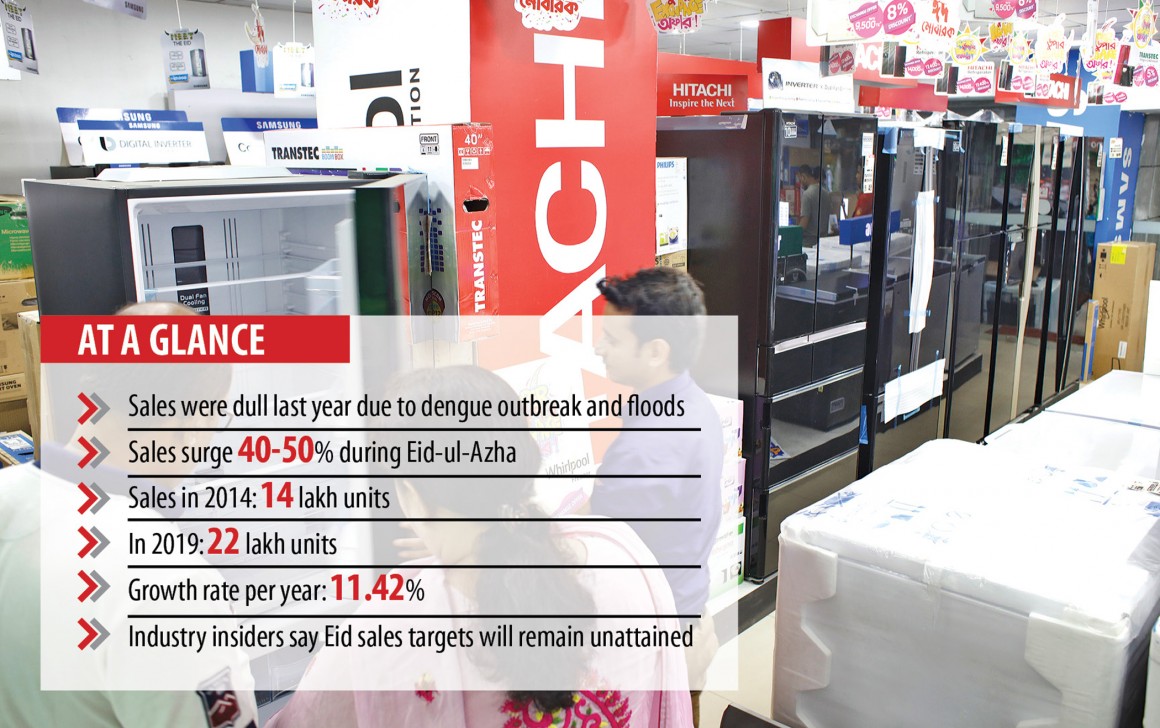

This past year the industry didn't see the usual pre-Eid rush of customers carrying out a dengue outbreak in the united states and floods in the northern regions.

As an Islamic tradition, livestock are sacrificed through the three-day festival and people purchase refrigerators to preserve the meat, leading to a 40 to 50 % bump in sales around this period. Besides, the surge in sales around Eid can be propelled by various purchase offers such as for example discounts, cashback and prizes, industry insiders said.

However, with the pandemic having caused great economic uncertainty worldwide, most private sector companies are paying their workers reduced wages and Eid bonuses in a bid to survive the coronavirus fallout.

It is that is why that this year's sales is going to be insignificant, they added.

Both manufacturers and retailers have accepted the situation but are hopeful that with roughly two weeks to go prior to the festival begins, sales could reach the same value as last year's.

Market insiders also think that since Covid-19 has resulted in a loss of income for most, people could possibly be surviving the pandemic through the use of funds they kept aside to get the quintessential home appliance.

About 14 lakh refrigerators were sold in 2014, however the number ran into 20 lakh in 2017 and 22 lakh in 2018 while sales were around the same in 2019.

This demonstrates the industry saw the average twelve-monthly growth rate of 11.42 per cent for days gone by six years, the industry insiders said.

According to Esquire Electronics' general manager, the industry's sales target for the festive period can no longer be attained while the yearly tally will be 22 lakh units at best, exactly like last year.

On the other hand, Karim was optimistic that sales of his company's chest freezer line will increase by for the most part 5 per cent.

"We are not focused on achieving the earnings target this season but instead are simply trying to keep carefully the business alive amid the pandemic by offering different advantages to customers," he said.

Since retail outlets across the country are unable to operate at full capacity or at all occasionally as a result of ongoing crisis, overall sales have been dull, said Rashedul Islam, product manager of Transcom Digital, the retailer for Whirlpool, Hitachi, Transtec and Samsung products.

"Among other offers, we are providing significant discount exchange offers and a maximum Tk 25,000 cashback on fridges to attract customers," Islam added.

The other offers add a 20 % discount on fridges, televisions and ac units when purchased with bank cards from select banks in addition to a Tk 2 lakh medical health insurance package.

Meanwhile, Shamim Ahsan Khan, product manager for gadgets at Samsung Bangladesh, said that his company's sales are rather satisfactory as they have already achieved 50 per cent of their target before Eid.

Taking into consideration the current trend, sales of chest freezers around the Eid festival could reach 30,000 units. Samsung now assembles the vast majority of their refrigeration products at the Narsingdi plant, Khan added.

He also said that the cost of various kitchen appliances would reduction in future as locally made pieces that are almost identical in quality with their imported counterparts are being adopted by the industry.

According to Khan, the demand for several high-end appliances, sans ac units, didn't decline amid the Covid-19 outbreak. However, sales of low-end products have dwindled as people with lower incomes bore the entire brunt of the coronavirus impact, he added.

Vision Electronics, a sister concern of Pran-RFL Group which has 100 refrigerator models on offer, witnessed a 20 per cent increase in demand ahead of Eid although it was 50 per cent through the same period last year.

Kamruzzman Kamal, director for marketing at Pran-RFL Group, said they manufacture 1,000 units daily at their Ghorashal factory in Narsingdi.

Vision Electronics retails its products through Best Buy showrooms and its own Vision emporiums alongside over 2,000 listed dealers.

The company's 50- to 556-litre capacity refrigerators are priced between Tk 12,200 and Tk 106,000 while 50- to 350-litre capacity chest freezers choose around Tk 22,400 to Tk 37,300, Kamal said, adding that glass door refrigerators are high in demand.

Vision Electronics recently introduced the 'Vision Warranty Plus' service, under which any client could get up to Tk 1 lakh cashback after obtain any outlet or dealer.

However, clients will have to sign up for the service through text beforehand.

Besides, the business also provides equated monthly instalment payment facility for credit cards of 19 banks.

To address the social concern of infection amid the pandemic, sales businesses are being run in line with health guidelines, he said.

Similarly, Augustin Sujan Barai, deputy director of the innovative and publications department at Walton Group, said that the Eid season is peak time to market refrigerators but as a result of Covid-19 situation, sales have slowed.

Through the May-June period, sales were dull however the situation has improved slightly this month, he added.

At present, Walton has over 150 types of frost, non-frost, and chest freezers alongside beverage coolers available in the market.

The business offers fridges priced between Tk 10,990 and Tk 69,900, with the choice to create purchases on instalments.

The merchandise of other international brands such as for example Panasonic, Haier, Kelvinator, Mitsubishi, Toshiba, Jamuna, Marcel and Electra are also available in the market.